Internet-Software & Services Outlook: Invest for the Long Haul

The Internet Software & Services industry is a relatively small industry primarily engaged in enabling and supporting commerce and other types of business transactions over the Internet. So they offer cloud-based solutions and services that make customer interaction with businesses easier.

So the primary factors impacting the industry are the general level of retail trade, industrial growth and progress, and level of technology adoption by businesses on the one hand and the proliferation of connected consumer devices that might help people connect and do business online on the other.

Since technology adoption by businesses is still in its relatively early days, there is a lot of scope for growth, directly benefiting companies in this industry. Consumer devices too are getting more sophisticated and more capable, spurring businesses to adopt more technology and artificial intelligence.

Industry Lags on Shareholder Returns

The industry appears to lag the broader computer software market as well as the tech influenced S&P 500 segment, which is not necessarily a negative in this case.

That’s because technology and particularly software has many drivers that don’t apply to this industry that is relatively more dependent on retail. And retail typically doesn’t grow at the same pace as technology by virtue of its being a relatively more mature segment. Still, electronic enabling continues to gather momentum, so growth rates should be sustainable.

The relative performance of the Zacks Internet-Software & Services Industry (a 20-stock group) with the broader Zacks Computer and Technology Sector and the S&P 500 is depicted in the chart below.

While the stocks in this industry have collectively gained 3.6%, the Zacks S&P 500 Composite and Zacks Computer and Technology Sector have rallied 17.6% and 18.1%, respectively.

One-Year Price Performance

Internet Software & Services Stocks Look Expensive

While the industry hasn’t had a great run in prices over the past year, there may be good reason for this. The last few years have seen considerably high financial leverage, probably necessitated by the volume of business moving online, but making the stocks relatively more risky. Therefore, a valuation based on the enterprise value may be in order.

The industry currently has an enterprise value to EBITDA ratio of 17.13X, which is below the annual high of 18.62X but above the median level of 16.83X, suggesting that upside if any will be limited. Comparing this with the S&P 500, we see that it is way ahead of the S&P 500’s 11.92X (median 11.50X).

The Earnings Outlook Doesn’t Look Encouraging

It’s evident that stocks in this industry are currently seeing rising costs and increasing investments, with a corresponding hit to profitability.

The above ratio analysis shows that investors are upbeat about the industry’s growth prospects. However, the real question for them is whether this group has the potential to continue performing better than the broader market in the quarters ahead.

One reliable measure that can help investors understand the industry’s prospects for a solid price performance going forward is the industry's earnings outlook. Empirical research shows that the earnings outlook for an industry, a reflection of the earnings revisions trend for the constituent companies, has a direct bearing on its stock market performance.

The Price & Consensus chart for the industry shows the market's evolving bottom-up earnings expectations for the industry and the industry's aggregate stock market performance. The red line in the chart represents the Zacks measure of consensus earnings expectations for 2019, while the light blue line represents the same for 2018.

Price and Consensus: Internet-Software & Services Industry

This becomes even clearer by focusing on the aggregate bottom-up EPS revisions trend. The chart below shows the evolution of aggregate consensus expectations for 2018.

Please note that the $1.29 'EPS' estimate for the industry for 2018 is not the actual bottom-up dollar EPS estimate for every company in the Zacks Internet Software & Services industry, but rather an illustrative aggregate number created by our proprietary analytics model. So the key factor to keep in mind is not the dollar earnings of $1.29 'per share' of the industry for 2018, but how this dollar number has evolved recently.

So looking at the aggregate earnings estimate revisions, it appears that analysts have turned cautious about this group’s earnings potential.

The consensus EPS estimate for the current fiscal year is down 23.7% since April and has declined consistently over the past year.

Current Fiscal Year EPS Estimate Revisions

Zacks Industry Rank Indicates Weak Prospects

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates underperformance in the near term.

The Zacks Internet Software & Services industry currently carries a Zacks Industry Rank #184, which places it at the bottom 28% of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Our proprietary Heat Map for the last five weeks shows significant deterioration in the first two weeks of August followed by very gradual improvement in subsequent weeks.

Internet-Software & Services Stocks Promise Long-Term Growth

While the near-term prospects look uncertain for investors, the long-term (3-5 years) EPS growth estimate for the Zacks Internet-Software & Services Industry appears attractive. That’s because more business is moving online as we speak from both existing and new players. New technology is also being introduced, existing tools fine-tuned and artificial intelligence is increasingly being employed to facilitate doing more business online.

So it isn’t surprising that the group’s mean estimate of long-term EPS growth rate of 13.74% compares favorably with the 9.82% growth for the Zacks S&P 500 composite.

Mean Estimate of Long-Term EPS Growth Rate

The long-term growth is a continuation of strong performance over the past few years. Take revenue for example, which is the best yardstick to measure the effectiveness of investments. It’s also an indication that the high level of investments can continue.

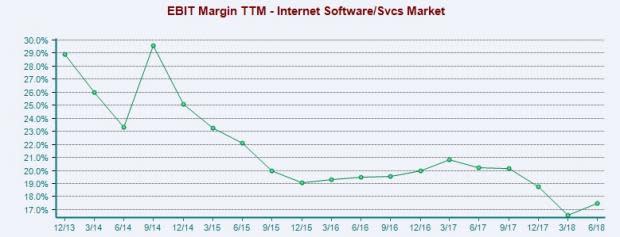

Understandably, profitability has declined as the industry continues to build assets, including intellectual property. So on the one hand, EBIT margin has dropped-

While on the other, book value per share has increased-

Even as return on assets declined-

The high level of investment was partially financed with debt, although the debt/total capitalization is currently at manageable levels-

Bottom Line

The above charts show that the industry is focused on long term growth and will continue to sacrifice margins because the longer-term prospects are too good. Whether near term performance is matching up to expectations will be best understood by watching the topline.

Given the above, investors with a short term focus won’t find the industry attractive. Our model also doesn’t have too many buy-ranked stocks in the industry (Zacks Ranks #1 and #2). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

While none of the stocks in our Internet-Software & Services universe currently hold a Zacks Rank #1 (Strong Buy), here are four stocks that have been seeing positive earnings estimate revisions and carry a Zacks Rank #2 (Buy). Investors with a longer term focus may take a look at the following-

ChannelAdvisor Corp. (ECOM): The Zacks Rank #2 stock has gained 2.6% over the past year. The Zacks Consensus Estimate for the current-year EPS is up 133.33% in the last 60 days.

Price and Consensus: ECOM

Globant S.A. (GLOB): The Zacks Rank #2 stock has gained 59.0% over the past year. The Zacks Consensus Estimate for the current-year EPS is down 3.73% in the last 60 days.

Price and Consensus: GLOB

Ringcentral, Inc. (RNG): The Zacks Rank #2 stock has gained 123.6% over the past year. The Zacks Consensus Estimate for the current-year EPS is up 8.06% in the last 60 days.

Price and Consensus: RNG

VeriSign, Inc. (VRSN): The Zacks Rank #2 stock has gained 53.9% over the past year. The Zacks Consensus Estimate for the current-year EPS is down 0.88% in the last 60 days.

Price and Consensus: VRSN

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VeriSign, Inc. (VRSN) : Free Stock Analysis Report

Ringcentral, Inc. (RNG) : Free Stock Analysis Report

Globant S.A. (GLOB) : Free Stock Analysis Report

ChannelAdvisor Corporation (ECOM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance