KeyCorp (KEY) Up as Q4 Earnings Beat on Higher Fee Income

KeyCorp’s KEY fourth-quarter 2021 earnings per share from continuing operations of 64 cents easily surpassed the Zacks Consensus Estimate of 57 cents. The bottom line improved 14.3% from the prior-year quarter.

The stock rallied almost 1% during the pre-market trading, reflecting investors’ optimism over the better-than-expected results. The full-day trading session will display a clearer picture.

Results benefited from a rise in non-interest income and lower provisions. However, a fall in net interest income due to lower rates and a decline in loan balance, and higher operating expenses were the undermining factors.

Net income from continuing operations attributable to common shareholders was $601 million, up 9.5% year over year.

In 2021, earnings from continuing operations of $2.62 per share outpaced the consensus estimate of $2.55 and substantially increased from $1.26 in the prior year. Net income from continuing operations available to common shareholders was $2.61 billion, up 96.5%.

Revenues Improve & Expenses Rise

Quarterly total revenues grew 5.5% year over year to $1.95 billion. The top line surpassed the Zacks Consensus Estimate of $1.81 billion.

In 2021, total revenues were up 7% from the prior year to $7.29 billion. The top line beat the Zacks Consensus Estimate of $7.14 billion.

Net interest income (on a tax-equivalent basis) declined marginally to $1.04 billion. The fall was mainly due to lower reinvestment yields and the exit of the indirect auto loan portfolio, largely offset by higher earning asset balances.

Taxable-equivalent NIM from continuing operations contracted 26 basis points (bps) to 2.44%.

Non-interest income was $909 million, growing 13.3%. The rise was mainly driven by an increase in investment banking and debt placement fees, commercial mortgage servicing fees, service charges on deposit accounts and corporate service income.

Non-interest expenses were up 3.7% to $1.17 billion. The increase was mainly due to higher personnel costs, business services and professional fees, and computer processing fees.

At the fourth-quarter end, average total deposits were $151 billion, up 2.8% from the prior quarter. Average total loans were $99.4 billion, down almost 1%.

Credit Quality Improves

Net loan charge-offs, as a percentage of average loans, decreased 45 bps year over year to 0.08%. Allowance for loan and lease losses was $1.06 billion, down 34.7%.

Provision for credit losses was $4 million, down 80% from the prior-year quarter. Non-performing assets, as a percentage of period-end portfolio loans, other real estate-owned properties assets and other non-performing assets were 0.48%, down 44 bps.

Capital Ratios Deteriorates

KeyCorp's tangible common equity to tangible assets ratio was 6.9% as of Dec 31, 2021, down from 7.9% in the corresponding period of 2020. Tier 1 risk-based capital ratio was 10.7%, down from 11.1% in the prior-year quarter level.

Our Take

Solid loans and deposit balances, along with a focus on fee income, are likely to continue supporting KeyCorp’s revenues. However, lower rates and rising expenses are near-term concerns.

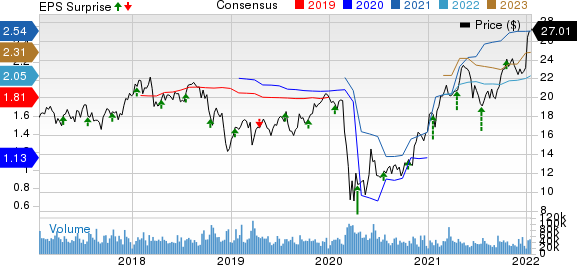

KeyCorp Price, Consensus and EPS Surprise

KeyCorp price-consensus-eps-surprise-chart | KeyCorp Quote

KeyCorp currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Major Banks

Truist Financial’s TFC fourth-quarter 2021 adjusted earnings of $1.38 per share easily surpassed the Zacks Consensus Estimate of $1.26. The bottom line grew 16.9% from the prior-year quarter.

Truist’s results were aided by higher fee income, a decline in operating expenses, modest loan growth and provision benefits. However, lower interest rates and a fall in net interest income (NII) were the undermining factors.

The PNC Financial Services Group, Inc. PNC pulled off a fourth-quarter 2021 positive earnings surprise of 1.94% on substantial recapturing of credit losses. Earnings per share, as adjusted (excluding pre-tax integration costs related to the BBVA USA acquisition), of $3.68 surpassed the Zacks Consensus Estimate of $3.61 and improved 12.5% year over year.

Fee income growth on higher asset management revenues and corporate services supported PNC Financial’s results. However, higher expenses, margin contraction and a decline in loans were the headwinds.

State Street’s STT fourth-quarter 2021 adjusted earnings of $2.00 per share outpaced the Zacks Consensus Estimate of $1.91. The bottom line was 18.3% higher than the prior-year level.

State Street’s results reflected new investment servicing wins, provision benefits and improvement in fee income. However, a rise in expenses, a fall in net interest revenues and lower interest rates were the undermining factors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The PNC Financial Services Group, Inc (PNC) : Free Stock Analysis Report

State Street Corporation (STT) : Free Stock Analysis Report

KeyCorp (KEY) : Free Stock Analysis Report

Truist Financial Corporation (TFC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance