Japanese Yen Gains as Bank of Japan Leaves Policy Unchanged Again

DailyFX.com -

Talking Points

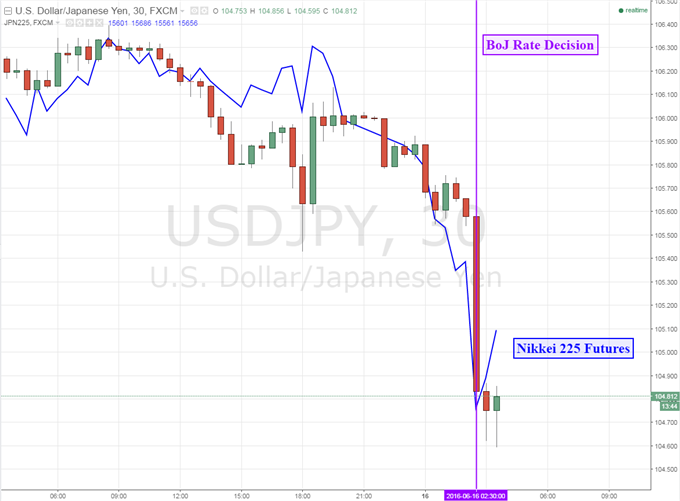

Japanese Yen gains versus major peers, Nikkei 225 futures fall

The Bank of Japan left rates unchanged, QE purchases at ¥80t

Lack of more stimulus expansion clues likely fueled risk aversion

Having trouble trading the Japanese Yen? This may be why.

The Japanese Yen soared against its major peers and Nikkei 225 futures tumbled amid risk aversion as the Bank of Japan left monetary policy unchanged. Board members voted 8 to 1 to keep the monetary base target unchanged at ¥80t yen. The central bank also voted 7 to 2 to continue applying a negative interest rate of -0.1 percent.

The Bank of Japan maintained the familiar status quo that it will consider applying additional stimulus if necessary. During its April interest rate decision, the central bank forecasted that CPI will hit the 2 percent target some time in 2017. Today, the committee said that inflation expectations have weakened recently, but from the longer-term perspective, appear to be rising. In addition, the BOJ said that the year-on-year rate of change in prices is likely to be slightly negative or about 0 percent for the time being.

Failing to give any imminent signs of easing in the near-term to further stimulate the economy, this could explain why Nikkei 225 futures fell more than 1 percent in the aftermath of the Bank of Japan rate decision. Meanwhile, the DailyFX Speculative Sentiment Index (SSI) is showing a positive reading. The SSI is a contrarian indicator, implying further USD/JPY weakness ahead.

Want to learn more about the DailyFX SSI indicator? Click here to watch a tutorial.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance