ISDN Holdings: Powering Ahead Into Indonesia And Myanmar Energy Sector

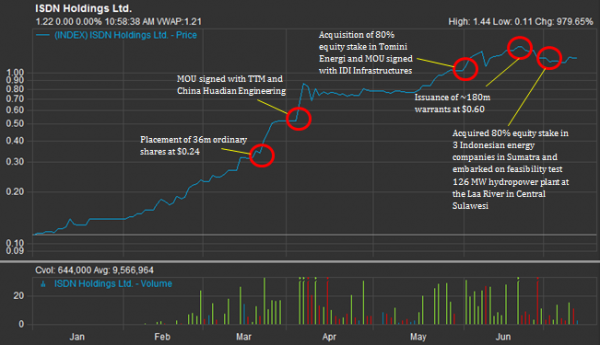

Imagine if you have $100 to invest at the start of 2013 and you did it by buying into ISDN Holdings, you would have earned a capital appreciation return of $900 by 5 July. Yes! That’s a rewarding return in a short timeframe. In retrospect, if you think you have missed the opportunity to catch the boat, it might not be the case as ISDN’s energy diversification strategy has just began and is still at the incubation stage with huge potential to fulfil.

One of the hottest entity to hold in the stock market for the year till date, ISDN Holdings, an integrated engineering solutions provider for a wide range of industries, has seen its stock price surged a whopping 900 over percent. This remarkable upward price movement was due in part to a positive view taken by investors on ISDN, as its business transformation strategy which began in 2009 into the renewable energy sector is starting to gather momentum. With its business evolution creating a buzz in the financial market,Shares Investment was privileged to have an exclusive interview with ISDN’s managing director and president, Teo Cher Koon, to share with us insights on its new exciting business ventures in Indonesia and Myanmar, as well as his take on the company’s future direction and the outlook of its current core business – automation engineering.

Source: FactSet, SGX

Renewable Energy

Indonesia, the country with the largest populace in Southeast Asia, has seen a steady gross domestic product growth of about six percent for the past decade and this has resulted in a country with huge energy needs, which are currently not met. It is estimated that supply lags demand by about 15 to 25 percent, in part due to heavy government subsidy on their diesel power plant which amounted to about US$6.8 billion in 2012. With a burgeoning middle class, the energy shortage situation might deepen as the country’s energy growth rate is projected to grow by about nine percent annually for the next five years.

To solve its energy subsidy and shortage problem, the Indonesia government has expressed its desire to turn to renewable energy through favourable regulations and incentives given to private investors. Teo elaborated that the whole of Indonesia has earmarked 75,000 megawatts (MW) for hydropower, but less than five percent of capacity is taken at the moment, presenting a business opportunity for ISDN to capitalise and diversify itself into hydropower energy. Adding to its attractiveness is its low running cost of around US$0.005 to US$0.007 per kilowatts hour (KWh), and a high tariff of about US$0.08 per KWh, this translates to an EBITDA margin close to over 90 percent.

Last month, ISDN proposed to acquire effective stakes of between 40 to 80 percent in two Indonesian energy companies, PT Prisma Karun Energy and PT Potensia Tomini Energi, thereby potentially giving ISDN a foothold in three mini hydropower plant projects in Sulawesi with a combined installed capacity of 18 MW. Based on the tariff price of US$0.08 per KWh, it is estimated that annual revenue may range between US$7 million to US$9 million. Construction is expected to begin in early FY14 and will take about 18 to 24 months per plant.

Striking while the iron is hot, ISDN via its PT Potensia Tomini Energi subsidiary was given a recommendation letter by the Governor of Central Sulawesi to develop a 126 MW hydropower plant at the Laa River. “If the feasibility study is successful, we would be embarking on a total of 168 MW worth of hydropower projects and would surpass our FY14 short term target of 100 MW,” said Teo, when probed about ISDN’s hydropower energy capacity target. In the long term, ISDN expects to double the capacity to 200 MW within the next three to five years and is considering other parts of Indonesia in addition to its current project locations Sumatra and Sulawesi.

Sungai Tinombo River Upstream

Underpowered Nation

In Myanmar, currently only 26 percent of the population is powered, this is grossly underserved and there are a lot of opportunities for energy investment. Teo opined that Myanmar is genuinely opening up their economy, and from the top brass government officials to the local partners, they are all very positive about economic development to improving living standards. He added further that infrastructure power is the catalyst to bringing investors and without it a lot of investments could not take off because of insufficient power.

As such in May, ISDN’s foray into Myanmar began through a Memorandum of Agreement entered into with Tun Thwin Mining (TTM) for the proposed formation of a joint venture company to acquire concession rights held by TTM to a coal mine located in the Kalewa Township, Sagaing Region. TTM operates an area of 4,500 acres of coal mining concession and holds a development permit for a coal power plant in the Sagaing Region. The planned capacity for the proposed plant of 2 x 270 MW coal-fired power plant located at the mouth of the coal mine, will be more than four times the capacity of the only operating coal-fired power plant in Myanmar, which has a power capacity of 2 x 60 MW. “As the project undertaken is rather huge, the focus for ISDN in Myanmar now will be on getting the 540 MW power plant up and running in stages, and we may consider scaling it up in the future,” remarked Teo.

With both its renewable hydropower and conventional coal energy projects in place, Teo expects the incubation period to be around two to three years, and topline and bottomline to gradually come in by end FY15 to early FY16. By early 2016, there will likely be a structural change in ISDN’s business mix to about 50/50, engineering and energy, if the diversification plans fully materialise.

Sungai Palasa River Upstream

Steady Core Business

For now, ISDN’s core business remains in automation engineering which has been operationally steady and fundamentally sound, and has been in the black since incorporation. For 1Q13, revenue fell 5.9 percent quarter-on-quarter due to weaker demand from customers who are from industries like semiconductor, as a result of a slowdown in the global economy. In line with the decline in topline, gross profit fell by 10.3 percent, leading to a 62.8 percent decrease in net profit to $747,000.

When asked about its recent 1Q13 performance, Teo was calm and quoted: “This industry in the past one to two years has been experiencing ups and downs because of the China climate but as we mainly serve the mid-to high-end markets, we see lesser price competition than the mass market in down times.”

With the bulk of its revenue drawn from China (about 70 percent), Teo is optimistic about the country’s future and opined that there is a structural change going on in China. He said: “The mindset in China is changing, in the past, companies in China prefer to utilise the cheap labour available but now they are more willing to spend on automation in light of the labour shortage problem and increasing manpower cost.” Companies are beginning to look at automation and mechanisation which opens up a big market for ISDN, he added.

As a whole, considering all its energy diversification projects (with more expected to come) and its reliable core business, it is little wonder that investors have been upbeat about ISDN in the past few months. Nonetheless, notwithstanding the many positives which the company has to offer, investors would do well to pay heed to inherent risks involved in large scale projects which might affect the timing and amount of investment returns.

More From Shares Investment:

Yahoo Finance

Yahoo Finance