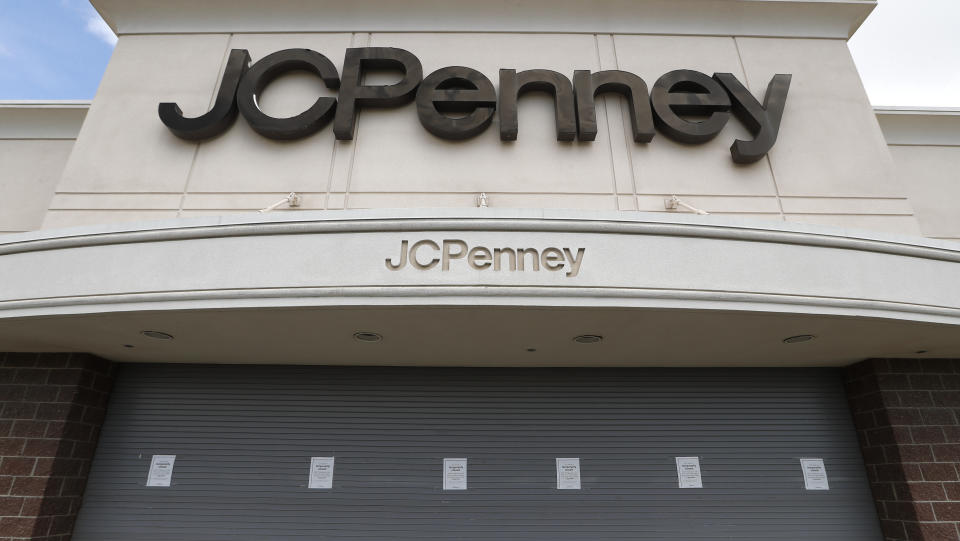

J.C. Penney bankruptcy aftermath: 700 very large stores may completely vanish

J.C. Penney (JCP) will be a shell of its former self if it emerges from bankruptcy, retail experts tell Yahoo Finance, and there is a big question mark around the if component.

“J.C. Penney will look a lot different if they survive. Perhaps they could have 150 stores. It will look like a very different model just like what happened with Sears,” SW Retail Advisors chief Stacey Widlitz said on Yahoo Finance’s The First Trade.

Putting J.C. Penney in the same bucket as Sears isn’t exactly flattering.

Since emerging from bankruptcy last year, Sears has become even more irrelevant with shoppers as it operates a little more than 100 stores across the country. The company’s smaller store footprint relative to its heyday has lost its considerable cachet with suppliers and customers. And the model doesn’t afford Sears the scale needed to successfully compete with better capitalized retailers such as Target that are investing more in the future of commerce.

J.C. Penney has 860 or so stores, but that’s about to drastically change before 2020 is done.

The debt-laden, money-losing J.C. Penney filed for Chapter 11 bankruptcy protection on May 15.

As part of the filing, J.C. Penney has received debtor-in-possession (DIP) financing of $900 million of which $450 million is new money. J.C. Penney said it believes the new financing and cash generated from the business, is expected to be sufficient to sustain its business and restructuring needs. As part of the financing, J.C. Penney must explore additional opportunities to maximize value, including a third-party sale process.

In court proceedings on May 16, J.C. Penney reportedly unveiled a plan to spin off real estate into a REIT in an effort to raise cash for its turnaround. The formation of a REIT would also alleviate heavy capital costs for J.C. Penney, which has been saddled with lease obligations.

A source familiar with the situation told Yahoo Finance last week that it’s not guaranteed J.C. Penney emerges from bankruptcy, and the company may opt to liquidate in a bid to satisfy creditors. All options continue to be discussed, the source said. A J.C. Penney spokesperson declined to comment to Yahoo Finance on how many stores would be closed to support a turnaround. The company hasn’t disclosed any number, but speculation has been up to 200 stores will be shuttered.

Brian Sozzi is an editor-at-large and co-anchor of The First Trade at Yahoo Finance. Follow Sozzi on Twitter @BrianSozzi and on LinkedIn.

Read the latest financial and business news from Yahoo Finance

Levi's reports solid quarterly earnings, CEO says jeans maker will come out of coronavirus stronger

Yum! Brands CEO on how his 50,000 restaurants are doing amidst the coronavirus pandemic

Grubhub founder: our sign-ups are surging during the coronavirus

HP CEO: here’s how we are helping coronavirus relief efforts

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance