IQVIA (IQV) Riding on Global IT Infrastructure, Debt Woe Stays

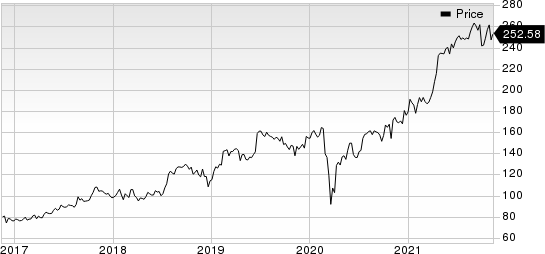

IQVIA Holdings Inc.’s IQV shares have appreciated 50.5% over the past year against 16.1% decline of the industry it belongs to.

The company recently reported solid third-quarter 2021 results with adjusted earnings per share of $2.17 beating the Zacks Consensus Estimate by 1.9% and improving 33.1% on a year-over-year basis. Total revenues of $3.39 billion outpaced the consensus estimate by 1% and increased 21.7% year over year.

IQVIA Holdings Inc. Price

IQVIA Holdings Inc. price | IQVIA Holdings Inc. Quote

How is IQVIA Doing?

IQVIA has an enormous treasure trove of healthcare information — around 45 petabytes of proprietary data sourced from around 150,000 data suppliers. The company delivers information and insights on roughly 85% of the world’s pharmaceuticals. IQVIA’s unique ability to standardize, organize and integrate this information by applying sophisticated analytics and global technology infrastructure helps it build a strong client base.

A set of robust capabilities places IQVIA strongly in the life sciences space and positions it well to make most of the market opportunities. The company has a strong healthcare-specific global IT infrastructure, analytics-driven clinical development capabilities, a robust real-world solutions ecosystem, and a growing set of proprietary clinical and commercial applications that allow it to grow and retain relationships with healthcare stakeholders. The company’s combined offerings of research and development, and commercial services have been helping it develop trusted relationships with its clients, resulting in a diversified base of more than10,000 clients in over 100 countries.

IQVIA’s addressable market size is around $260 billion and consists of outsourced research and development, real-world evidence and connected health, and technology-enabled clinical and commercial operations markets. The company aims to expand into and penetrate these markets through innovating new offerings and improving its existing ones using its information resources, advanced analytics, transformative technology and significant domain expertise.

Meanwhile, IQVIA’s cash and cash equivalent balance of $1.57 billion at the end of the third-quarter 2021 was well below the long-term debt level of $12.1 billion, underscoring that the company doesn’t have enough cash to meet this debt burden. The cash level, however, can meet the short-term debt of $91 million.

Zacks Rank and Stocks to Consider

IQVIA currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Some better-ranked stocks in the broader Business Services sector are Avis Budget CAR, Automatic Data Processing ADP and FactSet Research Systems FDS, each carrying a Zacks Rank #2 (Buy).

Avis Budget has an expected earnings growth rate of around 395.6% for the current year. The company has a trailing four-quarter earnings surprise of 76.9%, on average.

Avis Budget’s shares have surged 624.4% so far this year. The company has a long-term earnings growth of 27.5%.

Automatic Data Processing has an expected earnings growth rate of around 12.3% for the current fiscal year. The company has a trailing four-quarter earnings surprise of 9.7%, on average.

Automatic Data Processing’s shares have surged 29.7% so far this year. The company has a long-term earnings growth of 12%.

FactSet Research Systems has an expected earnings growth rate of around 9% for the current fiscal year. The company has a trailing four-quarter earnings surprise of 2.4%, on average.

FactSet Research Systems’ shares have surged 37.4% so far this year. The company has a long-term earnings growth of 8.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Avis Budget Group, Inc. (CAR) : Free Stock Analysis Report

FactSet Research Systems Inc. (FDS) : Free Stock Analysis Report

IQVIA Holdings Inc. (IQV) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance