Intel (INTC) Launches 13th-Gen Chip, Expands Developer Cloud

Intel Corporation INTC recently unveiled the 13th-Generation Intel Core Processor in a concerted effort to arrest the dwindling PC sales and raise the standards of PC performance. Codenamed Raptor Lake, the new chip is widely expected to bring the company to the forefront of the processor market amid intense competitive pressure and strengthen its leading market position.

The top-of-the-line version of the chip, the Core i9-13900K, is reportedly the fastest desktop processor (with a top speed of 5.8Ghz) with 24 processing cores that are broken down into eight performance cores and 16 efficiency cores. Leveraging Intel 7 process and x86 performance hybrid architecture, the chip enables up to 15% better single-threaded performance and up to 41% better multi-threaded performance per company standards.

While the performance cores for the new chip handle heavy-duty tasks like gaming, coding, photo and video editing, the efficiency cores handle less intensive basic tasks like web browsing and emailing. Although the company is yet to divulge the pricing details, experts believe that the flagship chip could be priced at around $700.

Intel further intends to expand the horizon of the Intel Developer Cloud to enable developers try out the new range of chips before they hit the market. This will facilitate the early testing of several applications in the cloud, offering a healthy software developer ecosystem for highly competitive semiconductor hardware manufacturers. This can help accelerate the time to market for solutions built on Intel platforms.

Intel is betting big on the IoT business and is investing heavily to gain a higher market presence. While the focus was earlier on making the best computing chips and generating industry-leading margins from them, the company now prefers to focus on a product range targeting different market segments. Management believes that the higher-end business in more developed economies continues to look up, but the new strategy should help it get into many more device categories, where Intel products will continue to enjoy a premium based on performance and cost of ownership.

However, the imposition of tariffs owing to the trade war between the United States and China, and the coronavirus outbreak is anticipated to negatively impact growth prospects. The uncertainty over the economic impact of the coronavirus crisis has affected investors’ confidence and is likely to remain an overhang on the company’s performance. Impending global recession is anticipated to weigh on IOTG end markets, especially retail and industrial. Moreover, lower automotive production due to lockdowns is a concern for Mobileye. Additionally, sluggish data center demand across enterprise and government end-markets remains a woe.

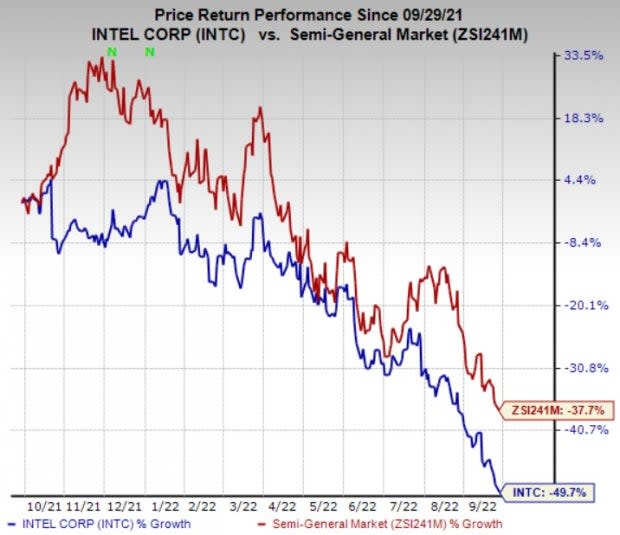

The stock has lost 49.7% over the past year compared with the industry’s decline of 37.7%. Intel carries a Zacks Rank #5 (Strong Sell).

Image Source: Zacks Investment Research

A better-ranked stock in the industry is STMicroelectronics N.V. STM, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings estimates for the current year for STMicroelectronics have moved up 77.2% over the past year, while that for the next fiscal is up 51.6%. STM has a long-term earnings growth expectation of 5% and delivered an earnings surprise of 9.6%, on average, in the trailing four quarters.

Infineon Technologies AG IFNNY, carrying a Zacks Rank #2, is another solid pick for investors. It delivered an earnings surprise of 14.6%, on average, in the trailing four quarters and has a long-term growth expectation of 23.8%. Earnings estimates for the current year for Infineon have moved up 25.3% since September 2021.

Navitas Semiconductor Corporation NVTS carries a Zacks Rank #2. It delivered an earnings surprise of 7.4%, on average, in the trailing four quarters. Navitas is the world’s first CarbonNeutral-certified semiconductor firm.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

STMicroelectronics N.V. (STM) : Free Stock Analysis Report

Infineon Technologies AG (IFNNY) : Free Stock Analysis Report

Navitas Semiconductor Corporation (NVTS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance