Just How Cheap Is Applied Materials (AMAT) Stock?

Shares of Applied Materials AMAT dipped recently on the back of weaker-than-expected guidance after the company reported its second-quarter financial results at the end of last week. However, the chipmaking equipment power posted strong overall results, and the stock looks like a great value at the moment.

Recent Results

Applied Materials reported adjusted Q2 earnings of $1.22 per share, which not only topped our Zacks Consensus Estimate by 9 cents but also marked a 54% surge from the year-ago period. Meanwhile, the company’s revenues climbed by 29% to $4.57 billion, also beating our consensus estimate.

Investors reacted poorly to Applied Materials third-quarter guidance. The company now expects to post adjusted earnings in the range of $1.13 to $1.21 per share, which, at the time, came in at the low end of our Zacks estimate of $1.14 per share. The firm also called for revenues to fall between $4.33 billion and $4.53 billion, which came in line with our $4.45 billion estimate.

Applied Materials’ updated Q3 guidance is not devastatingly low. And the recent stock price dip, coupled with strong overall growth projections has made AMAT stock look rather attractive.

Recent Price Movement

Shares of Applied Materials are up roughly 11.7% over the last year, while the “Semiconductor Equipment - Wafer Fabrication” industry has surged nearly 30%. Year to date, AMAT stock has dipped 1.8% against its industry’s average climb of 8.6%. Applied Materials stock closed Monday at $50.00 per share or almost 20% below its 52-week high of $62.40 per share.

With that said, AMAT stock is cheap at the moment based on its price alone, and also has a long way to go before it must face the added burden of having to jump into a new range. Furthermore, if we go back farther, investors will see that Applied Materials stock is on a stellar run.

Applied Materials stock has skyrocketed 243.8% over the past five years, which outpaces its industry’s climb of 205%. Investors will also see that during the last three years, AMAT stock has soared 149%, against the S&P 500’s 28% gain. Clearly, the stock has performed insanely well over the last several years, and its recent dip just makes it a bit more attractive on the value end.

Valuation

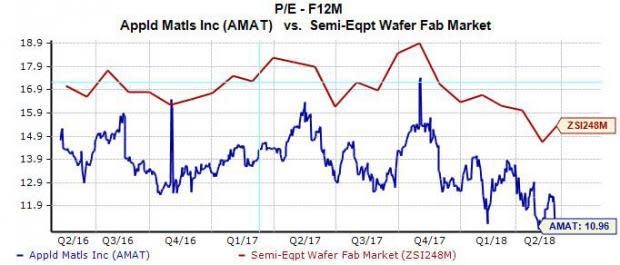

Coming into Tuesday, AMAT stock was trading at 10.9X forward 12-months earnings estimates, which marks a major discount compared the S&P 500’s 16.9X average. Diving a bit deeper, Applied Materials has traded well below its industry’s average over the last two years. This industry includes the likes of Lam Research LRCX, Advanced Energy Industries AEIS, and ASML Holding N.V. ASML.

Applied Materials stock has traded as high as 17.4X over the past two years, with its median resting at 13.7X. The company is also currently trading almost directly in line with its two-year low, which it touched briefly last week. Over the last five years, the lowest AMAT stock has ever traded at was 10.6X forward 12-months earnings estimates—a figure it hit in late September of 2015.

Therefore, looking back over the last several years, investors can say with some degree of confidence that AMAT stock is attractive at its current valuation, if not downright cheap.

And a major reason that Applied Materials stock currently presents investors great value, on top of its recently declining stock price, is the company’s earnings outlook. Applied Materials is projected to see its adjusted earnings surge by nearly 35% this quarter, while its full-year EPS figure is expected to expand by nearly 41%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ASML Holding N.V. (ASML) : Free Stock Analysis Report

Lam Research Corporation (LRCX) : Free Stock Analysis Report

Applied Materials, Inc. (AMAT) : Free Stock Analysis Report

Advanced Energy Industries, Inc. (AEIS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance