The iPhone at 10: five ways smartphones have changed money forever

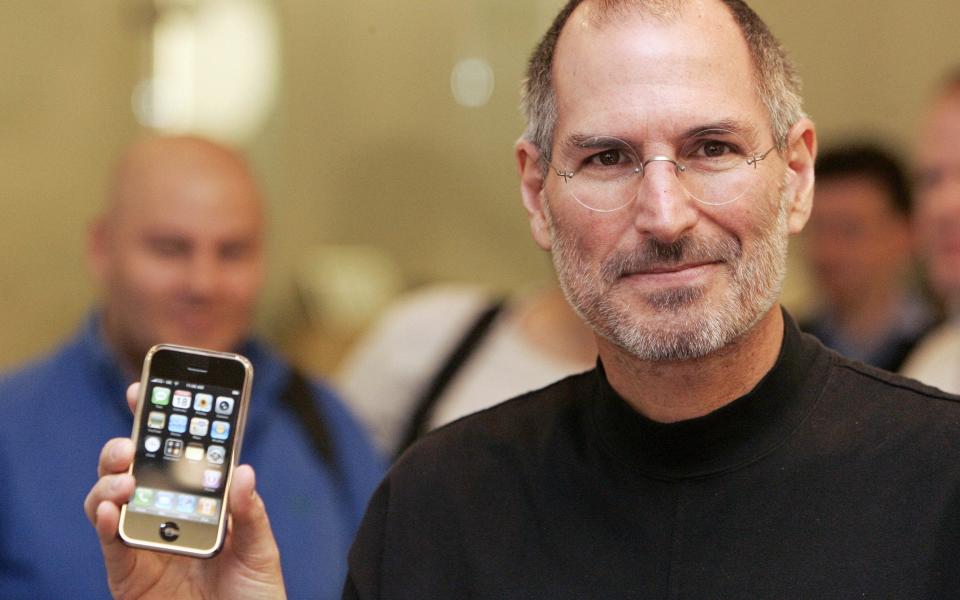

This month marks 10 years since arguably the biggest product launch this century: Apple’s iPhone. The event created huge excitement and Apple’s smartphone has gone from strength to strength, notching up seven incarnations in a decade.

Of course the iPhone was not actually the first smartphone, but it certainly accelerated the market to the point that 80pc of us now own one.

Smartphones have changed the way we interact with everything, from our friends, family and social media accounts to matters as basic as booking a taxi.

But they have also changed the way we spend and think about our money, in ways that even Steve Jobs cannot have imagined.

1. Online banking

Probably the most noticeable change has been in the form of online banking. Many of us, particularly the younger generations, rarely see the inside of a bank and branches are closing up and down the country as a result.

Instead, we increasingly bank online, with a huge increase recorded in Britain since 2007. When the iPhone was launched only around 30pc of Britons used online banking every month. By 2016, according to Statista, a market researcher, that had doubled to 60pc.

The trend accelerated after 2010 thanks, in part, to the rise of the smartphone. Statista’s data showed a sharp rise in the number of people who accessed online banking via their phone each month between 2010 and 2015 – from 8pc to more than a third.

2. Shopping online

Online shopping has boomed in the past decade, with 71pc of us now browsing deals on the internet, according to figures from the Centre for Retail Research released earlier this year.

The same figures predicted that shoppers would spend almost £70bn online in 2017, of which £27bn would be via smartphones.

The use of smartphones to make online purchases grew by 47pc in Britain last year.

Using your phone allows us to become closer to the experience of shopping

Dimitrios Tsivrikos

Dimitrios Tsivrikos, a consumer psychologist at University College London, said retailers had worked hard to make online shopping an enjoyable experience.

“Using a phone allows us to become closer to the experience of shopping,” he said. “The flexibility makes it easier to engage with these retailers, and the trust we have in them improves.

“Our mobile phone is for socialising. We still see a computer as a vehicle for significant chores such as doing our taxes or replying to work emails.”

3. Apple Pay and contactless

Although Apple Pay, which allows your phone to act as a debit or credit card, was launched just under three years ago, it and wider contactless payments have accelerated in the past year.

According to the UK Cards Association, there are now more than 100 million contactless cards in Britain and £4bn was spent on them in March – an increase of 165pc from the previous year.

Mr Tsivrikos said: “Particularly in London, there has been a great impact on travelling now you can pay with your mobile phone. That really started engaging us to use our phone as our wallet.

“Apple Pay has been very important. We have seen that people have been distrustful of banking since the financial crisis and my research has indicated that technology is more trusted.”

He added: “Of course Apple Pay is just a middleman – you still have to deal with a bank – but the illusion is created that the consumer has the power.”

4. The 'gig economy'

Want to book a taxi? Tap your smartphone. Order pizza? Tap. Get a cleaner? Tap. The so-called “gig” or “sharing” economy has risen hand-in-hand with iPhones and smartphones.

Uber has made booking a taxi much cheaper and easier, even if it is to the detriment of traditional black cab drivers. Apps such as Just Eat and Task Rabbit have done the same for takeaways and odd jobs. Mr Tsivrikos said: “With your smartphone you can now get practically any household chore you want done, transport yourself anywhere and even date.

“Money and our personal behaviours are now going through our phones, so our phone has become the main gatekeeper of these things.”

5. Debt

Of course more ways to pay mean more ways to run up a bill and one side-effect of the iPhone money revolution has been the impact it has had on debt.

Many people, particularly those with mental health issues, have found that smartphones have exacerbated their financial woes.

In January, the journalist Leah Milner described in Telegraph Money how her bipolar disorder had cost her £25,000. During high phases, she wrote, she would be filled with confidence and make multiple useless purchases online in the middle of the night.

The Money and Mental Health Policy Institute, set up by MoneySavingExpert.com’s Martin Lewis, has developed the “Shopper Stopper”, a program that blocks you from online shopping at specific times of day when the compulsion to shop is strongest.

Yahoo Finance

Yahoo Finance