Iovance (IOVA) Pipeline Aids Growth Amid Lack of Marketed Drugs

Iovance Biotherapeutics IOVA is focused on developing novel T cell-based cancer immunotherapies.

With no marketed products in its commercial portfolio, Iovance lacks a stable stream of revenues. Hence, the company is highly dependent on the successful development and potential commercialization of its pipeline. These candidates target oncology indications, which represent significant potential.

The lead candidate in Iovance’s pipeline is lifileucel, a tumor infiltrating lymphocyte (TIL) therapy, which is being developed as a monotherapy for treating metastatic melanoma and metastatic cervical cancer in two separate mid-stage studies. Iovance plans to file a biologics license application (BLA), seeking approval for lifileucel in metastatic melanoma by this August.

This BLA will be supported by data from the pivotal cohort 4 of the phase II C-144-01 study, announced last month, which evaluated lifileucel in heavily pre-treated melanoma patients. Participants who were treated with the drug achieved an overall response rate (ORR) of 29%. This result was consistent with the cohort 2 of the C-144-01 study, which achieved an ORR of 35%. Overall, data from both cohort 2 and cohort 4 showed that one-time treatment with lifileucel has the potential to provide meaningful benefits to heavily pre-treated patients.

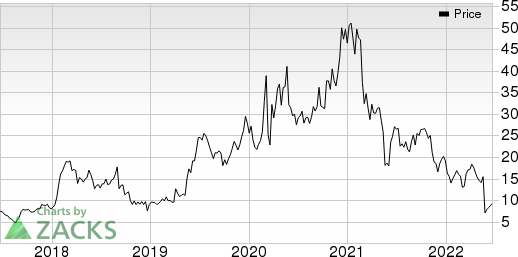

Shares of Iovance have plunged 51.9% so far this year compared with the industry’s 26.4% decline.

Image Source: Zacks Investment Research

The BLA will also be supported by positive feedback from the FDA on the potency assays and assay matrix issues for lifileucel as a potential treatment of melanoma, which was received by the company on Apr 1, 2022. This feedback was a much-needed one for IOVA, as the company was unable to initiate regulatory filing, seeking approval for the candidate in melanoma since the issue began in October 2020. In fact, if the issue is left unresolved, the company will not be able to proceed with plans for regulatory filings in other indications, including cervical cancer.

Another TIL therapy in Iovance’s pipeline is LN-145, which is being evaluated in separate phase II studies for the treatment of head and neck squamous cell carcinoma and non-small cell lung cancer (“NSCLC”).

In April, Iovance announced plans to start a phase III study, evaluating the combination of lifileucel and Merck’s MRK blockbuster PD-1 inhibitor, Keytruda (pembrolizumab), for melanoma later this year. The late-stage study will evaluate this combo as apotential treatment for immune checkpoint inhibitor naïve frontline metastatic melanoma. IOVA has already evaluated this combination for the given indication in a cohort of the phase II study (IOV-COM-202). Data from the same demonstrated an overall response rate of 67%.

The novel combination of lifileucel and Merck’s Keytruda demonstrated a safe clinical profile. Iovance has also conducted several studies evaluating this combination across multiple solid tumor indications. The studies have shown encouraging results in patients compared to treatments with either lifileucel or Keytruda monotherapies in the study participants.

A multi-center study, IOV-COM-202, comprised seven cohorts evaluating Iovance’s TIL therapies in multiple settings and for several indications, both as a monotherapy and in combination with Merck’s Keytruda or Bristol-Myers’ BMY Opdivo/Yervoy.

Opdivo and Yervoy are two of the many blockbuster drugs marketed by Bristol Myers and are key drivers of its top line. In first-quarter 2022, Bristol Myers generated $1.9 billion from Opdivo sales and recorded $515 million as product revenues from Yervoy.

IOVA is also focused on expanding its pipeline beyond lifileucel and LN-145. In April, the company announced that the FDA had accepted its regulatory filing to start clinical studies for its first TALEN-edited TIL therapy, IOV-4001. IOVA intends to start a clinical study later this year, evaluating this candidate for two advanced cancers, namely metastatic melanoma and Stage III or IV NSCLC. Per management, IOV-4001 provides an opportunity to assess the safety and efficacy of the combination of a TIL therapy and a PD-1 checkpoint inhibitor in a single formulation.

IOV-4001 utilizes the TALEN technology licensed from Cellectis CLLS. This license is part of a collaboration finalized between Iovance and CLLS in 2020. Per the agreement terms, IOVA has an exclusive worldwide license to use Cellectis’ proprietary TALEN technology to develop gene-editing TIL therapies, targeting cancer. In return, Cellectis will be entitled to receive milestones and royalty payments from IOVA, upon potential development and successful commercialization of the products developed using the TALEN technology.

Iovance also has an early-stage non-genetically modified, polyclonal T cell product candidate, IOV-2001, which is being developed for chronic lymphocytic leukemia or small lymphocytic leukemia in the phase I/II IOV-CLL-01 study.

Iovance Biotherapeutics, Inc. Price

Iovance Biotherapeutics, Inc. price | Iovance Biotherapeutics, Inc. Quote

Zacks Rank

Iovance currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance