Itau Unibanco (ITUB) Q3 Earnings & Revenues Increase Y/Y

Itau Unibanco Holding S.A. ITUB posted recurring managerial results of R$8.07 billion ($1.54 billion) for third-quarter 2022, up 19.2% year over year.

The results were supported by an increase in operating revenues. Increases in total deposits and credit portfolios reflect a strong balance sheet position. However, a rise in non-interest expenses was an offsetting factor.

Revenues Rise, Costs Increase

Operating revenues were R$36.7 billion ($7 billion) in the reported quarter, up 20.3% on a year-over-year basis.

The managerial financial margin increased 22.5% year over year to R$23.9 billion ($4.56 billion). Also, managerial commissions and fees were down 0.8% to R$10.4 billion ($1.90 billion).

Non-interest expenses totaled R$13.93 billion ($2.65 billion), up 8.7% year over year.

In the third quarter, the efficiency ratio was 41.1%, down from 44% in the year-earlier quarter. A decrease in this ratio indicates increased profitability.

Credit Quality Weak

Cost of credit charges climbed 52.7% on a year-over-year basis to R$7.99 billion ($1.52 billion).

The non-performing loan ratio (loan transactions overdue more than 90 days) (NPL) was 2.8% in the third quarter, up from the prior-year quarter’s 2.6%.

Balance Sheet Position Strong

As of Sep 30, 2022, Itau Unibanco’s total assets increased 5.6% to R$2.42 trillion ($0.44 trillion) from the last reported quarter. Liabilities, including deposits, debentures, securities, and borrowings and onlending, totaled R$1.21 trillion ($0.22 trillion), increasing 3.2% on a sequential basis.

Itau Unibanco’s credit portfolio, including corporate securities and financial guarantees provided, reached R$1.11 trillion ($0.20 trillion) as of Sep 30, 2022, up 2.5% from the last reported quarter.

Capital Ratio & Profitability Ratios Up

As of Sep 30, 2022, the Common Equity Tier 1 ratio was 11.7%, down from 11.3% on Sep 30, 2021.

Annualized recurring managerial return on average equity climbed to 21% in the third quarter from 19.7% in the year-earlier quarter.

Our Viewpoint

Itau Unibanco’s third-quarter results were driven by the rise in the managerial financial margin. The declining efficiency ratio indicates a rise in profitability, which is a positive factor. However, the weak credit quality was concerning.

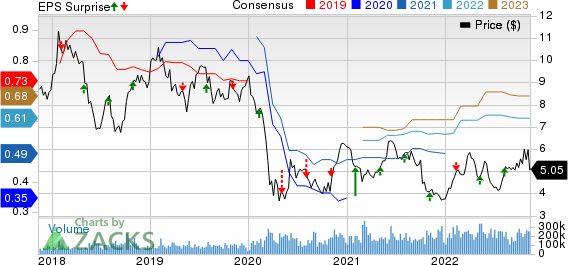

Itau Unibanco Holding S.A. Price, Consensus and EPS Surprise

Itau Unibanco Holding S.A. price-consensus-eps-surprise-chart | Itau Unibanco Holding S.A. Quote

Itau Unibanco currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Foreign Banks

HSBC Holdings HSBC reported a third-quarter 2022 pre-tax profit of $3.1 billion, down 41.8% from the prior-year quarter.

Results reflected a rise in adjusted revenues. However, adjusted expenses increased from the year-ago quarter, which was a headwind for HSBC. Expected credit losses and other credit impairment charges were a net charge in the quarter under review against a release in the prior-year quarter.

UBS Group AG UBS reported a third-quarter 2022 net profit attributable to shareholders of $1.73 billion, down 37.6% from the prior-year quarter.

UBS’ performance was affected by a fall in revenues and a decline in total net credit loss releases. Nonetheless, operating expenses decreased from the prior-year quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UBS Group AG (UBS) : Free Stock Analysis Report

Itau Unibanco Holding S.A. (ITUB) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance