Koninklijke Philips' (PHG) Q2 Earnings & Sales Rise Y/Y

Koninklijke Philips N.V. PHG reported second-quarter 2019 adjusted earnings of 49 cents per share and revenues of $5.25 billion.

The company reported earnings of €0.43, up 23% from the year-ago quarter. Sales increased 9% on a year-over-year basis to €4.67 billion.

Comparable sales (includes adjustments for consolidation charges & currency effects) grew 6%, reflecting mid-single-digit growth in all businesses.

The company’s comparable order intake increased 8% year over year, driven by double-digit growth in Diagnosis & Treatment and mid-single-digit decline in the Connected Care business.

Sales increased 9% on a comparable basis in growth geographies, driven by double-digit growth in China and high single-digit rise in Central & Eastern Europe. Comparable order intake grew double digit, driven by double-digit growth in China and Latin America.

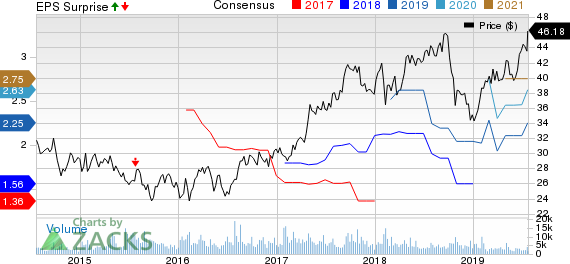

Koninklijke Philips N.V. Price, Consensus and EPS Surprise

Koninklijke Philips N.V. price-consensus-eps-surprise-chart | Koninklijke Philips N.V. Quote

Sales in mature geographies increased 5% on a comparable basis, due to high single-digit growth in other mature geographies and mid-single-digit rise in both North America and Western Europe. Comparable order intake was flat year over year.

Segment Details

Diagnosis & Treatment revenues increased 9.9% from the year-ago quarter to €1.88 billion. Comparable sales grew 6%, driven by double-digit growth in Image-Guided Therapy and high single-digit growth in Ultrasound. Diagnostic Imaging revenues were flat year over year.

On a geographic basis, China witnessed double-digit growth. Mature geographies grew at a mid-single-digit rate, reflecting high single-digit growth in North America, mid-single-digit rate in other mature geographies and low single-digit growth in Western Europe.

Image-Guided Therapy devices business grew at a double-digit rate, driven by robust performance from all major coronary and peripheral vascular product families.

During the quarter, Philips presented the three-year results from two major Stellarex clinical studies, involving roughly 600 patients. The study showed that Stellarex drug-coated balloon (DCB) is the only low-dose DCB with a significant treatment effect and had a high safety profile through three years. Both studies showed no difference in mortality compared with the current standard of care.

Moreover, the company extended the advanced automation capabilities of its EPIQ CVx cardiology ultrasound platform. This makes examinations faster and easier to conduct, while improving clinician productivity.

Connected Care business revenues increased 11.1% to €1.05 billion. Comparable sales climbed 6%, driven by mid-single-digit growth in Monitoring & Analytics and Sleep & Respiratory Care.

Mature geographies grew mid-single digits, primarily due to double-digit growth in Western Europe, high single-digit growth in other mature geographies and low-single-digit growth in North America. Growth geographies increased at high single-digit rates, reflecting double-digit growth in Latin America and high single-digit rise in China.

The company’s solutions to treat obstructive sleep apnea, a condition that affects more than 100 million patients globally, continue to benefit from healthy demand. Adoption of DreamStation GO’s portable therapy options remained strong in the reported quarter.

Personal Health sales increased 5% year over year to €1.28 billion. Comparable sales grew 5%, driven by high single-digit growth in Oral Healthcare and mid-single-digit rise in Personal Care and Domestic Appliances.

Growth geographies increased in high single digit, driven by double-digit growth in China and Central & Eastern Europe. Mature geographies showed mid-single-digit growth, reflecting double-digit growth in other mature geographies, mid-single-digit growth in Western Europe and low-single-digit growth in North America.

In the reported quarter, Philips launched Sonicare DailyClean, an entry-level product that addresses lower price segments. The company also introduced Sonicare ExpertClean, featuring premium brush heads, connectivity and design, in the United States.

Moreover, Philips Shaver Series 9000 Prestige continued to gain significant market share in the premium shaver market, especially China, Germany and the United States.

Other segment sales increased 15.7% to €96 million in the reported quarter primarily due to higher IP royalty income.

Important Partnerships

During the quarter, Philips inked a 10-year agreement with Centre Hospitalier Régional Universitaire de Nancy in France to implement the IntelliSpace Enterprise Imaging Solution of the former.

The company also announced a 10-year agreement with Rutherford Diagnostics to deliver advanced imaging solutions to five new diagnostic centers of the former across the U.K.

Further, Philips teamed up with Humana HUM to improve care for at-risk, high-cost populations. The pilot program will support independent living for high-acuity patients with congestive heart failure by providing 24/7 access to care.

Operating Details

Gross margin contracted 130 basis points (bps) on a year-over-year basis to 45.5% in the reported quarter.

Selling, research & development, and general & administrative expenses declined 200 bps, 40 bps and 10 bps, respectively.

In the reported quarter, cost savings totaled €146 million, reflecting procurement savings of €48 million. Savings from overhead and other productivity programs were €98 million.

Philips’ adjusted earnings before interest, taxes and amortization (EBITA) — the company’s preferred measure of operational performance — were €549 million, up 13.9% from the year-ago quarter.

Adjusted EBITA margin expanded 50 bps on a year-over-year basis to 11.8%, benefiting from sales growth and operational improvements.

While Diagnosis & Treatment EBITA margin expanded 190 bps, Connected Care and Personal Health EBITA margins contracted 220 and 70 bps, respectively.

Balance Sheet & Other Details

As of Jun 30, 2019, Philips’ cash and cash equivalents were €1.08 billion and total debt was €5.82 billion.

Meanwhile, net cash flow generated from operating activities came in at €390 million. Free cash flow was €174 million.

Philips completed its €1.5-billion share buyback program, announced on Jun 28, 2017, in the reported quarter. The company has also completed 21.1% of its share buyback program that was announced on Jan 29, 2019.

Moreover, Philips completed the cancellation of 30 million shares that were acquired as part of the share buyback programs mentioned above. Additionally, the company successfully placed a €750-million 0.500% Green Innovation Bond, which is due 2026.

Guidance

Philips continues to expect the U.S. health care market to grow low- to mid-single digits in 2019. Western Europe is expected to grow at a modest low single-digit rate. China is expected to rise mid- to high-single digit, primarily due to favourable government policies expansion of private sector investments in health care facilities.

Tariffs, as a result of the U.S.-China trade war, are expected to have a negative impact of €45 million in 2019. This does not include potential U.S. batch 4 tariffs that will bring an additional €20-million headwind in the year, if made effective immediately.

Moreover, the company expects net costs of €40 million in the third quarter and €120 million for 2019. Included in these numbers are €15 million of restructuring cost and other incidental items in the third quarter and around €40 million for the full year. These are expected to hurt EBITA.

Nevertheless, Philips expects EBITA margin to improve in the second half of the year. Management expects EBITA margin to be closer to 14%.

The company still expects free cash flow between €1 billion and €1.5 billion for 2019.

Philips reiterated its overall targets of 4-6% comparable sales growth and an adjusted EBITA margin improvement of 100 bps on average per year for the 2017-2020 period.

Management expects the company to become a €20-billion health technology company with an adjusted EBITA margin close to 15% by 2020.

Zacks Rank and Other Stocks to Consider

Currently, Phillips sports a Zacks Rank #1 (Strong Buy).

Lattice Semiconductor LSCC and Alteryx AYX are similar-ranked stocks in the broader Computer & Technology sector. You can see the complete list of today’s Zacks #1 Rank stocks here.

While Lattice Semiconductor is set to report on Jul 30, Alteryx is expected to report on Jul 31.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lattice Semiconductor Corporation (LSCC) : Free Stock Analysis Report

Koninklijke Philips N.V. (PHG) : Free Stock Analysis Report

Humana Inc. (HUM) : Free Stock Analysis Report

Alteryx, Inc. (AYX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance