Kansas City Southern's (KSU) Q2 Earnings Lag, Rise 79.1% Y/Y

Kansas City Southern’s KSU second-quarter 2021 earnings (excluding $6.23 from non-recurring items) of $2.06 per share missed the Zacks Consensus Estimate of $2.16. The bottom line, however, surged 79.1% on a year-over-year basis despite adjusted operating expenses increasing 28.9%.

Quarterly revenues of $749.5 million surpassed the Zacks Consensus Estimate of $733.1 million and increased 36.8% year over year, driven by the 31% rise in overall carload volumes. Higher fuel surcharge revenues and foreign exchange-related tailwinds aided revenues.

In the reported quarter, operating expenses (on a reported basis) escalated more than 200% to $1,181.2 million. This elevation was mainly due to the inclusion of a $700-million termination fee paid to Canadian Pacific Railway Limited CP.

Operating loss (on a reported basis) was $431.7 million against an operating income of $180.4 million a year ago. Operating income (on an adjusted basis) increased 51.4% to $289.1 million. Kansas City Southern’s adjusted operating ratio (operating expenses as a percentage of revenues) improved to 61.4% from 65.2% a year ago. Lower the value of the metric, the better.

Per management, the merger between this Kansas City, MO-based company and Canadian National Railway Limited CNI, which is likely to be completed in the second half of 2022, received widespread support. It stated that more than 1,750 letters had been already filed with the Surface Transportation Board in support of the impending merger.

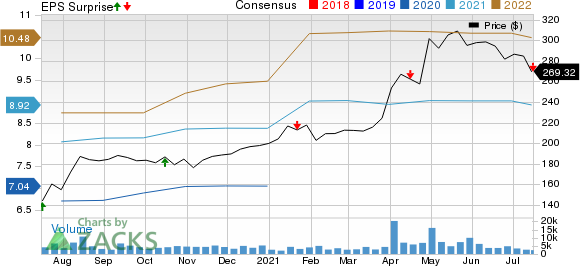

Kansas City Southern Price, Consensus and EPS Surprise

Kansas City Southern price-consensus-eps-surprise-chart | Kansas City Southern Quote

Other Financial Details of Q2

We note that segmental details reflect easy year-over-year comparisons since second-quarter 2020 was hardest hit by the COVID crisis, massively hurting earnings in the process.

The Chemical & Petroleum segment generated revenues worth $232.5 million, up 47% year over year. While segmental volumes climbed 37% year over year, revenues per carload improved 7% from the prior-year quarter.

The Industrial & Consumer Products segment’s revenues logged $144.6 million, up 20% year over year with all sub groups, metals and scrap, forest products and others performing well. Business volumes and revenues per carload increased 9% and 10%, respectively, on a year-over-year basis.

The Agriculture & Minerals segment’s total revenues increased 22% to $139.9 million. While business volumes expanded 14% year over year, revenues per carload gained 7%.

The Energy segment’s revenues of $54.5 million were up 39% year over year, riding on the 34% rise in revenues of the Utility Coal sub-group. While business volumes surged 43% year over year, revenues per carload dipped 3%.

Intermodal revenues were $91.1 million, up 43% year over year. While business volumes improved 31% year over year, revenues per carload climbed 10% year over year.

Revenues in the Automotive segment soared more than 200% year over year to $49.4 million. While business volumes surged 139%, revenues per carload increased 33% on a year-over-year basis.

Other revenues totaled $37.5 million, up 4% year over year.

Total capital expenses were $249 million in the first half of 2021 compared with $187 million in first-half 2020. The increase was due to higher capacity investments in first-half 2021.

The company returned $173 million to its shareholders in the first half of 2021 through dividend payments ($98 million) and share repurchases ($75 million). It did not repurchase shares in the June quarter as the buyback program was terminated. In first-half 2020, the company had rewarded its shareholders with $370 million through dividend payments ($76 million) and share buybacks ($294 million). The company generated free cash flow of $228 million in first-half 2021, up 0.8% year over year.

Outlook

The railroad operator updated its outlook. This currently Zacks Rank #3 (Hold) company still expects its 2021 revenues to grow in double digits from the 2020 levels. Its operating ratio estimate is now expected to be 60% (earlier guidance: 57.5%) for the current year while the same for 2022 is now projected in the 56-57% range (earlier view: 55-56%). The company continues to anticipate its current-year earnings per share to be roughly $9 (earlier guidance: $9 or better). The Zacks Consensus Estimate for 2021 earnings currently stands at $8.92.

Earnings per share view for next year is maintained in the $10.5-$11 band. The Zacks Consensus Estimate for 2022 earnings currently stands at $10.48 per share. Capital expenditures for 2021 and 2022 are reaffirmed to be roughly 17% of the company’s top line each. Free cash flow is still envisioned to be approximately $700 million for both the current year and the next.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Key Upcoming Railroad Release

Investors interested in the Zacks Transportation – Rail industry will be keenly awaiting the second-quarter 2021 earnings report of Union Pacific Corporation UNP on Jul 22.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Union Pacific Corporation (UNP) : Free Stock Analysis Report

Canadian National Railway Company (CNI) : Free Stock Analysis Report

Kansas City Southern (KSU) : Free Stock Analysis Report

Canadian Pacific Railway Limited (CP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance