KRX Dividend Stocks To Watch In July 2024

The South Korean market has experienced notable growth, climbing 2.8% in the last week and 9.4% over the past year, with earnings projected to grow by 30% annually. In this dynamic environment, dividend stocks that demonstrate consistent payouts and potential for capital appreciation are particularly compelling.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.58% | ★★★★★★ |

LOTTE Fine Chemical (KOSE:A004000) | 4.35% | ★★★★★☆ |

NH Investment & Securities (KOSE:A005940) | 6.08% | ★★★★★☆ |

Industrial Bank of Korea (KOSE:A024110) | 7.01% | ★★★★★☆ |

KT (KOSE:A030200) | 5.45% | ★★★★★☆ |

Shinhan Financial Group (KOSE:A055550) | 4.04% | ★★★★★☆ |

Kyung Nong (KOSE:A002100) | 4.97% | ★★★★★☆ |

HANYANG ENGLtd (KOSDAQ:A045100) | 3.13% | ★★★★★☆ |

Tong Yang Life Insurance (KOSE:A082640) | 4.83% | ★★★★☆☆ |

Korea Cast Iron Pipe Ind (KOSE:A000970) | 6.09% | ★★★★☆☆ |

Click here to see the full list of 71 stocks from our Top KRX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

ORION Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ORION Holdings Corp., with a market cap of approximately ₩918.59 billion, operates globally, manufacturing and selling confectioneries primarily in South Korea and China.

Operations: ORION Holdings Corp. generates significant revenue from its confectionery segment, amounting to ₩3.83 billion, with additional contributions from its video and landlord segments at ₩94.52 million and ₩38.50 million respectively.

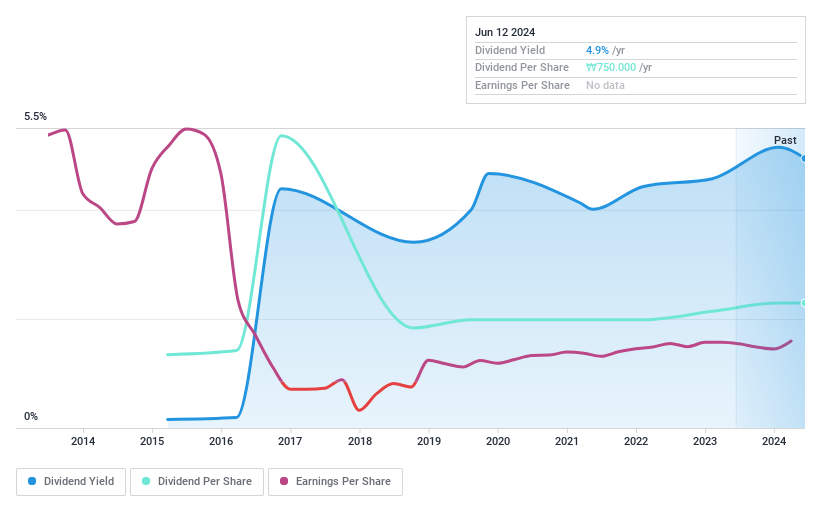

Dividend Yield: 4.9%

ORION Holdings maintains a dividend yield of 4.91%, ranking in the top 25% in South Korea, supported by a stable earnings coverage with a payout ratio of 42.4% and robust cash flow coverage at 11%. Despite trading at 13.3% below its estimated fair value, the company's dividend history is less consistent, having initiated payments only nine years ago with some volatility observed. Recent activities include multiple earnings calls and presentations, emphasizing ongoing financial communication to investors.

Kangwon Land

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kangwon Land, Inc. operates in South Korea, focusing on casino services, tourist hotels, and ski resorts with a market capitalization of approximately ₩2.86 billion.

Operations: Kangwon Land, Inc. generates its revenue primarily from casino services, tourist hotels, and ski resort operations in South Korea.

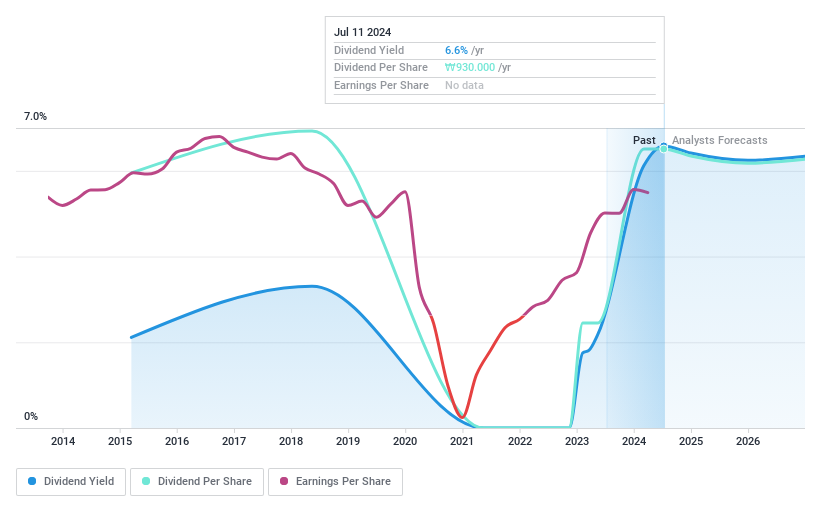

Dividend Yield: 6.6%

Kangwon Land offers a dividend yield of 6.58%, placing it among the top 25% of Korean dividend payers. The dividends are well-supported with a payout ratio of 56.8% and cash payout ratio of 67.9%. Despite this, the company's earnings are expected to decline by an average of 2.9% annually over the next three years, and its dividend history shows instability with volatile payments throughout its nine-year dividend-paying period. Recent financials indicate a slight decrease in net income despite increased sales, highlighting potential challenges ahead.

Hanatour Service

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hanatour Service Inc. operates as a travel services provider in South Korea, Northeast and Southeast Asia, the United States, and Europe, with a market capitalization of approximately ₩887.57 billion.

Operations: Hanatour Service Inc. generates revenue by offering travel and related services across South Korea, Northeast and Southeast Asia, the United States, and Europe.

Dividend Yield: 8.7%

Hanatour Service reported a significant increase in Q1 2024 sales to KRW 3.87 million from KRW 0.00015 million, and net income rose to KRW 21,362.52 million from KRW 7,990.55 million year-over-year. Despite a high dividend yield of 8.73%, ranking in the top quartile of Korean dividend stocks, its sustainability is questionable with a payout ratio at an elevated 128.6% and dividends not well-covered by earnings or consistent cash flows over the past decade, reflecting potential risk for long-term stability.

Seize The Opportunity

Dive into all 71 of the Top KRX Dividend Stocks we have identified here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A001800 KOSE:A039130 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com