What Investors Should Know About AIA Group (HKEX: 1299), Asia’s Largest Insurance Stock

Insurance is a big part of our lives. Here in Singapore, while we buy a lot of insurance products, we don’t actually have that many listed insurance stocks that we can invest in on the local Singapore Exchange (SGX).

One of the good things about the Hong Kong Stock Exchange is that it offers investors access to a wide range of large companies in various sectors.

In the insurance sector, Hong Kong’s stock market is home to Asia’s largest listed insurance company by market capitalisation – AIA Group Ltd (HKEX: 1299).

Currently, AIA has a market cap of HK$797 billion (US$101.5 billion). For context, in Singapore the largest insurance stock on the SGX is Great Eastern Holding Ltd (SGX: G07), which has a market cap of around S$8.6 billion (US$6.1 billion).

So, for investors interested in AIA Group and its business, here’s what investors should know about Asia’s largest listed insurance company.

A Brief History Of AIA Group

AIA Group was founded in Shanghai in 1919, meaning that the company originally has its roots in Asia.

While it was a subsidiary of US-based insurer American International Group Inc (AIG) (NYSE: AIG) – that was a key victim of the Global Financial Crisis – none of AIA’s business was related to its parent.

In 2010, AIG spun off AIA in a Hong Kong initial public offering (IPO) that raised US$17.9 billion, making it the world’s third-largest IPO at the time. Shares were priced at HK$19.68.

Today, the company is present in 18 Asia-Pacific markets, from Malaysia, Thailand, and Singapore to China, India, South Korea, and Australia, among others.

It serves mainly the health and life insurance segments, which is a sizeable and growing market in Asia.

A China focus for AIA Group

AIA was known as a pan-Asian insurance company when it was first listed in 2010. While that still applies, its business has become more geared towards the growth of the insurance industry in Mainland China.

It’s currently the only foreign life insurance company with a wholly-owned subsidiary (AIA China) that operates in Mainland China.

Initially confined to business in coastal cities in China, the company has increasingly been receiving approvals to start branches of operations in new provinces.

Over the past two or three years, the company has received approval from the China Banking and Insurance Regulatory Commission (CBIRC) to open branches in new Chinese provinces and cities, including Hubei, Sichuan, and Henan.

This focus on expansion in China can be seen through its earnings makeup. For insurance companies, many investors look at the Value of New Business (VONB) as a measure of growth.

In the first half of 2022, AIA recorded VONB of US$1.54 billion, down 13% year-on-year. Most of this fall was attributed to movement restrictions in China during the period, which negatively impacted AIA China’s VONB growth.

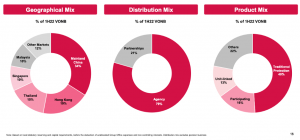

As investors can see, China made up over one-third of AIA’s overall VONB in the first half of this year and Hong Kong made up 19% (see below).

Meanwhile, Thailand, Malaysia, Singapore, and Other Markets (which include Vietnam, Australia, India, South Korea, the Philippines, Sri Lanka, Taiwan, New Zealand, Indonesia, Cambodia, Brunei, and Myanmar) combined make up nearly 50% of the group’s VONB.

Source: AIA Group H1 2022 earnings presentation

Operating & Business Metrics For AIA Group

AIA sells a lot of its policies via its own agency force, as can be seen from the chart above. The rest comes from partnerships such as bancassurance agreements with large financial institutions and banks.

This model has seen the company grow its operating profit after tax (OPAT) at a steady rate over the years.

In the first half of 2012, the company’s OPAT was US$1.08 billion while in the first half of 2022 AIA posted an OPAT of US$3.22 billion (see below).

Quite a bit of this OPAT growth in the first half of 2022 came from Hong Kong, Mainland China, and Singapore.

Source: AIA Group H1 2022 earnings presentation

In terms of capital allocation, in March of this year, AIA announced that it would be carrying out a US$10 billion share buyback over three years given the strong free surplus that it holds.

The company has also been paying shareholders a dividend since 2011. It has grown this annual dividend per share (DPS) from HK$0.33 per share in 2011 to HK$1.46 in 2021.

That equates to a compound annual growth rate (CAGR) in its dividend of 16% over the past decade.

At its current price, AIA shares provide investors with a 12-month trailing dividend yield of 2.2%.

If individuals want to buy its stock, you will have to be aware that the company sells its shares in board lots of 200 shares each.

That means – based on its latest price of HK$68.05 – the minimum amount required to purchase AIA shares would be HK$13,610, which at current exchange rates is S$2,423.

AIA Group Is A Big Insurance Stock To Monitor

Overall, AIA is a large insurance company that is also a constituent member of the Hang Seng Index (Hong Kong’s equivalent of the Straits Times Index).

The company is continuing to see a recovery in key markets in which it operates in. In its latest brief Q3 2022 business update, the company stated that group VONB was up 7% year-over-year to US$741 million.

For investors who are interested in insurance stocks in Asia, AIA is a big company worth following.

The post What Investors Should Know About AIA Group (HKEX: 1299), Asia’s Largest Insurance Stock appeared first on DollarsAndSense.sg.

Yahoo Finance

Yahoo Finance