KRX Dividend Stocks To Watch In July 2024

The South Korean market has experienced a 3.7% decline over the past week and has generally remained flat over the last year, though earnings are expected to grow by 30% annually. In this context, dividend stocks that offer consistent payouts could be particularly appealing to investors looking for stable returns in a fluctuating market environment.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.65% | ★★★★★★ |

NH Investment & Securities (KOSE:A005940) | 5.93% | ★★★★★☆ |

LOTTE Fine Chemical (KOSE:A004000) | 4.27% | ★★★★★☆ |

Industrial Bank of Korea (KOSE:A024110) | 7.08% | ★★★★★☆ |

KT (KOSE:A030200) | 5.28% | ★★★★★☆ |

Shinhan Financial Group (KOSE:A055550) | 3.81% | ★★★★★☆ |

Kyung Nong (KOSE:A002100) | 4.89% | ★★★★★☆ |

HANYANG ENGLtd (KOSDAQ:A045100) | 3.29% | ★★★★★☆ |

Cheil Worldwide (KOSE:A030000) | 6.27% | ★★★★☆☆ |

Samyang (KOSE:A145990) | 3.62% | ★★★★☆☆ |

Click here to see the full list of 69 stocks from our Top KRX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Koryo Credit Information

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koryo Credit Information Co., Ltd. operates in the debt collection, credit investigation, and civil complaint agency sectors both domestically in South Korea and internationally, with a market capitalization of approximately ₩145.66 billion.

Operations: Koryo Credit Information Co., Ltd. generates revenue primarily from its operations in debt collection, credit investigation, and civil complaint agency services across both domestic and international markets.

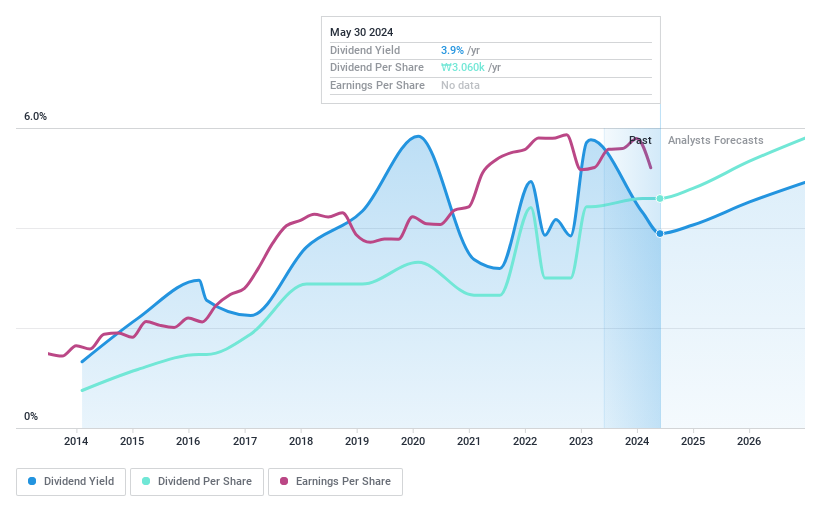

Dividend Yield: 3.8%

Koryo Credit Information offers a dividend yield of 3.82%, ranking in the top 25% in the South Korean market. With a payout ratio of 46.8% and a cash payout ratio of 26.1%, its dividends are well-supported by both earnings and cash flows, indicating sustainability despite a relatively short dividend history of three years. However, investors should note the company's unstable dividend track record, which may raise concerns about future reliability and growth potential.

Dive into the specifics of Koryo Credit Information here with our thorough dividend report.

Our valuation report here indicates Koryo Credit Information may be overvalued.

Multicampus

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Multicampus Corporation specializes in providing educational services for the HRD system, primarily in South Korea, with a market capitalization of approximately ₩195.29 billion.

Operations: Multicampus Corporation generates its revenue primarily through its educational business segment, which amounted to ₩0.36 billion.

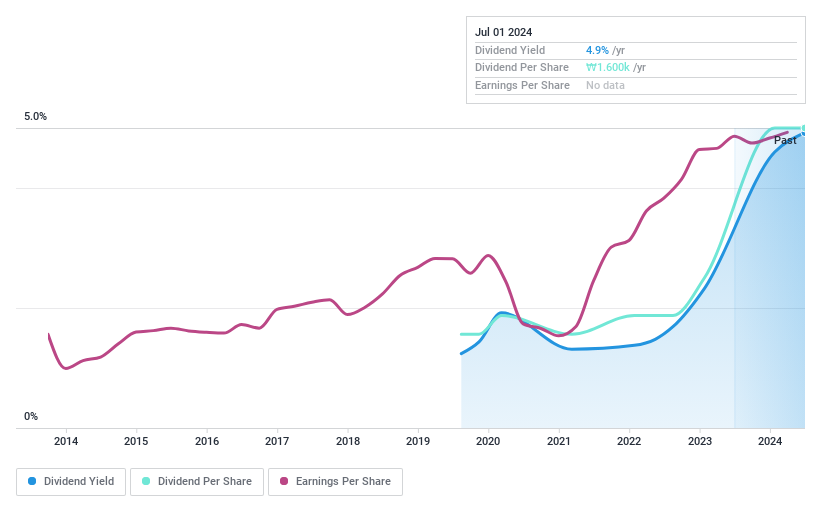

Dividend Yield: 4.9%

Multicampus reported improved first-quarter earnings in 2024, with net income rising to KRW 5.86 billion from KRW 5.24 billion year-over-year, supported by a positive shift in sales. The firm maintains a low payout ratio of 29.5%, ensuring dividends are well-covered by earnings and cash flows (cash payout ratio: 16.8%). Despite its solid financial performance and a competitive dividend yield of 4.86%, the company's dividend history is relatively short at five years, which might concern those seeking long-term stability.

Take a closer look at Multicampus' potential here in our dividend report.

Our valuation report unveils the possibility Multicampus' shares may be trading at a premium.

KB Financial Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KB Financial Group Inc. operates as a comprehensive financial services provider offering banking and related services to individuals and businesses in South Korea and globally, with a market cap of approximately ₩33.58 billion.

Operations: KB Financial Group Inc.'s revenue is primarily generated through its banking sector, with corporate finance and household finance segments contributing ₩4.39 billion and ₩4.23 billion respectively, followed by the non-life insurance sector at ₩1.19 billion, securities at ₩1.59 billion, and the credit card sector at ₩1.10 billion.

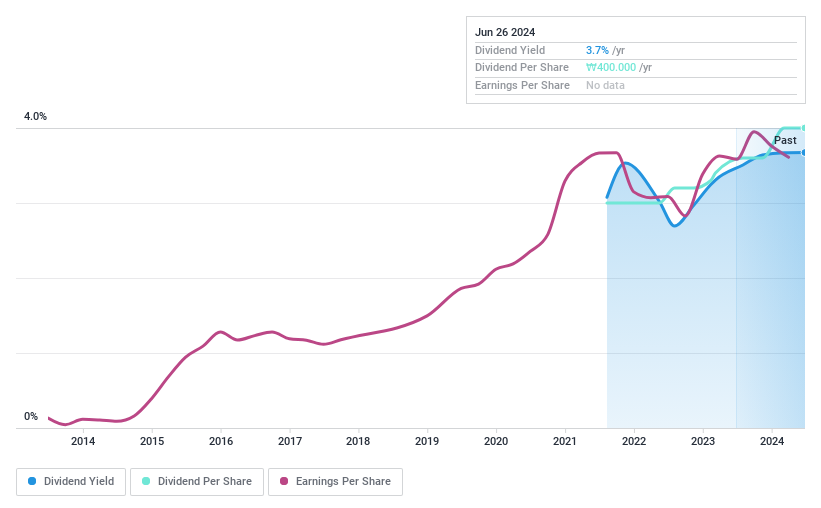

Dividend Yield: 3.5%

KB Financial Group has a mixed record on dividends, with a history of volatility and unreliable payouts over the past decade. Despite this, its current dividend yield stands at 3.47%, slightly below the top quartile in South Korea. The company's dividends are currently well-covered by earnings with a payout ratio of 32%, and forecasts suggest continued coverage at 24.2% in three years. Recent share repurchase programs, including a KRW 400 billion plan announced on July 23, 2024, aim to return value to shareholders and boost corporate worth before expiring in March 2025.

Next Steps

Unlock our comprehensive list of 69 Top KRX Dividend Stocks by clicking here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSDAQ:A049720 KOSDAQ:A067280 and KOSE:A105560.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com