Kollect on Demand Holding (STO:KOLL) Will Have To Spend Its Cash Wisely

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we'd take a look at whether Kollect on Demand Holding (STO:KOLL) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. Let's start with an examination of the business's cash, relative to its cash burn.

Check out our latest analysis for Kollect on Demand Holding

When Might Kollect on Demand Holding Run Out Of Money?

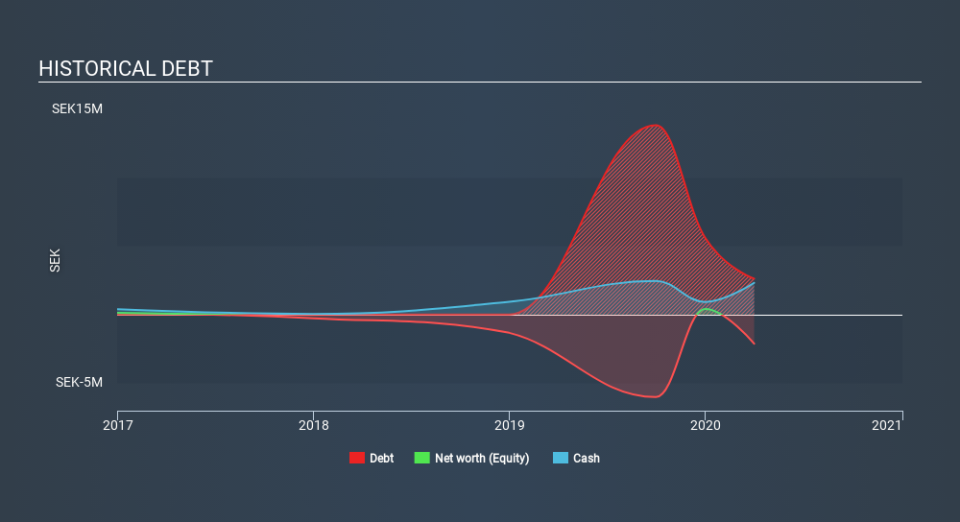

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at March 2020, Kollect on Demand Holding had cash of kr2.3m and such minimal debt that we can ignore it for the purposes of this analysis. Looking at the last year, the company burnt through kr26m. So it seems to us it had a cash runway of less than two months from March 2020. To be frank we are alarmed by how short that cash runway is! You can see how its cash balance has changed over time in the image below.

How Well Is Kollect on Demand Holding Growing?

One thing for shareholders to keep front in mind is that Kollect on Demand Holding increased its cash burn by 1236% in the last twelve months. But the silver lining is that operating revenue increased by 44% in that time. Considering both these factors, we're not particularly excited by its growth profile. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic revenue growth shows how Kollect on Demand Holding is building its business over time.

How Easily Can Kollect on Demand Holding Raise Cash?

Given the metrics mentioned above, we wouldn't be surprised if many Kollect on Demand Holding shareholders were wondering if it could raise more cash with ease. Companies can raise capital through either debt or equity. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of kr32m, Kollect on Demand Holding's kr26m in cash burn equates to about 80% of its market value. That suggests the company may have some funding difficulties, and we'd be very wary of the stock.

Is Kollect on Demand Holding's Cash Burn A Worry?

As you can probably tell by now, we're rather concerned about Kollect on Demand Holding's cash burn. Take, for example, its cash runway, which suggests the company may have difficulty funding itself, in the future. But the silver lining was its revenue growth, which was encouraging. The measures we've considered in this article lead us to believe its cash burn is actually quite concerning, and its weak cash position seems likely to cost shareholders one way or another. Separately, we looked at different risks affecting the company and spotted 5 warning signs for Kollect on Demand Holding (of which 3 are a bit unpleasant!) you should know about.

Of course Kollect on Demand Holding may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance