Kim Iskyan: What Every ETF Investor Needs To Know Today

The exchange traded fund (ETF) revolution is well underway…

Last week, we wrote about how the ETF industry has exploded over the past few years. A record US$3.4 trillion in assets under management (AUM) are now held in ETFs. That’s a nearly 17-fold increase since 2003. Investors have already sunk $391 billion into ETFs so far in 2017, according to industry consultancy ETFGI, surpassing last year’s record in just seven months.

There are now over 1,200 ETFs listed on the New York Stock Exchange. And about 5,000 ETFs around the world – up from just 450 in 2005.

This growth is part of the larger trend of passive investing. This has been great for everyday investors… their portfolio performance has been a lot better than actively managed funds. But passive investing is becoming a snake that’s eating itself… and the unintended consequences of a good thing could turn into something bad.

The passive investment boom

Passive investing involves investing with a buy-and-hold strategy through an ETF or index fund that simply tracks an index.

It works – well. Depending on the fund, somewhere between 71% and 93% of active U.S. stock mutual funds have closed or underperformed the index funds they are trying to beat, according to Morningstar.

What’s more, passively managed funds are a lot cheaper… expenses can be just 3.0% or 5.0% of the fees of actively managed funds. Over time, that kind of expense difference can have a huge impact on performance.

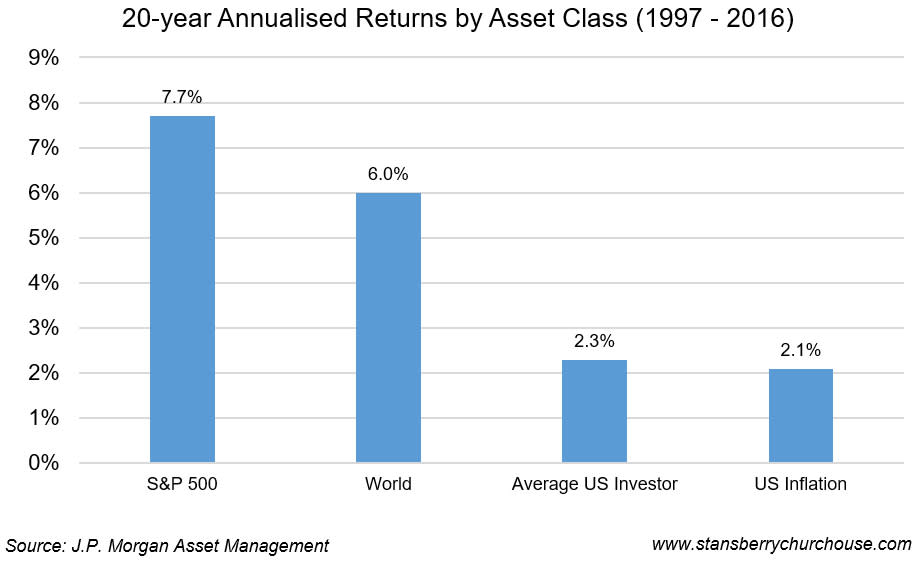

And over the past two decades, the S&P 500 has returned over three times more than the average U.S. investor. The average U.S. investor has earned just 2.3% over this time… far behind the 7.7% for the S&P 500 and just ahead of inflation at 2.1%, as the graph below shows.

So, the average investor might as well have left his cash in the bank – he would have at least not spent money on trading fees. Most fund managers don’t beat the market either… even though that’s their job.

As a result, passive investing is in the midst of a big boom. Over 40% of all funds under management in U.S. equities are passive investments. Industry estimates suggest that number is expected to grow to 50% by 2018.

The profound effect of passive investing

At Stansberry Churchouse Research, we’re fans of ETFs. Most of the time, ETFs are good for everyday investors. Remember, ETFs are simple, low-cost and often outperform more active funds.

But at a certain point, if too many investors follow the same benchmark, the benchmark becomes the tail that wags the dog.

For example, the continued flood of money into index-tracking funds is having a big impact on overall market liquidity. And it’s also distorting the valuation of stocks that are in the indices.

Just consider… Vanguard Group (one of the world’s largest investment companies) now owns at least a 5.0% stake in 491 stocks in the S&P 500… that’s up from just 116 companies in 2010. And Vanguard now owns almost 7.0% of the entire index, according to the Financial Times.

And since 2009, clients at Bank of America have dumped US$200 billion worth of individual stocks… and bought US$160 billion worth of ETFs instead. ETFs now make up 24% of trading in U.S. equities… that’s up from 20% back in 2014, the Financial Times reports.

Wall Street analysts are sounding the alarm…

Last summer, investment firm Sanford C. Bernstein released a report titled “The Silent Road to Serfdom: Why Passive Investing Is Worse than Marxism”. That’s a bit much – but its main point was that index investing can lead to mispricing of stocks.

No less an authority than the grandfather of passive investing, Vanguard Group founder John C. Bogle, thinks that indexing can get too big for its own good. “What happens when everybody indexes?” he asks. “Chaos, chaos without limit. You can’t buy or sell, there is no liquidity, there is no market.” Not surprisingly, he only sees this danger if passive investing gets a lot bigger than it is now, though.

In short, the Wall Street is worried that passive investing is undermining basic market principles – that good companies’ share prices should rise in value as their businesses grow, and bad companies’ share prices should go bust.

Passive investing means investors are focusing less on company fundamentals – they’re less interested in distinguishing between well-run, growing companies and poorly managed companies. They’re not focused on determining what shares are cheap and which are overvalued. Instead, they’re throwing their money at an index, regardless of its composition.

In other words, no one is kicking the tires of sectors and companies to check their fundamentals… passive vehicles are just investing in 500 stocks at a time, with capital allocated to each stock depending on nothing more than their market cap, regardless of changing circumstances.

As the Wall Street Journal recently explained in an article titled “The Dying Business of Picking Stocks”:

“Passive funds are designed only to match the markets, so investors are giving up the chance to outperform them. And if fewer managers are drilling into financial reports to pick the best stocks and avoid the worst – index funds buy stocks blindly – that could eventually undermine the market’s capacity to price shares efficiently.”

Also… the law of passive investing means that the de facto asset managers of hundreds of billions of dollars become none other than the people who create the indices that are followed by ETFs. The rules that govern what stocks are allowed into the golden gates of the biggest indices are probably among the most important – and least scrutinised – investment dictates in the world of finance today.

What should you do?

When it comes to ETFs – just like with beer and fast food – moderation always works best. So use ETFs by all means – but don’t use them exclusively.

Also remember, not all ETFs are good. Some ETFs, like these in Vietnam, have a terrible record of tracking their benchmark index. Just because an ETF promises to track an index, it doesn’t mean that it will deliver on that promise.

And tracking error is just one of the risks that come with investing ETFs. As the ETF market has grown, providers have developed more exotic – and risky – products to stand out in this increasingly crowded field.

Leveraged ETFs (that claim to double or triple the returns of an index) and inverse ETFs (that do the opposite of what an index does) are some of the riskiest investments around. Leveraged and inverse ETFs use derivatives, and this allows managers to stimulate or multiply the returns of the index.

These products track daily returns, so short-term traders can make a quick profit. But over time, these ETFs can seriously underperform their index (especially if it is more volatile), as we’ve written before.

And maybe most importantly, index investing isn’t the final word. There’s still a place for stock analysis and selection. It’s not for everyone, of course.

P.S. Kim will be speaking at our upcoming Shares Investment Convention, where he will share insights from his 20+ years of experience. Learn more below.

This is a guest post by Stansberry Churchouse Research, an independent investment research company based in Singapore and Hong Kong that delivers investment insight on Asia and around the world. Click here to sign up to receive the Asia Wealth Investment Daily in your inbox every day, for free.

Upcoming Event

We managed to invite a few popular names in the finance and investment education world to speak at our upcoming Shares Investment Convention on 16 September 2017 (Saturday)!

They’ll be covering topics on personal finance, macroeconomics and investment strategies to help retail investors make more shrewd decisions especially in the current uncertain and volatile economy. Click on the button above to learn more and grab your tickets. See you there!

P.S. Don’t forget to enter promo code “SHARES10” for a $10 discount!

Yahoo Finance

Yahoo Finance