June 2024 Insights Into Stocks Estimated Below Value On SIX Swiss Exchange

Amidst a cautious atmosphere in the Switzerland market, with investors holding back ahead of key policy announcements, the Swiss National Bank's anticipated rate cut could stir significant economic implications. In such a context, identifying undervalued stocks on the SIX Swiss Exchange offers potential opportunities for investors seeking value in a market characterized by restrained yet hopeful movements.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

Name | Current Price | Fair Value (Est) | Discount (Est) |

COLTENE Holding (SWX:CLTN) | CHF49.60 | CHF76.20 | 34.9% |

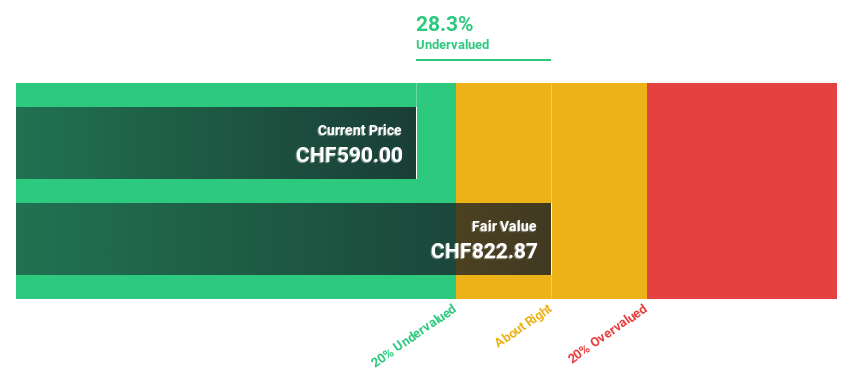

Burckhardt Compression Holding (SWX:BCHN) | CHF590.00 | CHF822.87 | 28.3% |

Julius Bär Gruppe (SWX:BAER) | CHF50.88 | CHF96.07 | 47% |

Sonova Holding (SWX:SOON) | CHF269.60 | CHF448.50 | 39.9% |

Temenos (SWX:TEMN) | CHF61.40 | CHF83.21 | 26.2% |

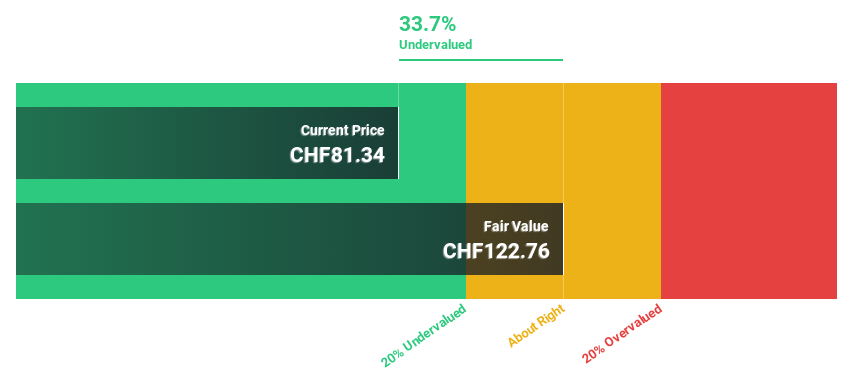

SGS (SWX:SGSN) | CHF81.34 | CHF122.76 | 33.7% |

Comet Holding (SWX:COTN) | CHF371.00 | CHF545.58 | 32% |

Medartis Holding (SWX:MED) | CHF68.00 | CHF120.52 | 43.6% |

Kudelski (SWX:KUD) | CHF1.43 | CHF1.84 | 22.2% |

Galderma Group (SWX:GALD) | CHF76.06 | CHF147.99 | 48.6% |

Let's take a closer look at a couple of our picks from the screened companies

Burckhardt Compression Holding

Overview: Burckhardt Compression Holding AG is a global manufacturer and seller of reciprocating compressors, with a market capitalization of approximately CHF 1.998 billion.

Operations: The company generates revenue through two primary segments: the Systems Division, which brought in CHF 642.81 million, and the Services Division, with revenues of CHF 339.15 million.

Estimated Discount To Fair Value: 28.3%

Burckhardt Compression Holding AG, reflecting a solid financial year with sales reaching CHF 981.96 million and net income at CHF 89.99 million, is trading below its estimated fair value by over 20%, marked at CHF 590 against a fair value of CHF 822.87. Despite dividends not being well covered by cash flows, the company's earnings and revenue growth are projected to surpass the Swiss market average, with an expected very high Return on Equity in three years.

SGS

Overview: SGS SA, headquartered in Geneva, Switzerland, specializes in offering inspection, testing, and verification services across various regions including Europe, Africa, the Middle East, the Americas, and Asia Pacific with a market capitalization of CHF 15.40 billion.

Operations: The company's revenue is divided into several segments: Business Assurance (CHF 746 million), Natural Resources (CHF 1.58 billion), Health & Nutrition (CHF 857 million), Connectivity & Products (CHF 1.25 billion), and Industries & Environment (CHF 2.19 billion).

Estimated Discount To Fair Value: 33.7%

SGS, priced at CHF 81.34, is identified as undervalued with a current market estimation of CHF 122.76 based on discounted cash flows, suggesting significant potential despite trading 33.7% below its fair value. While the dividend yield of 3.93% is poorly supported by earnings, SGS forecasts robust earnings growth at 9.8% annually, outpacing the Swiss market's average of 8.2%. However, concerns include high debt levels and shareholder dilution over the past year, alongside a revenue growth prediction (4.7% per year) that does not reach exceptionally high levels but still exceeds market growth rates (4.4%).

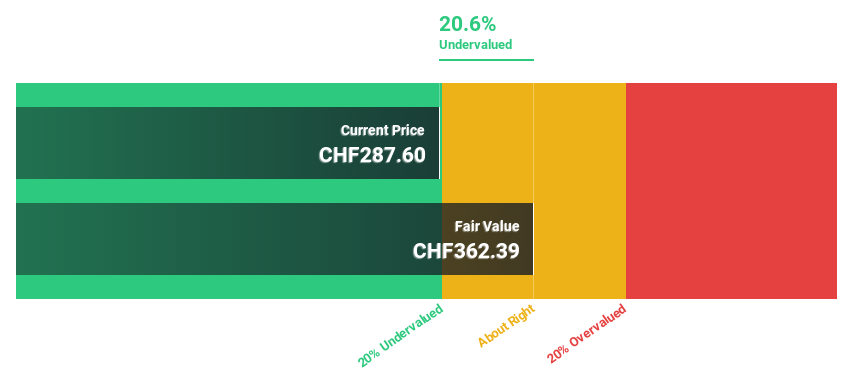

Swissquote Group Holding

Overview: Swissquote Group Holding Ltd operates globally, offering a range of online financial services to retail, affluent, and professional institutional clients with a market capitalization of CHF 4.27 billion.

Operations: The company generates revenue primarily through leveraged Forex and securities trading, contributing CHF 101.09 million and CHF 429.78 million respectively.

Estimated Discount To Fair Value: 20.6%

Swissquote Group Holding, valued at CHF 287.6, is considered undervalued by 20.6%, with its price below the estimated fair value of CHF 362.39 based on discounted cash flows. The company's revenue and earnings growth forecasts of 10.3% and 14% respectively surpass the Swiss market averages, indicating potential despite not reaching exceptionally high levels. Additionally, a forecasted Return on Equity of 23.1% in three years underscores strong profitability prospects relative to benchmarks.

Where To Now?

Access the full spectrum of 13 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows by clicking on this link.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BCHN SWX:SGSN and SWX:SQN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com