KeyCorp's (KEY) Q2 Earnings Match Estimates, Revenues Down

KeyCorp’s KEY second-quarter 2019 adjusted earnings of 44 cents per share were in line with the Zacks Consensus Estimate. Also, the figure was on par with the prior-year quarter level.

Results were adversely impacted by lower non-interest income, decline in net interest margin (mainly due to flattening of yield curve), higher expenses and deterioration in credit quality. However, a marginal increase in interest income, and decent loan and deposit growth acted as tailwinds.

After taking into consideration certain non-recurring items, net income from continuing operations was $403 million or 40 cents per share, down from $464 million or 44 cents per share in the prior-year quarter.

Revenues Decline, Expenses Rise

Total revenues were down 2.2% year over year to $1.61 billion. Also, the figure lagged the Zacks Consensus Estimate of $1.62 billion.

Tax-equivalent net interest income increased slightly year over year to $989 million. This included $17 million of purchase accounting accretion. The rise was driven by benefits from higher interest rates and increase in earning asset balances.

Taxable-equivalent net interest margin from continuing operations decreased 13 basis points (bps) year over year to 3.06%.

Non-interest income was $622 million, declining 5.8%. The fall was mainly due to lower trust and investment services income, service charges on deposit accounts and corporate services income. These were partially offset by improved mortgage banking performance.

Non-interest expenses jumped 2.6% year over year to $1.02 billion. Excluding efficiency-related expenses, operating expenses increased marginally, reflecting the impact of Laurel Road buyout, partly offset by the successful implementation of expense initiatives.

At the end of the second quarter, average total deposits were $109.6 billion, up 1.9% from the prior quarter. Average total loans were $90.8 billion, up 1.3% on a sequential basis.

Credit Quality Worsens

Net loan charge-offs, as a percentage of average loans, increased 2 bps year over year to 0.29%. Also, provision for credit losses rose 15.6% to $74 million.

Further, KeyCorp’s allowance for loan and lease losses was $890 million, up marginally from the prior-year quarter. Also, non-performing assets, as a percentage of period-end portfolio loans, other real estate owned properties assets and other nonperforming assets were 0.66%, up 1 bp.

Capital Ratios Improve

KeyCorp's tangible common equity to tangible assets ratio was 8.59% as of Jun 30, 2019, up from 8.32% on Jun 30, 2018. Also, Tier 1 risk-based capital ratio was 11.05%, up from 10.95%.

The company’s estimated Basel III Common Equity Tier 1 ratio was 9.60% at the end of the reported quarter.

Share Repurchases Update

During the reported quarter, KeyCorp repurchased $180 million worth of shares as part of its 2018 capital plan.

Our Take

Steady loan and deposit growth (as witnessed in the second quarter) is expected to continue supporting net interest income amid the Federal Reserve’s accommodative stance. However, rise in operating expenses and deteriorating asset quality are near-term major concerns.

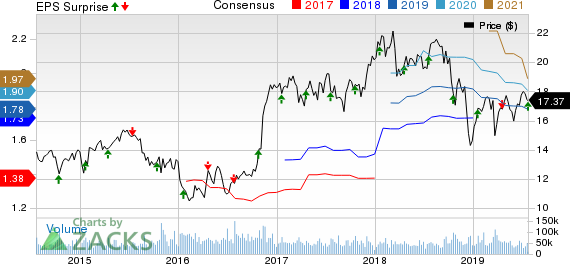

KeyCorp Price, Consensus and EPS Surprise

KeyCorp price-consensus-eps-surprise-chart | KeyCorp Quote

KeyCorp currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Major Banks

BB&T Corporation’s BBT second-quarter 2019 adjusted earnings of $1.12 per share surpassed the Zacks Consensus Estimate of $1.08. The bottom line also represented 11% growth from the year-ago figure.

SunTrust Banks' STI second-quarter 2019 adjusted earnings of $1.44 per share reflect a decline of 3.4% from the year-ago quarter’s reported figure. The Zacks Consensus Estimate for earnings was pegged at $1.46.

Driven by top-line strength, U.S. Bancorp’s USB second-quarter 2019 earnings per share of $1.09 surpassed the Zacks Consensus Estimate of $1.07. Also, the reported figure jumped 6.9% from the prior-year quarter.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BB&T Corporation (BBT) : Free Stock Analysis Report

SunTrust Banks, Inc. (STI) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

U.S. Bancorp (USB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance