John Paulson Trims Allergan, Sprint, Discovery

John Paulson (Trades, Portfolio)'s Paulson & Co. sold shares of the following stocks during the first quarter of 2020.

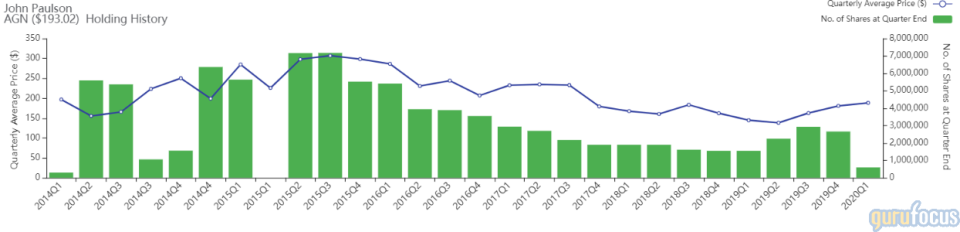

Allergan

The firm trimmed its position in Allergan PLC (AGN) by 77.38%. The trade had an impact of -8.50% on the portfolio.

The specialty pharmaceutical manufacturer has a market cap of $63.66 billion and an enterprise value of $81.17 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of -4.2% and return on assets of -2.64% are underperforming 59% of companies in the drug manufacturers industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.13 is below the industry median of 0.92.

The largest guru shareholder of the company is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 2.15% of outstanding shares, followed by Daniel Loeb (Trades, Portfolio)'s Third Point with 1.31% and David Abrams (Trades, Portfolio) with 0.38%.

SPDR Gold Trust

The firm trimmed the SPDR Gold Trust (GLD) stake by 56.15%. The portfolio was impacted by -7.49%.

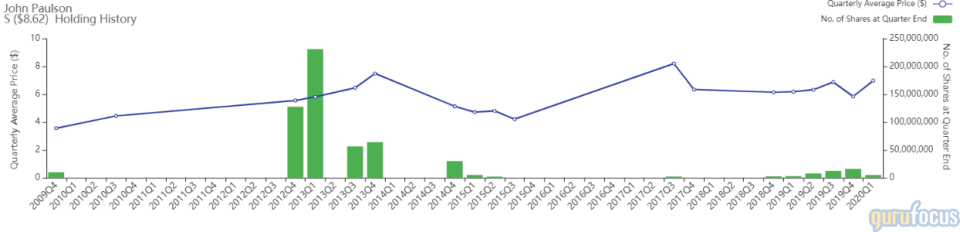

Sprint

The firm trimmed its holding in Sprint Corp. (S) by 68.39%. The portfolio was impacted by -1.23%.

The wireless telecom company has a market cap of $35.44 billion and an enterprise value of $76.87 billion.

GuruFocus gives the company a profitability and growth rating of 4 out of 10. The return on equity of -10.14% and return on assets of -3.08% are underperforming 50% of companies in the telecommunication services industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.07 is below the industry median of 0.28.

The largest guru shareholder of the company is Dodge & Cox with 2.17% of outstanding shares, followed by Renaissance Technologies with 1.91% and PRIMECAP Management (Trades, Portfolio) with 0.61%

Discovery

The firm cut its position in Discovery Inc. (DISCK) by 15.35%, impacting the portfolio by -1.10%.

The global media provider has a market cap of $9.88 billion and an enterprise value of $25.80 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 16.18% and return on assets of 6.2% are outperforming 78% of companies in the media, diversified industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.09 is below the industry median of 0.92.

The largest guru shareholder of the company is HOTCHKIS & WILEY with 2.43% of outstanding shares, followed by Paulson's firm with 1.82% and Mario Gabelli (Trades, Portfolio)'s GAMCO Investors with 0.22%.

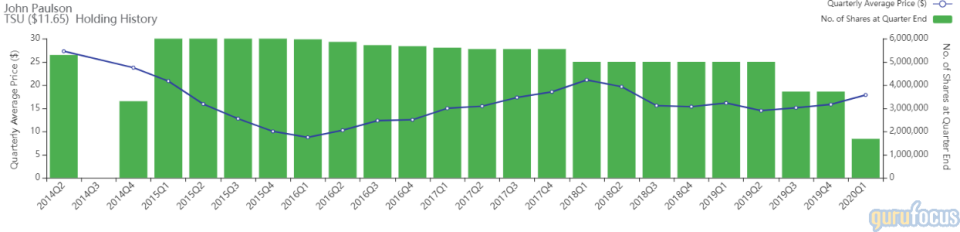

Tim Participacoes

The investment firm reduced its position in Tim Participacoes SA (TSU) by 54.78%. The trade had an impact of -0.84% on the portfolio.

The wireless carrier has a market cap of $5.64 billion and an enterprise value of $7.22 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 15.99% and return on assets of 9.24% are outperforming 77% of companies in the telecommunication services industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.15 is below the industry median of 0.28.

Notable shareholders include Renaissance Technologies with 0.44%, Paulson's firm with 0.35% and Steven Cohen (Trades, Portfolio)'s Point72 Asset Management with 0.24%.

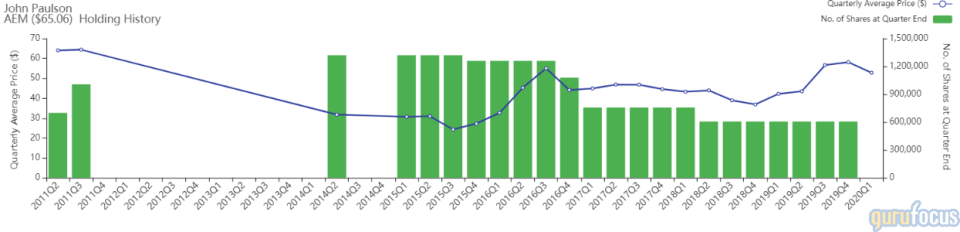

Agnico Eagle Mines

The firm closed its holding in Agnico Eagle Mines Ltd. (AEM).The trade had an impact of -0.81% on the portfolio.

The gold miner operator has a market cap of $15.67 billion and an enterprise value of $17.05 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 8.42% and return on assets of 4.75% are outperforming 89% of other companies in the metals and mining industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.48 is below the industry median of 14.42.

Notable shareholders include First Eagle Investment (Trades, Portfolio) with 3.44% of outstanding shares, Renaissance Technologies with 1.70% and Pioneer Investments (Trades, Portfolio) with 0.70%.

Disclosure: I do not own any stocks mentioned.

Read more here:

Caxton Associates Exits Aptiv, Bank of America

Maverick Capital Sells Monster Beverage, DXC Technology

ValueAct Holdings Exits FedEx, Cuts Morgan Stanley

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance