Interactive Brokers' (IBKR) Q1 Earnings Beat, DARTs Rise Y/Y

Interactive Brokers Group’s IBKR first-quarter 2020 adjusted earnings per share of 69 cents surpassed the Zacks Consensus Estimate of 67 cents. The figure was 25.5% higher than the prior-year earnings.

Increase in daily average revenue trades (DARTs), mainly due coronavirus-induced volatility, supported the results. However, lower revenues and rise in expenses acted as headwinds.

The results excluded certain non-recurring items. After considering these, net income came in at $290 million or 60 cents per share, down from $324 million or 64 cents per share in the prior-year quarter.

Interactive Brokers reported comprehensive income available to common shareholders of $46 million or 51 cents per share, down from $49 million or 64 cents per share in the prior-year quarter.

Revenues & Expenses Rise

Total net revenues were $532 million, down 4.7% year over year. The fall was mainly due to lower non-interest income. Further, the top line missed the Zacks Consensus Estimate of $580.9 million. Adjusted revenues were $581 million, up 24.1% from the prior-year quarter.

Total non-interest expenses increased 2.3% from the year-ago quarter to $224 million. Rise in all expense components except for customer bad debt was attributed to this increase.

Income before income taxes was $308 million, down 9.1% from the prior-year quarter.

Adjusted pre-tax profit margin was 61%, down from 62% a year ago.

Other Business Highlights

During the first quarter, total DARTs surged 71% year over year to 1.45 million. Further, total cleared DARTs jumped 72% from the year-ago quarter to 1.3 billion.

Additionally, customer accounts grew 22% from the year-ago quarter to 760,000.

Strong Capital Position

As of Mar 31, 2020, cash and cash equivalents (including cash and securities set aside for regulatory purposes) totaled $17.4 billion compared with $12.3 billion on Dec 31, 2019.

As of Mar 31, 2020, total assets were $75.8 billion compared with $71.7 billion on Dec 31, 2019. Total equity was $8.1 billion compared with $7.9 billion at the end of December 2019.

Our Take

Interactive Brokers remains well poised to capitalize on its prospects, backed by the company’s efforts to explore emerging markets and the launch of IBKR Lite service. Further, market volatility owing to the coronavirus pandemic will likely support the top line in the near term. However, higher expenses pose a major concern for the company.

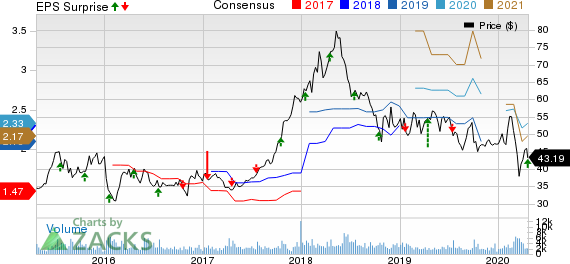

Interactive Brokers Group, Inc. Price, Consensus and EPS Surprise

Interactive Brokers Group, Inc. price-consensus-eps-surprise-chart | Interactive Brokers Group, Inc. Quote

Currently, Interactive Brokers carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance and Upcoming Releases of Other Investment Brokers

Charles Schwab’s SCHW first-quarter 2020 adjusted earnings of 62 cents per share lagged the Zacks Consensus Estimate of 64 cents. Also, the bottom line decreased 10% from the prior-year quarter.

E*TRADE Financial ETFC and Raymond James RJF are scheduled to announce quarterly results on Apr 23 and Apr 29, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

E*TRADE Financial Corporation (ETFC) : Free Stock Analysis Report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Raymond James Financial, Inc. (RJF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance