Investors’ Favorite Dividend Stocks

Dividend stocks such as Devro and Stagecoach Group can help diversify the constant stream of cash flows generated by your portfolio. These stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. Dividends play a key role in compounding returns over time and can form a large part of our portfolio return. Here are other similar dividend stocks that could be valuable additions to your current holdings.

Devro plc (LSE:DVO)

Devro plc, together with its subsidiaries, manufactures and supplies collagen casings in the Americas, Europe, and the Asia-Pacific. Established in 1991, and currently run by Rutger Helbing, the company size now stands at 2,166 people and with the market cap of GBP £362.14M, it falls under the small-cap category.

DVO has an appealing dividend yield of 4.06% and is distributing 94.18% of earnings as dividends . The company’s DPS has increased from UK£0.044 to UK£0.088 over the last 10 years. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. Devro’s future earnings growth looks strong, with analysts expecting 99.75% EPS growth in the next three years. More on Devro here.

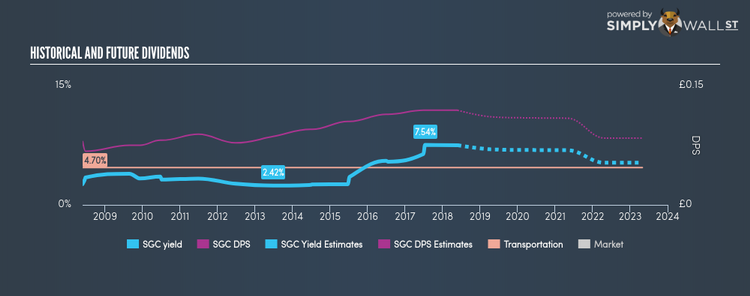

Stagecoach Group plc (LSE:SGC)

Stagecoach Group plc, together with its subsidiaries, provides public transportation services in the United Kingdom, mainland Europe, the United States, and Canada. Started in 1980, and currently headed by CEO Martin Griffiths, the company provides employment to 34,000 people and with the company’s market cap sitting at GBP £908.26M, it falls under the small-cap group.

SGC has an alluring dividend yield of 7.51% and pays 184.95% of its earnings as dividends . In the last 10 years, shareholders would have been happy to see the company increase its dividend from UK£0.08 to UK£0.12. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. Stagecoach Group is also a strong prospect for its future growth, with analysts expecting the company’s earnings to grow by an exciting triple-digit over the next three years. More detail on Stagecoach Group here.

Ferrexpo Plc (LSE:FXPO)

Ferrexpo plc mines for, develops, processes, produces, markets, exports, and sells iron ore pellets to the metallurgical industry worldwide. The company size now stands at 9063 people and with the market cap of GBP £1.34B, it falls under the small-cap category.

FXPO has a large dividend yield of 5.05% and pays out 9.84% of its profit as dividends , with an expected payout of 29.04% in three years. Despite some volatility in the yield, DPS has risen in the last 10 years from US$0.016 to US$0.12. Ferrexpo’s performance over the last 12 months beat the gb metals and mining industry, with the company reporting 109.73% EPS growth compared to its industry’s figure of 31.29%. Dig deeper into Ferrexpo here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance