Kirby (KEX) Q3 Earnings Surpass Estimates, Increase Y/Y

Kirby Corporation’s KEX third-quarter 2019 earnings of 80 cents per share surpassed the Zacks Consensus Estimate of 71 cents. The bottom line also improved 14.3% year over year.

However, total revenues of $666.8 million fell short of the Zacks Consensus Estimate of $719.7 million and also declined 5.4% year over year. The top line was hurt by reduced sales at the distribution and services division.

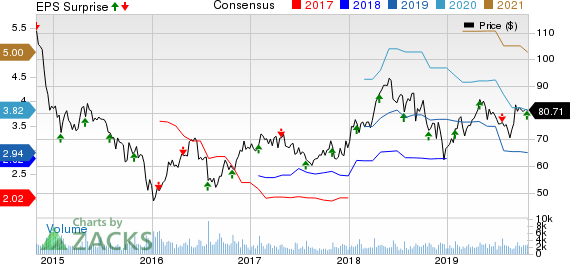

Kirby Corporation Price, Consensus and EPS Surprise

Kirby Corporation price-consensus-eps-surprise-chart | Kirby Corporation Quote

Segmental Performance

The company through its subsidiaries operates via the following segments of marine transportation as well as distribution and services.

The marine transportation division is responsible for providing transportation services by tank barge to inland and coastal markets. Revenues at the marine transportation unit increased 8% to $412.7 million. Segmental operating income also soared almost 50% to $72.7 million. Segmental operating margin too expanded to 17.6% from 12.7% a year ago.

Inland market revenues rose approximately 10% year over year owing to contributions from last year’s acquisitions and favorable pricing. The operating margin for the inland business was 20% in the September quarter.

Revenues at the coastal market increased 3% on a year-over-year basis, attributable to favorable pricing and improved barge utilization. However, the coastal operating was in the high single digits on the back of lower operating expenses, driven by improved efficiencies and higher pricing.

The distribution and services segment is responsible for selling replacement parts and focuses on oil and gas, and commercial and industrial markets. Segmental revenues decreased 21.2% to $254.1 million due to below-par performance in the oil and gas market. Moreover, operating margin at the distribution and services segment declined to 3.6% from 7.4% a year ago.

The oil and gas market was weak in the quarter under review due to reduction in North America oilfield activity. Operating margin for oil and gas was in the negative low single digits.

In the commercial and industrial market, revenues and operating income improved year over year, mainly owing to higher service levels in the marine repair business coupled with increased demand for back-up power generation equipment. During the quarter under review, the commercial and industrial operating margin was in the high single digits.

Balance Sheet Highlights

Long-term debt at Kirby (including the current portion) increased to $1,434.43 million at the end of the third quarter of 2019 from $1,399.93 million at the end of third-quarter 2018. Debt to capitalization ratio at the end of the third quarter was 29.8% compared with 30.2% a year ago.

Outlook

This Zacks Rank #3 (Hold) company revised its earnings guidance for the full year in the range of $2.80-$3 per share (old guidance: $2.80-$3.20). The mid-point ($2.90) of the guided range is below the Zacks Consensus Estimate of $2.97. The outlook for capital expenditures is also unchanged between $225 million and $245 million. You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Upcoming Releases

Investors interested in the broader Transportation sector are keenly awaiting third-quarter earnings reports from key players like Hertz Global Holdings, HTZ, Expeditors International of Washington EXPD and Air Lease Corporation AL. While Hertz will report third-quarter earnings numbers on Nov 4, Expeditors and Air Lease will announce the same on Nov 5 and Nov 7, respectively.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Air Lease Corporation (AL) : Free Stock Analysis Report

Kirby Corporation (KEX) : Free Stock Analysis Report

Expeditors International of Washington, Inc. (EXPD) : Free Stock Analysis Report

Hertz Global Holdings, Inc (HTZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance