Insurance Stocks' Q4 Earnings on Jan 26: AJG, MMC and WRB

Better pricing, exposure growth, solid retention, favorable renewals, reinsurance agreements and accelerated digitalization in the fourth quarter are likely to have benefited insurance industry players such as Arthur J. Gallagher & Co. AJG, Marsh & McLennan Companies, Inc. MMC and W. R. Berkley Corporation WRB, which are due to report tomorrow. However, an active catastrophe level is likely to have weighed on their performance.

Premiums are likely to have benefited from continued improved pricing, strong retention and exposure growth across business lines. An active catastrophe environment accelerated the policy renewal rate and aided in better pricing in the fourth quarter.

The fourth quarter of 2022 bore the brunt of winter storm Elliot. Karen Clark & Company estimates industry losses from Elliot to be about $5.4 billion. Nonetheless, better pricing, reinsurance arrangements, portfolio repositioning, reinsurance covers, favorable reserve development and prudent underwriting are likely to drive an improvement in underwriting results.

Increased travel across the world is likely to have induced higher auto premiums. A stronger mortgage market is likely to have favored mortgage insurance premiums. A low unemployment rate is likely to have aided commercial insurance and group insurance.

Insurers, being beneficiaries of an improving rate environment, are likely to witness improved investment results. The last year saw seven rate hikes, with the fourth quarter witnessing two hikes by the Fed. A larger investment asset base and alternative investments in private equity, hedge funds and real estate among others are expected to have aided net investment income.

Accelerated digitalization is expected to have saved costs, thus aiding margins. A solid capital position aided insurers in strategic mergers and acquisitions to sharpen their competitive edge, build on a niche, expand geographically and diversify their portfolio, apart from enhancing shareholders value via share buybacks and raising dividends.

Let’s take a sneak peek into how the abovementioned insurers are poised prior to their fourth-quarter 2022 earnings on Jan 26.

According to the Zacks model, a company needs the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Arthur J. Gallagher’s fourth-quarter results are expected to reflect new business, strong retention and renewal premium increases across its business lines.

Arthur J. Gallagher estimates organic revenue growth from existing clients, growing claim counts and new business to have favored Brokerage and Risk Management segments. Total expenses are likely to have increased. We expect total expense of $1.6 billion in the to-be-reported quarter. (Read more: What's in Store for Arthur J. Gallagher in Q4 Earnings?)

The Zacks Consensus Estimate for Arthur J. Gallagher’s fourth-quarter earnings per share of $1.50 indicates a 53.1% increase from the year-ago quarter reported figure. The company has an Earnings ESP of -2.76% and a Zacks Rank #3.

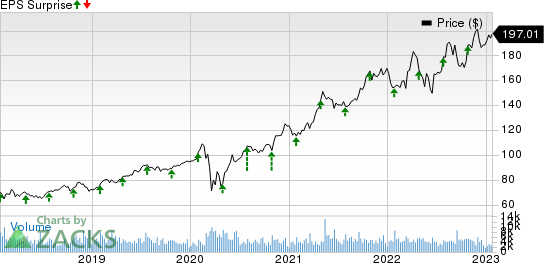

AJG’s earnings surpassed estimates in the last four reported quarters. This is depicted in the chart below:

Arthur J. Gallagher & Co. Price and EPS Surprise

Arthur J. Gallagher & Co. price-eps-surprise | Arthur J. Gallagher & Co. Quote

Marsh & McLennan Companies’ revenues of Marsh & McLennan are likely to have benefited on the back of solid contributions from Risk and Insurance Services as well as Consulting segments in the fourth quarter. MMC’s margins are expected to have taken a hit from escalating compensation and benefits costs, coupled with expenses related to talent investments in the to-be-reported quarter. Per the last earnings call, foreign exchange is expected to have an adverse impact of 7 cents per share on Marsh & McLennan’s margins in the fourth quarter. Management estimated interest expenses of $121 million for the to-be-reported quarter.

The Zacks Consensus Estimate for the bottom line is pegged at $1.40, indicating a 2.9% increase from the year-ago quarter reported figure. The consensus estimate for revenues is pegged at $5.2 billion, indicating an increase of 1.9% year over year. The company has an Earnings ESP of +0.36% and a Zacks Rank 2. (Read more: Can Marsh & McLennan Sustain Its Beat Streak in Q4 Earnings?)

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Marsh & McLennan Companies’ earnings outpaced estimates in the last four reported quarters. The same is depicted in the chart below:

Marsh & McLennan Companies, Inc. Price and EPS Surprise

Marsh & McLennan Companies, Inc. price-eps-surprise | Marsh & McLennan Companies, Inc. Quote

W.R. Berkley’s fourth-quarter results are likely to benefit from higher premiums in the Insurance segment as well as the Reinsurance & Monoline Excess segment. Higher income from fixed maturity securities, rising interest rate environment and increase in equity securities are likely to have aided improvement in net investment income. The expense ratio is likely to have improved on net premiums earned, surpassing compensation expense growth. Higher-than-expected cat losses are likely to have weighed on underwriting profitability and thus combined ratio.

The Zacks Consensus Estimate for the bottom line is pegged at $1.07, indicating a 4.9% increase from the year-ago quarter reported figure. The consensus estimate for revenues is pegged at $2.9 billion, indicating an increase of 13.9% year over year. The company has an Earnings ESP of +1.17% and a Zacks Rank 3. (Read more: Will W.R. Berkley's Beat Streak Continue in Q4 Earnings?)

W.R. Berkley’s earnings surpassed estimates in the last four quarters. This is depicted in the chart below:

W.R. Berkley Corporation Price and EPS Surprise

W.R. Berkley Corporation price-eps-surprise | W.R. Berkley Corporation Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

W.R. Berkley Corporation (WRB) : Free Stock Analysis Report

Marsh & McLennan Companies, Inc. (MMC) : Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance