KBR Wins Contract From LG Chem to Allow Use of Hydro-PRT

In a bid to help clients realize their sustainability and ESG goals, KBR, Inc. KBR, together with Mura, has inked a deal with LG Chem, Korea, to provide technology licensing and engineering for its one-of-a-kind Hydro-PRT.

Developed by Mura, Hydro-PRT is licensed exclusively by KBR. This breakthrough plastics recycling technology utilizes a uniquely patented, supercritical steam process to convert a wide range of single-use and other plastics into commercial raw materials that are used to produce new plastics. KBR’s support will enable LG Chem to implement the innovative and scalable Hydro-PRT technology at its Dangjin plant.

KBR’s Technology president, Doug Kelly, said, "KBR is committed to helping clients realize their sustainability and ESG objectives and LG Chem's early leadership in this area is a testament to their sustainability commitment."

KBR’s Robust Technology Support to Aid Business

For more than 50 years, KBR has been leading process technology development, commercialization and the plant design solutions industry.

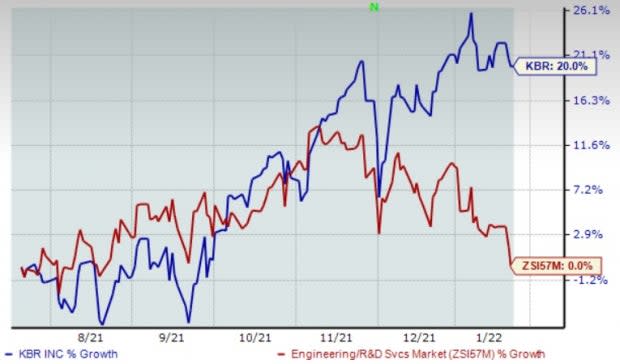

Image Source: Zacks Investment Research

KBR’s best-in-class technologies have been helping to design and build end-to-end, sophisticated digitization solutions as well as services for clients across the world. This includes high-fidelity operator training simulators, reliability-based maintenance solutions, dynamic simulation solutions, advanced process control solutions and more. These notable digitized technologies and solutions allow companies to increase efficiency and productivity, reduce costs as well as create opportunities for generating higher revenues and profitability.

Over the past several years, KBR has been offering proprietary sustainable technologies and professional services to support decarbonization. Also, it is actively involved in the hydrogen value chain, both as a technology provider and an advisor by providing differentiated project delivery solutions.

Overall, it has been driving growth by focusing on lowering carbon emissions, product diversification, energy efficiency, and more sustainable technologies as well as solutions. Demand for the company’s technologies across ammonia for food production, olefins for non-single-use plastics, and in refining for product diversification and more green solutions to meet tighter environmental standards has been strong. A strategic shift to IP-enabled maintenance is gaining traction and KBR continues to see increasing activity across the advisory portfolio, particularly in energy transition.

KBR’s solid prospects are backed by continuous contract wins, strong project execution, backlog level, and potential government as well as technology businesses. KBR’s shares have gained 20% in the past six months, outperforming the Zacks Engineering - R and D Services industry’s breakeven level.

Zacks Rank

Currently, KBR carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some Better-Ranked Stocks From the Broader Construction Sector

Lennar Corporation LEN currently sports a Zacks Rank #1. This Miami, FL-based homebuilder continues to gain from effective cost control and focus on making its homebuilding platform more efficient, which in turn is resulting in higher operating leverage.

Lennar’s earnings are expected to rise 10.9% year over year in fiscal 2022.

Toll Brothers, Inc. TOL: This luxury homebuilder’s strategy of broadening the product lines, price points and geographies will drive growth going forward. The company has been strategically adding more affordable luxury communities in view of the current demographic trends and expanding footprint and customer base. TOL has been expanding geographically via selective acquisitions.

Toll Brothers currently sports a Zacks Rank #1. Earnings are expected to grow 49.9% in fiscal 2022.

KB Home KBH is a well-known homebuilder in the United States and one of the largest in the United States. It offers a diverse range of new homes that are designed primarily for first-time, move-up and active adult homebuyers on acquired or developed lands. It also builds attached and detached single-family and town homes as well as condominiums.

KB Home currently has a Zacks Rank #2. Earnings are expected to grow 67.9% in fiscal 2022.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

KBR, Inc. (KBR) : Free Stock Analysis Report

Toll Brothers Inc. (TOL) : Free Stock Analysis Report

KB Home (KBH) : Free Stock Analysis Report

Lennar Corporation (LEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance