J.D. Power: Issues credit card holders face in Singapore

Credit cards a large part of our daily spending habits. In a society that is largely cashless, credit cards are with us all the time. But are we all really satisfied with our credit cards?

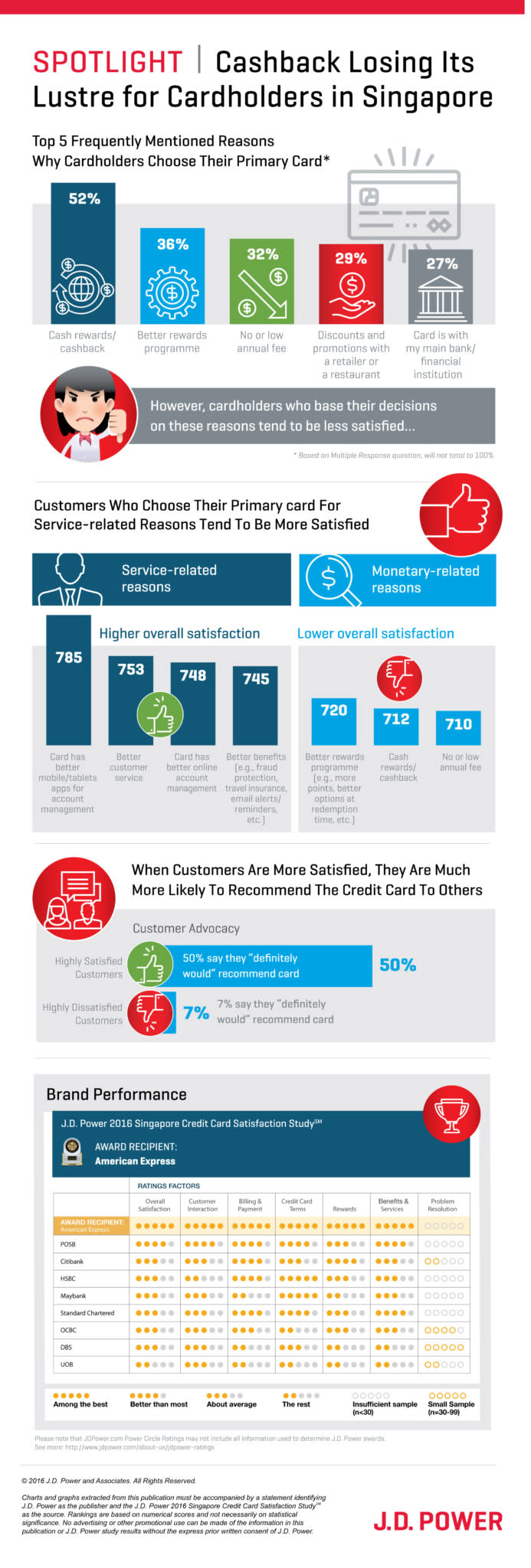

J.D. Power Singapore conducted a credit card satisfaction study which was released in October 2016. It found that what affected customer satisfaction the most was poor customer service. 2,927 cardholders were surveyed in August and September this year.

It was revealed that American Express ranked the highest in credit card customer satisfaction, while POSB and Citibank came in second and third respectively.

The study, now in its second year, measures customer satisfaction with their credit card issuer by examining six key factors: interaction; credit card terms; billing and payment; rewards; benefits and services; and problem resolution.

The following are highlights from the 2016 study:

Mobile Wins Big: Mobile app usage has increased this year to 29%, up from 21% in 2015.

Reward Programmes Are Confusing: 18% of cardholders surveyed perceive that card issuers are making their rewards programmes harder to understand. The changing conditions for cardholders to earn and redeem rewards, as well as limitations on offers and promotions, can make it difficult for cardholders to get the most out of their cards.

Lack of Understanding of Credit Card Terms: Foreign currency and transaction fees are the most common areas in which customers lack understanding. Nearly half (47%) of all cardholders say they partially understand or completely do not understand foreign currency and transaction fees.

Low Interest Rate Awareness: More than one-third (37%) of cardholders are not aware of their credit card interest rate. Even among customers who carry a balance on their credit card, and hence are affected more by an Annual Percentage Rate (APR) on their outstanding balance, 40% say they partially or do not at all understand their interest rate.

Problem Incidences Decline from Last Year: Only 10% of customers have experienced a problem with their card in the past 12 months, a decline of four percentage points from last year. Late or annual fees is the problem most commonly reported by customers (29%), followed by issues with rewards programmes (16%).

Source: J.D. Power

Mobile Digital Wallets Off to a Promising Start

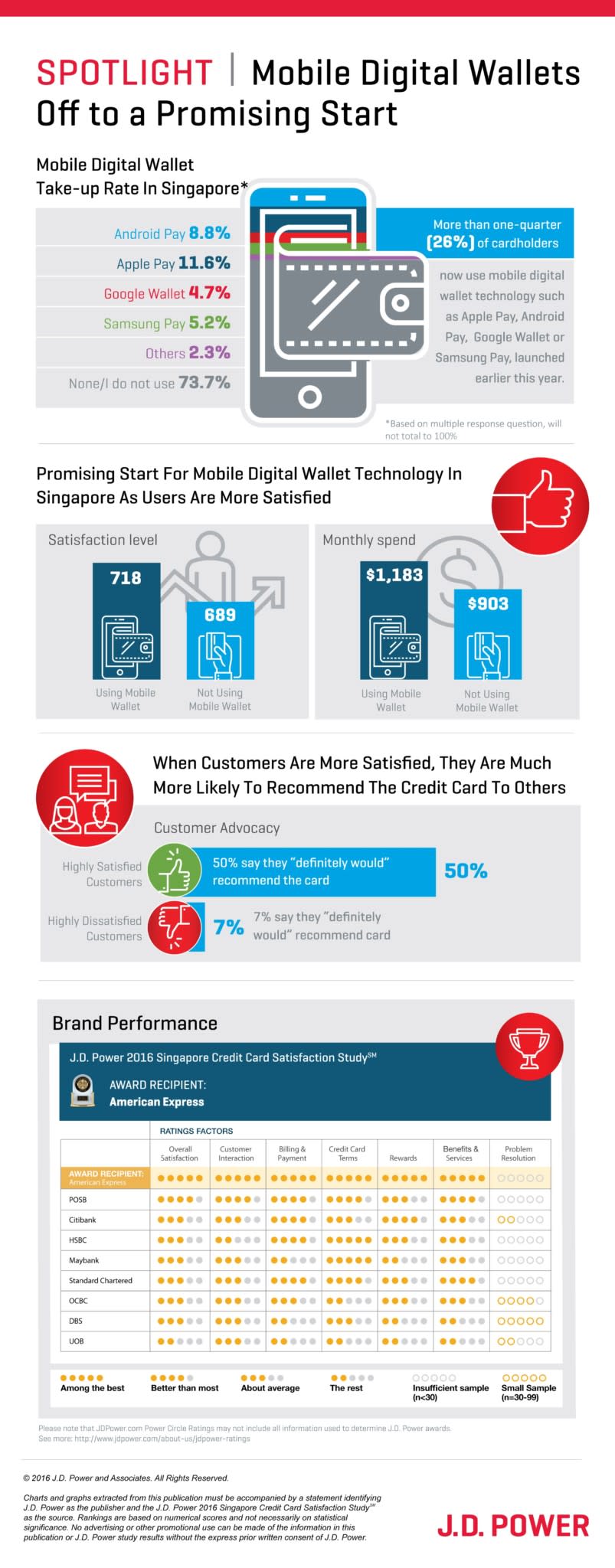

The study also found that more than one-fourth (26%) of cardholders now use mobile digital wallet technology such as Apple Pay, Android Pay, Google Wallet or Samsung Pay, which was launched earlier this year.

The average satisfaction score among users of mobile digital wallets was higher than those who do not use digital wallets.

“It is encouraging to see mobile digital wallet technology not only gaining traction but also helping to increase customer satisfaction with their credit card issuer,” said Gordon Shields, director at J.D. Power.

Source: J.D. Power

(By Samantha Chiew)

Related Articles

- Tiger Street Food Support Fund: Preserving Singapore’s Culture

- Singapore’s Fintech Push

- 5 myths about saving money and what to do about them

Yahoo Finance

Yahoo Finance