Kimco Realty (KIM) Beats on Q1 FFO, Collects 60% of April Rent

Kimco Realty Corp.’s KIM first-quarter 2020 funds from operations (FFO) came in at 37 cents per share, surpassing the Zacks Consensus Estimate of 36 cents. The retail REIT generated revenues of $289.7 million, beating the Zacks Consensus Estimate of $287.7 million.

Results reflect healthy portfolio occupancy, leasing spreads on new lease and positive same-property net operating income (NOI).

However, on a year-over-year basis, the FFO per share came in lower than the year-ago quarter’s number of 38 cents. Revenues too slipped 1.8% year on year.

Notably, at the end of April, all of the company’s shopping centers remained open and operational with around 56% of tenants, based on the annualized base rent currently open, including some that are operating on a limited basis. About 43% of the company’s tenants are deemed to be essential.

The company noted that it has collected roughly 60% of the total pro-rata base rents billed for April. This included 78% from its top 50 tenants and 40% from those tenants that are shut. Further, it received rent deferral requests approximating 35% of its pro-rata minimum base rent for April. Kimco is selectively permitting deferrals for 14% of the minimum base rent for this period and is negotiating for payment of the residual April rent not yet collected.

Kimco had earlier withdrawn its guidance for the full year. The company’s board has now temporarily suspended the dividend on its common shares amid the coronavirus pandemic and related economic uncertainties.

Quarter in Detail

Pro-rata occupancy ended the first quarter at 96%, stable year on year. The company attained pro-rata anchor occupancy of 98.6%, displaying an 80-basis-point expansion, year over year. However, small-shop occupancy ended the reported quarter at 88.8%. This marks a sequential contraction of 50 basis points. It primarily reflects Pier 1 vacating four leases and six remaining Dress Barn stores closing during the quarter.

Pro-rata rental-rate leasing spreads on comparable spaces increased 7.3%, with rental rates for new leases and renewals/options climbing 13.3% and 6.8%, respectively. Same-property NOI inched up 1.5% year over year, primarily reflecting a 230-basis-point contribution from minimum rent.

Portfolio Activity

During the reported quarter, Kimco sold one property for $13.5 million. The company also acquired an unowned parcel at North Valley Shopping Center in Peoria, AZ for $7 million.

Balance-Sheet Position

Kimco exited first-quarter 2020 with cash and cash equivalents of $451.8 million, down from the $123.9 million recorded at the end of 2019. Further, the company ended the quarter with a consolidated weighted-average debt maturity profile of 10.1 years and more than 320 unencumbered properties.

The company closed on a new $2-billion unsecured revolving credit facility. This facility can be expanded to $2.75 billion under an accordion feature, with commitments from 21 lending institutions.

Moreover, in April, the company secured a new $590-million unsecured term loan facility due April 2021, with an option to extend it through April 2022.

At the end of April, Kimco has access to more than $2.2 billion of immediate liquidity, with nearly $900 million of cash on the balance sheet and $1.3 billion available under its unsecured revolving credit facility.

Furthermore, it ended April with total pro-rata debt of $113.5 million and $707.2 million maturing during 2020 and 2021,respectively.

Notably, the company has deferred roughly $95 million of capital spending and investment initially planned for the current year.

Kimco currently carries a Zacks Rank #4 (Sell).

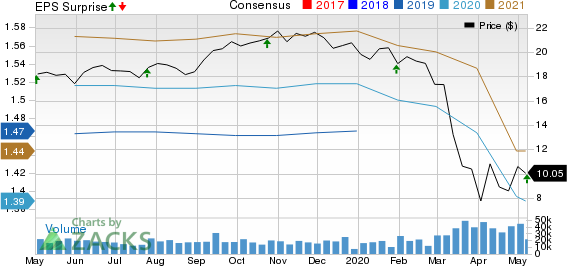

Kimco Realty Corporation Price, Consensus and EPS Surprise

Kimco Realty Corporation price-consensus-eps-surprise-chart | Kimco Realty Corporation Quote

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We, now, look forward to the earnings releases of other REITs like Park Hotels & Resorts Inc. PK, Simon Property Group, Inc. SPG and The Macerich Company MAC, which are slated to report quarterly numbers next week.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimco Realty Corporation (KIM) : Free Stock Analysis Report

Macerich Company The (MAC) : Free Stock Analysis Report

Simon Property Group Inc (SPG) : Free Stock Analysis Report

Park Hotels Resorts Inc (PK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance