Job openings, trade balance — What you need to know for the week ahead

The May jobs report was good news.

Over 200,000 jobs were created in May while the unemployment rate fell to 3.8%, matching the lowest level since April 2000. If you take the decimals out a few more places, the unemployment rate was 3.755%, marking the lowest since 1969.

About an hour before the report was released, President Donald Trump tweeted his excited about the May jobs numbers that were forthcoming. No wonder.

Since then, Trump has tweeted quite a bit and his breaking of protocol will pass as just another example of how untraditional his presidency has been.

In response to the May jobs numbers, markets finished higher across the board on Friday as investors shook off the early-week concerns over the political situation in Italy and another tariff announcement from the Trump administration to finish the holiday-shortened trading week in the green.

In the week ahead, the earnings calendar will be fairly quiet with no major companies set to report results, though investors will get quarterly updates from Conn’s (CONN), Palo Alto Networks (PANW), HD Supply Holdings (HDS), Okta (OKTA), Verifone (PAY), J M Smucker (SJM), Vail Resorts (MTN), and Stitch Fix (SFIX).

And on the economics side the biggest reports expected in the week ahead will be the latest report on job openings due out Tuesday and the April report on the trade balance expected for release on Wednesday morning.

Amid President Trump’s continued moves on trade policy and insistence that the U.S. close the trade deficit with many major trading partners, expect Wednesday’s report to get a bit more attention that usual.

Economic calendar

Monday: Factory orders, April (-0.5% expected; +1.6% previously); Durable goods orders, final estimate, April (-1.7% previously)

Tuesday: Markit services PMI, May (55.7 expected; 55.7 previously); ISM non-manufacturing PMI, May (57.6 expected; 56.8 previously); Job openings and labor turnover survey, April (6.55 million open jobs previously)

Wednesday: Nonfarm productivity, first quarter (+0.7% expected; +0.7% previously); Trade balance, April (-$49.6 billion expected; -$49 billion previously)

Thursday: Initial jobless claims (223,000 expected; 221,000 previously); Federal Reserve Z.1 Flow of Funds report, first quarter; Consumer credit, April (+$14.5 billion expected; +$11.62 billion previously)

Friday: Wholesale inventories, April (0% expected; 0% previously)

The aging U.S. labor market

In the tenth year of the economic expansion, the U.S. labor market continues to grow solidly.

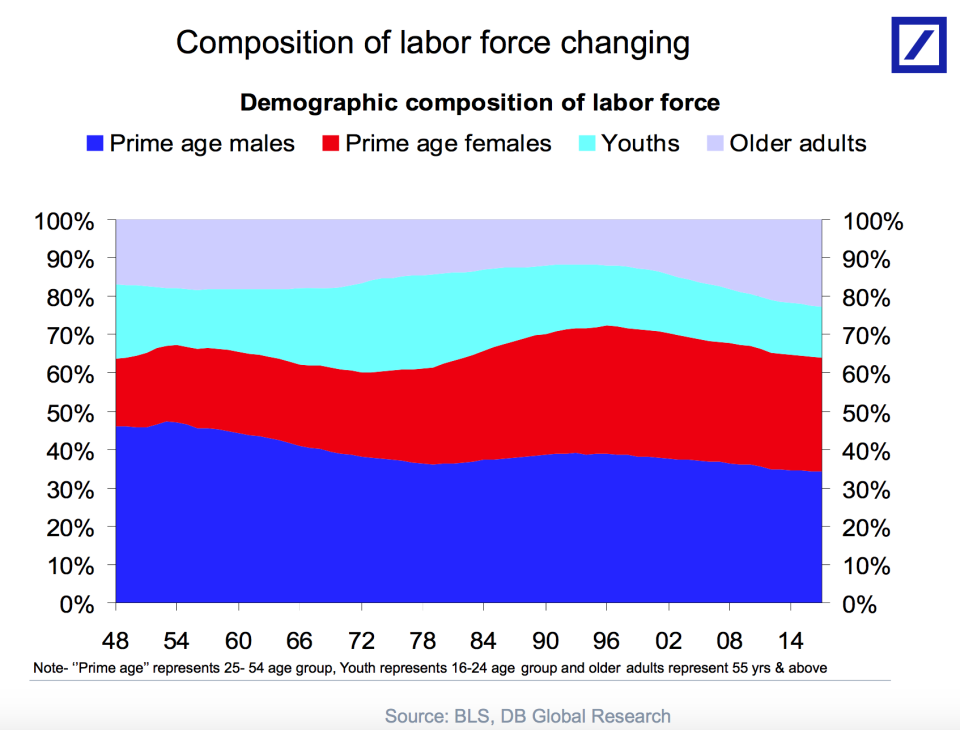

And while there are a number of themes that one can point to as “defining” the labor market recovery — higher millennial participation, the shocking drop in overall unemployment, the black unemployment rate hitting a record low, the dominance of the services sector — what is undeniable is the persistent aging of the U.S. population and the workforce at large.

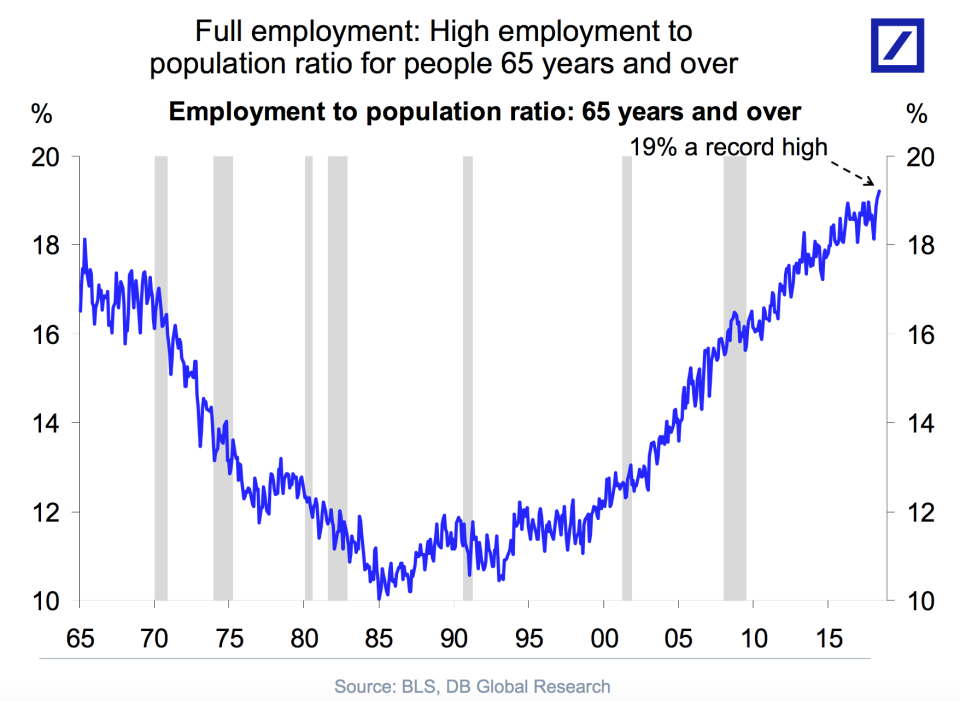

In May, the employment-to-population ratio for adults over 65 hit a record high of 19%. This means nearly one-in-five folks who are more or less all eligible for Social Security are still working.

If you include workers 55 and older, these older people make up about 22% of the total workforce, almost double the percentage this group accounted for 20 years ago.

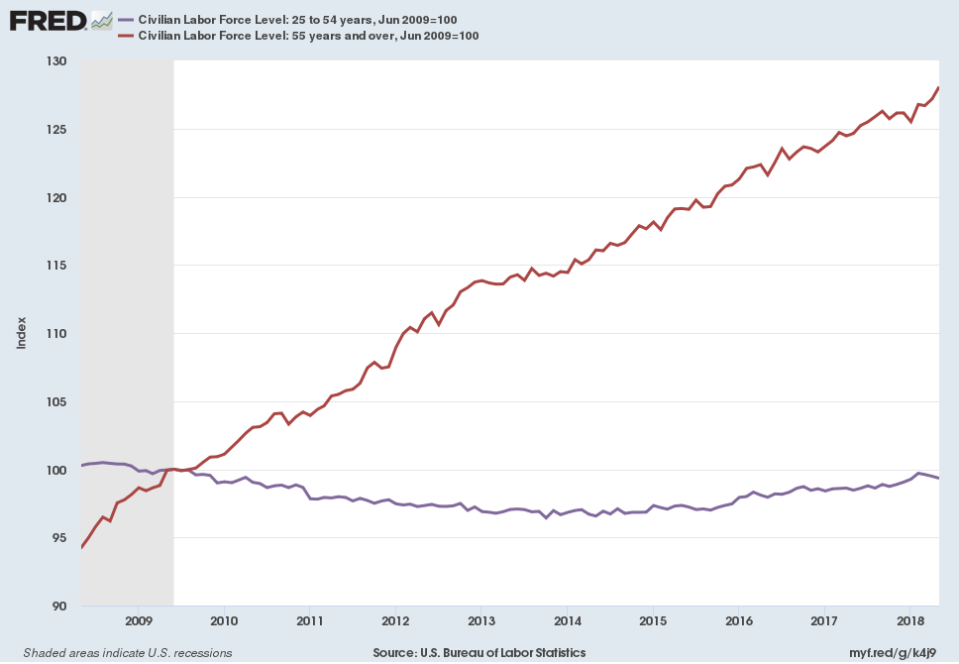

And looking at total labor force growth since the end of the crisis, prime age workers, which includes those between ages 25 and 54, have seen no labor force growth while the number of those over 55 working has increased more than 25%.

This past week, the Federal Reserve released its latest Beige Book report, a collection of economic anecdotes from across the country, business contacts in the Dallas Fed’s region said one staffing firm was attempting to re-hire workers who had previously retired to meet demand.

There’s been no shortage of warnings over a pending retirement crisis in the U.S. where many people simply do not have the savings that will be required to meet a multi-decade retirement.

But it seems that the current economic expansion has given many who lost work during the crisis a chance to re-enter the workforce. And perhaps foreshadow an American economic future in which broad-based retirements are a thing of the past.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Yahoo Finance

Yahoo Finance