June Top Undervalued Cyclical Stocks

Cyclical companies are those that offer goods and services that are luxuries, instead of absolute necessities, such as entertainment and gambling. Noel Gifts International and Stamford Tyres are cyclical companies that are currently trading below what they’re actually worth. There’s a few ways you can determine how much a cyclical company is actually worth. The most popular methods include discounting the company’s cash flows it is expected to create in the future, or comparing its price to its peers or the value of its assets. The discrepancy between the price and value means investors have an opportunity to buy shares at a discount. Below are the stocks I believe are undervalued on all criteria, based on their latest financial data.

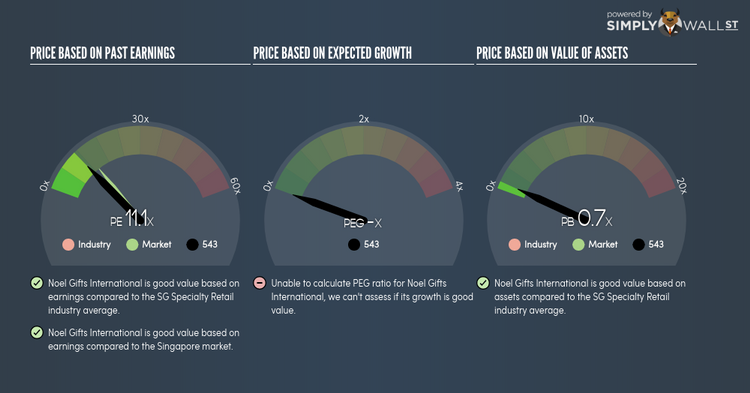

Noel Gifts International Ltd (SGX:543)

Noel Gifts International Ltd provides hampers, flowers, and gifts in Singapore and Malaysia. Noel Gifts International was started in 1975 and with the company’s market capitalisation at SGD SGD21.01M, we can put it in the small-cap category.

543’s shares are now floating at around -33% less than its real value of $0.3, at a price of S$0.20, based on my discounted cash flow model. The mismatch signals a potential chance to invest in 543 at a discounted price. What’s even more appeal is that 543’s PE ratio is trading at around 11.07x while its index peer level trades at, 13.49x indicating that relative to other stocks in the industry, you can buy 543’s shares at a cheaper price. 543 is also strong in terms of its financial health, as near-term assets sufficiently cover liabilities in the near future as well as in the long run. 543 also has no debt on its balance sheet, which gives it headroom to grow and financial flexibility. Interested in Noel Gifts International? Find out more here.

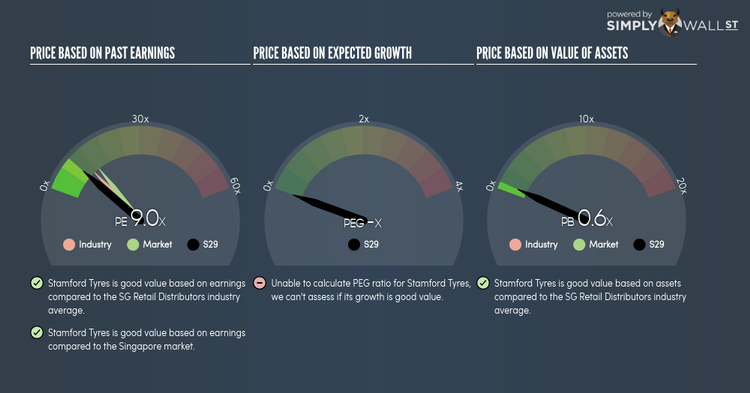

Stamford Tyres Corporation Limited (SGX:S29)

Stamford Tyres Corporation Limited, an investment holding company, engages in the wholesale and retail of tires and wheels in South East Asia, North Asia, Africa, and internationally. Stamford Tyres was started in 1989 and with the company’s market cap sitting at SGD SGD77.74M, it falls under the small-cap stocks category.

S29’s shares are currently trading at -40% below its real value of $0.55, at the market price of S$0.33, based on my discounted cash flow model. This difference in price and value gives us a chance to buy low. Additionally, S29’s PE ratio stands at around 9x against its its Retail Distributors peer level of, 11.32x indicating that relative to its competitors, S29’s stock can be bought at a cheaper price. S29 also has a healthy balance sheet, with current assets covering liabilities in the near term and over the long run. The stock’s debt-to-equity ratio of 73.15% has been declining for the past few years showing S29’s capability to pay down its debt. Dig deeper into Stamford Tyres here.

The Hour Glass Limited (SGX:AGS)

The Hour Glass Limited, an investment holding company, retails and distributes watches, jewelry, and other luxury products in South East Asia, Australia, and North East Asia. The company was established in 1979 and with the market cap of SGD SGD465.31M, it falls under the small-cap stocks category.

AGS’s shares are now hovering at around -53% below its true value of $1.41, at the market price of S$0.66, based on my discounted cash flow model. The discrepancy signals an opportunity to buy low. In addition to this, AGS’s PE ratio is around 9.34x compared to its Specialty Retail peer level of, 11.07x indicating that relative to its comparable company group, you can purchase AGS’s stock for a lower price right now. AGS is also robust in terms of financial health, as near-term assets sufficiently cover liabilities in the near future as well as in the long run. It’s debt-to-equity ratio of 9.56% has been dropping over the past couple of years revealing AGS’s capability to reduce its debt obligations year on year. More detail on Hour Glass here.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance