Key Factors Influencing First Republic's (FRC) Q3 Earnings

First Republic Bank FRC is scheduled to report third-quarter 2022 earnings, before the opening bell on Oct 14. The company’s quarterly revenues and earnings are likely to have improved year over year.

In the last reported quarter, the company’s earnings surpassed the Zacks Consensus Estimate on increases in net interest income (NII) and non-interest income. However, higher expenses and elevated provisions for credit losses were the offsetting factors.

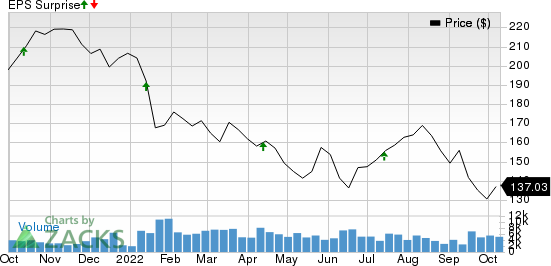

First Republic has an impressive earnings surprise history. Its earnings surpassed the consensus estimate in the trailing four quarters, the average surprise being 5.2%.

First Republic Bank Price and EPS Surprise

First Republic Bank price-eps-surprise | First Republic Bank Quote

Here are the factors that are likely to have influenced First Republic’s third-quarter performance:

Loan Growth: Per the Fed’s latest data, there was moderation in commercial and consumer lending in July and August. Residential real estate loan growth was decent, while commercial real estate loans held ground.

An increase in the utilization rate, strong loan pipeline and solid positioning of its business banking franchise are expected to have aided loan growth. The Zacks Consensus Estimate for the company’s average interest-earning assets is pegged at $190.6 trillion, suggesting a 4.3% increase from the prior quarter’s reported figure.

NII: Aggressive rate hikes this year are expected to have offered sufficient tailwind for NII growth and asset yields. However, yield curve flattening and rapidly rising funding costs in the September-end quarter are likely to have hindered the bank’s net interest margin.

The consensus mark for NII is pegged at $1.29 billion for the quarter, suggesting a 3.7% rise on a sequential basis.We project NII to be $1.28 billion for the quarter.

Non-Interest Income: The bank has a robust wealth management practice, with a focus on personalized customer service experience through its relationship banking model. It has also been expanding its investment management service offering to clients. These efforts are expected to have aided the company in onboarding customers, increasing wealth management assets.

Geopolitical tensions and uncertainty due to recession fears have dampened the market performance. Weaker equity markets are expected to have affected FRC’s wealth management business and revenues. The consensus estimate for investment management fees (comprising 65% of the total fee income) is pegged at $150 million, implying a fall of 8.5% sequentially. Management expects the same to be $148-$150 million for the third quarter.

Nonetheless, the consensus estimate for brokerage and investment fees of $27.58 million indicates a 16.4% increase from the previous quarter’s reported number.

Higher transaction volume from clients is expected to have hampered foreign exchange fee income. The consensus estimate for the same is pegged at $6.25 million, indicating a marginal increase from the previous quarter’s reported number.

With this, overall fee income is expected to see a 2.7% sequential decline to $256 million. Our estimate for the same is pinned at $285.9 million.

Expenses: First Republic’s investments in franchise development or digital initiatives, including mobile banking applications and data analytics, are anticipated to have kept costs elevated in the quarter. The investments are expected to aid the company over the long term, but the rising current expense level has been curbing the bottom-line expansion.

Asset Quality: The Federal Reserve’s accelerated pace of interest rate hikes and continued flattening/inversion of the yield curve have increased concerns regarding a downturn in the broader economy and loan losses. Hence, higher reserve built during the quarter is expected to have weighed on FRC’s bottom-line growth in the third quarter.

Now let’s take a look at what our quantitative model predicts for the to-be-reported quarter:

Our proven model does not show that First Republic has the right combination of the two key ingredients — positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Earnings ESP for First Republic is -0.06%.

Zacks Rank: The company currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for third-quarter earnings has been revised marginally downward over the past month to $2.19. Nonetheless, it suggests a rise of 14.7% from the year-ago reported figure.

Moreover, the consensus estimate for revenues of $1.55 billion indicates an increase of 18.9% from the year-ago reported figure.

Stocks That Warrant a Look

BankUnited BKU and M&T Bank MTB are a few stocks that you might want to consider, as these have the right combination of elements to post an earnings beat in their upcoming releases, per our model.

The Earnings ESP for BKU is +1.32% and the company carries a Zacks Rank #3 at present. BKU is slated to report third-quarter 2022 results on Oct 20.

MTB is scheduled to release third-quarter results on Oct 19. MTB currently has a Zacks Rank #3 and an Earnings ESP of +0.34%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

M&T Bank Corporation (MTB) : Free Stock Analysis Report

First Republic Bank (FRC) : Free Stock Analysis Report

BankUnited, Inc. (BKU) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance