Keep Close Tabs on These 3 New Dividend Aristocrats

Investors love consistent, reliable dividend payouts. After all, who doesn’t love the thrill of getting paid?

In a highly-volatile 2022, dividends have been a precious item for investors, helping to cushion the impact of drawdowns in other positions.

And when seeking dividend-paying stocks, many turn to the Dividend Aristocrats.

Dividend Aristocrats have consistently paid and increased their dividends for a minimum of 25 consecutive years, putting their well-established and successful business natures on full display.

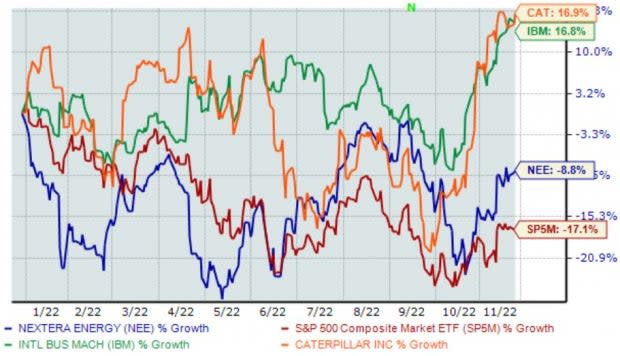

Three rookies that have just recently joined the club – International Business Machines Corp. IBM, Caterpillar CAT, and NextEra Energy, Inc. NEE – could all be considerations for investors seeking income.

The chart below illustrates the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

International Business Machines

International Business Machines is an information technology (IT) company operating through five segments: software, consulting, infrastructure, financing, and others. 2022 marked the 27th consecutive year that the company has increased its dividend.

IBM’s annual dividend currently yields a solid 4.5% paired with a payout ratio of 74% of its earnings. As we can see in the chart below, the company’s yield easily outmatches its Zacks Computer and Technology sector average.

Image Source: Zacks Investment Research

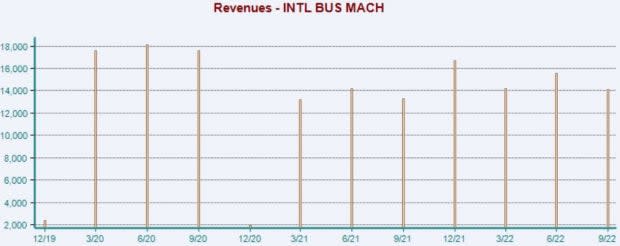

The company has consistently impressed with its quarterly results as of late, exceeding earnings and revenue estimates in three consecutive quarters.

Just in its latest release, IBM posted a 1.7% EPS beat paired with a 2.7% sales surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Caterpillar

Caterpillar is the world’s largest construction-equipment manufacturer. The company designs, develops, engineers, manufactures, markets, and sells machinery, engines, financial products, and insurance to customers. 2022 marked the company’s 29th consecutive year of increased dividend payouts.

CAT’s annual dividend currently yields 2.1% paired with a solid 9% five-year annualized dividend growth rate.

The company’s payout ratio sits at a sustainable 38% of its earnings.

Image Source: Zacks Investment Research

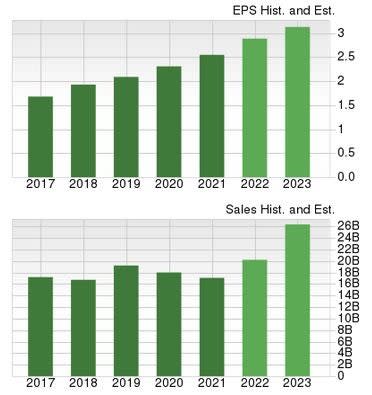

Further, the company’s earnings outlook has turned visibly bright over the last several months, helping land the stock into a favorable Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

NextEra Energy

NextEra Energy is a public utility holding company engaged in the generation, transmission, distribution, and sale of electric energy. The company has upped its dividend payout for 28 consecutive years.

NEE’s annual dividend currently comes in at 2%, below that of the Zacks Utilities sector by a fair margin. Still, the company’s 11.5% five-year annualized dividend growth rate helps to pick up the slack in a big way.

Image Source: Zacks Investment Research

In addition, NEE’s growth profile is hard to ignore; earnings are forecasted to climb more than 13% in its current fiscal year (FY22) and an additional 8.3% in FY23.

The projected earnings growth comes on top of forecasted Y/Y revenue upticks of 19.5% and 30% in FY22 and FY23, respectively.

Image Source: Zacks Investment Research

For the cherry on top, NEE shares have been notably strong over the last five years, up more than 140% and easily outpacing the S&P 500.

Image Source: Zacks Investment Research

Bottom Line

When structuring a portfolio, many investors blend in dividend-paying stocks for obvious reasons, including limiting drawdowns in other positions, creating a passive income stream, and the ability to maximize return through dividend reinvestment.

And when it comes to dividend-paying stocks, Dividend Aristocrats are common targets, as they’ve upped their dividend payouts for a minimum of 25 consecutive years.

All three stocks above – International Business Machines Corp. IBM, Caterpillar CAT, and NextEra Energy, Inc. NEE – belong to the elite Dividend Aristocrat group, making them suitable considerations for investors seeking income.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance