Kim Iskyan: Why the Tech Stock Boom Might be Ending; Starting with Yahoo

If you haven’t already noticed, there are ups and downs in markets — bull and bear markets.

Tech stocks, which have been enjoying a year-long bull market, might be signaling the good times are coming to an end.

Usually in hindsight, we can see that there are actually factors or symptoms that signify a turning point.

What’s happening with Yahoo, the web portal, search, and internet advertising company, might actually be a starting point and symptom.

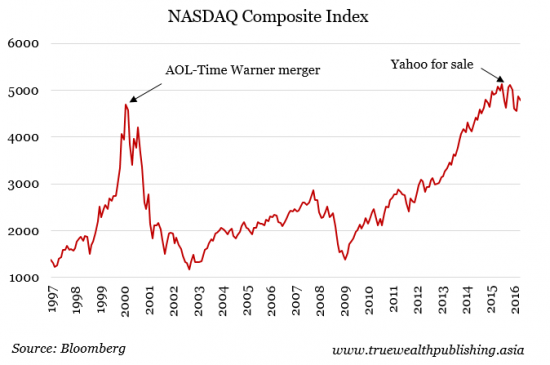

As shown below, the performance of the NASDAQ index in the U.S. and the Shenzhen stock market in China – two of the world’s biggest tech-heavy indices – have left the rest of the world far behind.

Following their 2008-2009 lows, the Shenzhen index has gained 310% and the NASDAQ 283 percent.

The S&P 500 is up 207% during the same period. And for the past two years, both have outperformed the S&P 500 and the MSCI World Index.

One symptom of a potential market plunge is when an industry player is acquired at a ridiculous valuation.

It suggests that investors – and companies – are getting overly enthusiastic about their sector.

The buyer usually has a good explanation for the overblown price, which typically doesn’t make sense later on.

Yahoo Might be a Sign the Market has Become Irrational

Times are hard for Yahoo. Last quarter, its core search and advertising businesses saw a steep decline in revenue, after years of flatlining.

Even though Yahoo is one of the original internet giants, it’s only worth a fraction of tech companies that came later.

Facebook is worth ten times more and Google is fourteen times more valuable.

Unfortunately, Yahoo has become a minor player in the online world.

Yahoo’s market value in early 2000 was US$94 billion. Today it’s worth has dropped to US$35 billion.

And this includes the US$30 billion that is tied up in China-based e-commerce titan Alibaba; and a stake in Yahoo Japan.

The company’s core assets – including Yahoo Finance, the Tumblr social media site, and its email and search functions – are up for sale.

The coming days will see final bidding, but estimates put the value of these assets at US$2 to $3 billion.

Bloomberg reports that as of late April there were 10 bids for Yahoo’s assets, including some around US$8 billion.

Rumors name bidders Verizon, the U.S. mobile company, two or three private well-financed equity firms, and even a partnership involving Warren Buffett as the financier.

Buyers say they are interested in “creating synergies” between their existing businesses and Yahoo’s assets.

This could be signalling that the top of the tech stock boom has been reached.

A bid many times the actual value of Yahoo’s assets would mean that the market has become irrational.

And this could be followed by a drop in tech share prices across the board.

The Worst Merger of All Time

This is not the first time the expression “create synergies” has been used regarding the sale of an internet company.

It was sixteen years ago, near the top of the first internet bubble, that internet giant America Online (AOL) merged with U.S. media giant Time Warner.

AOL was America’s leading internet provider, with 23 million dial-up internet subscribers.

The merger was valued at US$350 billion and is still the largest of all time. The new company was named AOL-Time Warner.

Time Warner president Richard Parsons announced the merger as “a pivotal moment in the unfolding of the Internet age”.

It was expected to “create synergies” between AOL’s internet customers and Time Warner’s media content (movies, magazines, cable TV).

And it was indeed a pivotal moment – it was the turning point of the internet stock market boom.

The tech-heavy NASDAQ had climbed 130 percent over the two years leading up to the merger. But two years after the merger, by mid-2002, the NASDAQ index had fallen 76 percent.

AOL-Time Warner’s stock price followed suit, falling from US$215 per share in March 2000 to US$32 two years later.

In 2003, AOL-Time Warner posted the largest yearly corporate loss in history up till that time.

Internet users were switching from AOL’s dial-up service to the much faster broadband network.

The company reported a loss of US$99 billion in January of that year, including a US$46 billion write-down of its AOL assets. By September, Time Warner Inc. had dropped AOL from its name.

Time Warner sold its AOL assets to Verizon Communications in June 2015 for just US$4.4 billion, for a loss of US$220 billion.

With Time Warner’s current market value at around US$59 billion, the merger ended up costing investors and shareholders US$290 billion.

It is now studied in businesses schools as an example of what not to do.

The Technology Market – at another top?

Once again, tech stocks are hot. Apple and Google (now Alphabet) are the world’s most valuable companies.

The NASDAQ composite index, a popular trading platform for technology shares, has passed the highs it reached during the last technology boom – 14 years later.

Will Yahoo sell itself to the highest bidder at far more than its true worth?

Buyers are again saying they want to purchase assets that will help them create “synergies”.

Investors think there is still time to make some money given the current bull market.

Yahoo would not be putting its assets up for sale if people weren’t excited about technology stocks.

Today’s tech stock boom is not the same as the bubble that burst in 2000. The technology market has come of age, and tech stock valuations are generally lower.

But if a major buyout or merger involving Yahoo or any other company is announced at a price far above market value, it’s almost an obvious sign that the bull market in technology shares is peaking.

Kim Iskyan is the founder of Truewealth Publishing, an independent investment research company based in Singapore. Click on the button below to sign up to receive the Truewealth Asian Investment Daily in your inbox every day, for free.

Yahoo Finance

Yahoo Finance