Keurig Dr Pepper (KDP) Q1 Earnings In Line, Sales Surpass

Keurig Dr Pepper Inc. KDP reported first-quarter 2022 results, wherein the bottom line was in line with the Zacks Consensus Estimate, while sales surpassed the same. While earnings were flat year over year, sales improved from the year-ago period’s level. Results gained from KDP’s solid brand portfolio. However, inflationary pressures as well as supply-chain disruptions and labor shortages acted as deterrents.

Shares of KDP have gained 6.1% in the past six months against the industry’s 2.3% dip.

Q1 in Detail

Adjusted earnings of 33 cents per share were flat year over year and matched the Zacks Consensus Estimate. The metric advanced 13.8% on a two-year basis.

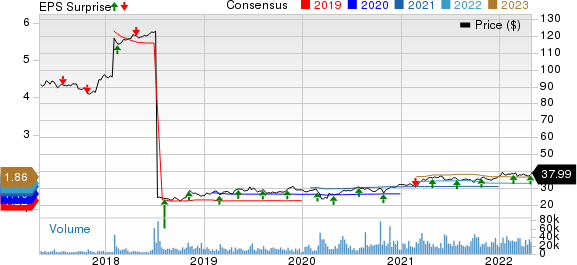

Keurig Dr Pepper, Inc Price, Consensus and EPS Surprise

Keurig Dr Pepper, Inc price-consensus-eps-surprise-chart | Keurig Dr Pepper, Inc Quote

Net sales of $3,078 million surpassed the Zacks Consensus Estimate of $3,021 million and jumped 6.1% from the year-ago quarter’s level and 17.5% on a two-year basis. The upside was driven by growth in the Packaged Beverages, Beverage Concentrates and Latin America Beverages segments. On a constant-currency (cc) basis, net sales increased 17.5% on a two-year basis. Net price realization grew 6.3%, slightly mitigated by a lower volume/mix of 0.2%.

During the reported quarter, Keurig Dr Pepper’s in-market performance in the Liquid Refreshment Beverages (LRB) category remained sturdy, with retail dollar consumption growing 9.9% and market share expanding above 87% of KDP's cold beverage portfolio. This mainly reflected strength in CSDs3, coconut water, seltzers, teas, apple juice and fruit drinks. Also, strength in Dr Pepper, Sunkist, Canada Dry, A&W and Squirt CSDs, Vita Coco, Polar seltzers, Snapple, and Mott's aided results. On a two-year basis, KDP’s retail dollar consumption rose 21% and gained a market share for 78% of the cold beverage portfolio.

In coffee, retail dollar consumption of single-serve pods manufactured by Keurig Dr Pepper rose 3.6% in channels tracked by IRi. KDP sequentially increased the manufacturing output owing to a focused supply-chain recovery program, and its manufactured share was solid at 82.5%. KDP witnessed improvement in the away-from-home channel’s performance in the quarter but was below the pre-COVID levels. On a two-year basis, retail consumption of single-serve pods climbed 8.2% in IRi-tracked channels.

We note that pricing in coffee increased to offset the impact of inflation. The single-serve coffee category pricing rose 5.4% in the quarter as pricing actions were robust. KDP-manufactured brands pricing jumped 6.7% in the reported quarter.

Adjusted gross profit rose 0.7% year over year to $1,623 million, while adjusted gross margin contracted 280 basis points to 52.7%. This was mainly due to higher inflationary pressures along with supply-chain disruptions and labor constraints.

Adjusted operating income dipped 1.2% to $732 million in the quarter due to major impacts of inflation, comprising the macro supply-chain and labor headwinds. Adjusted operating margin contracted 170 basis points to 23.8%.

Segmental Details

Sales in the Coffee Systems segment dipped 4.3% year over year to $1,093 million, mainly due to the supply-chain challenges. At cc, net sales increased 11.8% on a two-year basis. Net price realization grew 3.2%, offset by a lower volume/mix of 7.5%. Net price realization was backed by pricing actions, along with sequentially lower customer fines. The volume/mix decline was due to a reduced pod and brewer shipment volume, both of which fell 5.2% year over year.

Sales in the Packaged Beverages segment totaled $1,480 million, up 13.2% year over year, gaining from a favorable volume/mix of 4.9% and a higher net price realization of 8.3%. Segment sales rose 21.4% at cc on a two-year basis. The segment benefited from growth in Canada Dry, Dr Pepper, 7UP, A&W, Sunkist and Squirt CSDs, Mott's and Snapple, CORE Hydration, Polar seltzers, Hawaiian Punch and Vita Coco.

Sales in the Beverage Concentrates segment rose 9.5% year over year to $359 million, gaining from a favorable net price realization of 7.6% and a volume/mix rise of 1.9%. At cc, the segment’s net sales increased 16.7% on a two-year basis. Rise in fountain foodservice shipments on increased consumer mobility in the restaurant and hospitality channels aided volume/mix. While total shipment volume rose 1.9% year over year on increases in Dr Pepper and Sunkist, bottler case sales volume inched up 2.2%.

The Latin America Beverages segment’s sales advanced 16.8% to $146 million. At cc, net sales increased 17.6%, owing to volume/mix growth of 8% and an improved net price realization of 9.6%. Strength in Clamato, Peñafiel, Mott's and Squirt aided quarterly segment growth.

Financials

As of Mar 31, 2022, Keurig Dr Pepper’s cash and cash equivalents were $592 million. KDP also had long-term obligations of $11,584 million and a total stockholders’ equity of $25,511 million (excluding non-controlling interest). Net cash provided by operating activities totaled $663 million at the end of the first quarter.

This currently Zacks Rank #3 (Hold) company generated a free cash flow of $632 million in the reported quarter. The solid free cash flow enabled it to reduce total financial obligations by $350 million in the first quarter.

Outlook

Driven by robust quarterly results, Keurig Dr Pepper raised its sales view for 2022. Management now projects net sales at cc to grow in the high-single-digit range from the earlier expectation of an increase in mid-single digits.

Management reaffirmed the adjusted earnings per share view of a mid-single-digit range increase for 2022. Adjusted earnings per share growth is likely to be in the high-single-digits in the second half of 2022. However, inflation remains the greatest challenge ahead.

Stocks to Consider

Some better-ranked stocks in the Consumer Staples sector are Inter Parfums IPAR, McCormick MKC and Sysco SYY.

Inter Parfums currently sports a Zacks Rank #1 (Strong Buy). IPAR has a trailing four-quarter earnings surprise of 46.7%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Inter Parfums’ current financial-year sales and earnings per share (EPS) suggests growth of 12.5% and 10.9%, respectively, from the corresponding year-ago period’s reported figures.

McCormick currently has a Zacks Rank #2 (Buy). MKC has a trailing four-quarter earnings surprise of 7.3%, on average.

The Zacks Consensus Estimate for McCormick’s current financial-year sales suggests growth of 5% from the year-ago reported figure. The same for EPS suggests a rise of 3.9% from the year-ago reported figure.

Sysco currently has a Zacks Rank of 2. SYY has a trailing four-quarter earnings surprise of 3.7%, on average.

The Zacks Consensus Estimate for Sysco’s current financial-year sales and EPS suggests growth of 30.4% and 120.1%, respectively, from the corresponding year-ago actuals.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

McCormick & Company, Incorporated (MKC) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

Inter Parfums, Inc. (IPAR) : Free Stock Analysis Report

Keurig Dr Pepper, Inc (KDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance