Jack in the Box (JACK) Rides on Solid Comps Amid High Costs

Jack in the Box Inc. JACK is benefiting from growth in same-store sales, attributable to menu innovation and pricing along with franchised opening and digital delivery initiatives.

Recently, JACK reported impressive second-quarter fiscal 2023 results, with earnings and revenues beating the Zacks Consensus Estimate by 22.5% and 3.4%, respectively. Also, the top and bottom lines grew year over year by 22.8% and 26.7%, respectively. The upside was attributable to increased franchise sales along with Jumbo Shrimp and Beer Battered Fish Lent promotions and menu price.

Jack in the Box delivered a trailing four-quarter earnings surprise of 7.9%, on average. Earnings estimates for fiscal 2023 have moved north to $6.07 per share from $5.82 per share over the past 30 days. This depicts analysts' optimism over the company’s growth prospects. Moreover, the company has a strong VGM Score of A, backed by a Value Score of B and a Momentum Score of A.

However, this restaurant company is facing headwinds in the form of high costs and expenses.

Let’s discuss the factors broadly.

What is Favoring JACK?

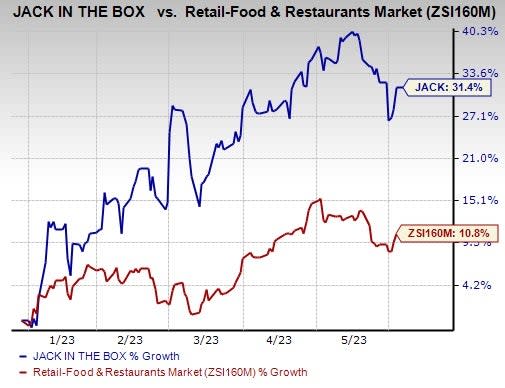

Shares of Jack in the Box have increased 31.4% in the year-to-date period compared with the Zacks Retail - Restaurants industry’s growth of 10.8%. The Zacks Consensus Estimate for JACK’s fiscal 2023 sales and earnings per share (EPS) indicates a rise of 16% and 3.9%, respectively, from the year-ago period’s levels.

Image Source: Zacks Investment Research

In the second quarter of fiscal 2023, same-store sales of Jack in the Box and Del Taco grew 9.5% and 3.2%, respectively, year over year. In the quarter, the company was awarded 76 development agreements to open 335 new restaurants, of which 27 have already been opened and 308 are in the pipeline. Also, the company refranchised 17 Del Taco restaurants in Las Vegas, with 10 new Del Taco restaurants to be built in Las Vegas, Wyoming and Montana as well as six Jack in the Box restaurants in Wyoming and Montana.

Menu innovation is one of the primary characteristics of Jack’s brand. The company is continuously working on maintaining the uniqueness of its brand, menu and premium food offerings. In second-quarter fiscal 2023, JACK’s $5 Jack Pack Combo drove the company’s sales growth, especially digital. It continues to focus on driving operating excellence across its existing store base by building brand loyalty. Given the menu diversity, price points and positive customer feedback, the company remains flexible and resilient against a shift in customer behavior.

Jack in the Box is also increasingly focusing on delivery channels, which is a growing area for the industry. Given the high demand for this service, the company has undertaken third-party delivery channels to bolster transactions and sales. The company partnered with DoorDash, Postmates, Grubhub and Uber Eats. After the implementation of the guest experience standard last year, the company witnessed a 30% improvement in its standards execution from third-party assessments.

In second-quarter fiscal 2023, the company zeroed in on two POS providers, which will be finalized by fiscal third quarter. The POS rollout will assist in driving down cost of the system. Also, it emphasized on technological investments covering applications, software and tools (like digital menu boards), AI and personalized in-store ordering. In the quarter, the company’s digital sales grew 11.5%, the highest since the company’s opening.

Headwinds

The company’s performance is being impacted by a rise in commodity inflation, advertising cost, wage inflation and higher utilities and maintenance and repair costs. In the second quarter of fiscal 2023, the company witnessed 4.8% wage inflation and 7.7% commodity inflation. Commodity costs grew due to a rise in price in nearly all categories, except pork and beef. The maximum impact was seen in sauces, potatoes, beverages and bakery. The company stated concerns about a challenging inflationary environment in 2023.

Zacks Rank & Key Picks

JACK currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks from the Zacks Retail-Wholesale sector include Yum China Holdings, Inc. YUMC, Chipotle Mexican Grill, Inc. CMG and Chuy's Holdings, Inc. (CHUY).

Yum China currently sports a Zacks Rank #1. YUMC has a trailing four-quarter earnings surprise of 301.6%, on average. Shares of the company have gained 29.2% in the past year.

The Zacks Consensus Estimate for YUMC’s 2023 sales and EPS suggests growth of 19.7% and 89.5%, respectively, from the year-ago period’s levels.

Chipotle Mexican sports a Zacks Rank #1. CMG has a trailing four-quarter earnings surprise of 4.7%, on average. The shares of the company have risen 49.7% in the past year.

The Zacks Consensus Estimate for CMG’s 2023 sales and EPS suggests growth of 14% and 33.9%, respectively, from the year-ago period’s levels.

Chuy's Holdings carries a Zacks Rank #2 (Buy). CHUY has a trailing four-quarter earnings surprise of 23.4%, on average. Shares of the company have increased 72.9% in the past year.

The Zacks Consensus Estimate for CHUY’s 2023 sales and EPS suggests growth of 9.9% and 24.8%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Janus Henderson Sustainable & Impact Core Bond ETF (JACK) : Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Chuy's Holdings, Inc. (CHUY) : Free Stock Analysis Report

Yum China (YUMC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance