Jacobs (J) and Palantir Extend Deal for New AI Solutions

Jacobs Solutions Inc. J extended its partnership with Palantir Technologies Inc. for data and technology solutions for the infrastructure and many other sectors.

This partnership remains focused on leveraging Jacobs’ data solutions and Palantir's artificial intelligence (AI) expertise to commercialize new AI solutions spanning critical infrastructure, advanced facilities, supply chain management and many more.

The collaboration is currently focused on the water sector and involves joint data analytics across public and private sector clients for more sustainable water and sewage systems. For this reason, Jacobs is deploying domain-specific algorithms with Foundry in its water sector as well as incorporating Palantir AIP.

Jacobs is consistently undertaking various initiatives to enhance its business. The company is expected to benefit from strong global trends in infrastructure modernization, energy transition, national security and a potential super-cycle in global supply chain investments.

In 2022, Jacobs undertook a “Boldly Moving Forward” strategy that comprises operational discipline to capture the high growth opportunities emerging across Climate Response, Data Solutions and Consulting & Advisory. This will drive significant value for customers and will enhance the profitability profiles of the company’s critical infrastructure, national security, energy transition and advanced facilities sectors. The company has been executing this strategy well and is creating compelling returns while advancing sustainability and social value in global communities.

Also, with its Focus 2023 initiative, the company has been accelerating the adoption of digital technology across all facets of operations. Jacobs expects that by 2023, this transformative initiative — which will provide Jacobs with the flexibility to materially invest in the business — to drive growth through technology-enabled solutions.

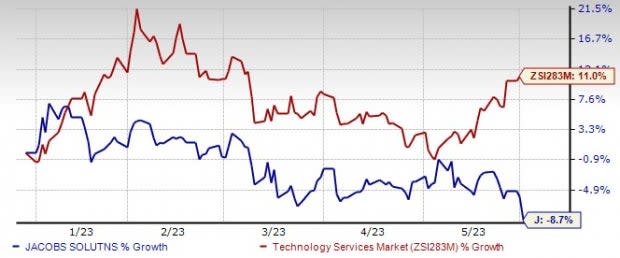

Jacobs shares have declined 8.7% this year against the industry’s 11% rise. Earnings estimates for fiscal 2023 have declined to $7.36 per share from $7.37 in the past 60 days. Foreign exchange risks, high costs and expenses are major concerns for the company.

Image Source: Zacks Investment Research

Nonetheless, a solid backlog level depicts accelerating demand for Jacobs’s consulting services like infrastructure, water, environment, space, broadband, cybersecurity and life sciences. A higher-margin backlog, focus on generating efficiencies through digital and technological solutions and solid project execution bode well. At the fiscal second-quarter end, it reported a backlog of $29 billion, up 4% year over year.

Zacks Rank & Key Picks

Jacobs currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Business Services sector are:

SPX Technologies, Inc. SPXC currently sports a Zacks Rank #1 (Strong Buy). SPXC has a trailing four-quarter earnings surprise of 28.4%, on average. Shares of the company have gained 16.4% this year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for SPXC’s 2023 sales and earnings per share (EPS) indicates growth of 11.7% and 26.5%, respectively, from the year-ago reported levels.

SPS Commerce, Inc. SPSC presently carries a Zacks Rank #2 (Buy). SPSC delivered a four-quarter average earnings surprise of 16.4%. The company’s shares have risen 21.3% this year.

The Zacks Consensus Estimate for SPSC’s 2023 sales and EPS indicates growth of 16.9% and 14%, respectively, from the prior-year reported figures.

Omnicom Group Inc. OMC currently has a Zacks Rank #2. OMC came up with a four-quarter average earnings surprise of 9.1%. The stock has risen 8.1% this year.

The Zacks Consensus Estimate for OMC’s 2023 sales and EPS indicates growth of 3% and 6.9%, respectively, from the prior-year reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

SPS Commerce, Inc. (SPSC) : Free Stock Analysis Report

SPX Technologies, Inc. (SPXC) : Free Stock Analysis Report

Jacobs Solutions Inc. (J) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance