Do Insurance Australia Group's (ASX:IAG) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Insurance Australia Group (ASX:IAG). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Insurance Australia Group with the means to add long-term value to shareholders.

See our latest analysis for Insurance Australia Group

Insurance Australia Group's Improving Profits

In the last three years Insurance Australia Group's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. It's good to see that Insurance Australia Group's EPS has grown from AU$0.27 to AU$0.32 over twelve months. There's little doubt shareholders would be happy with that 18% gain.

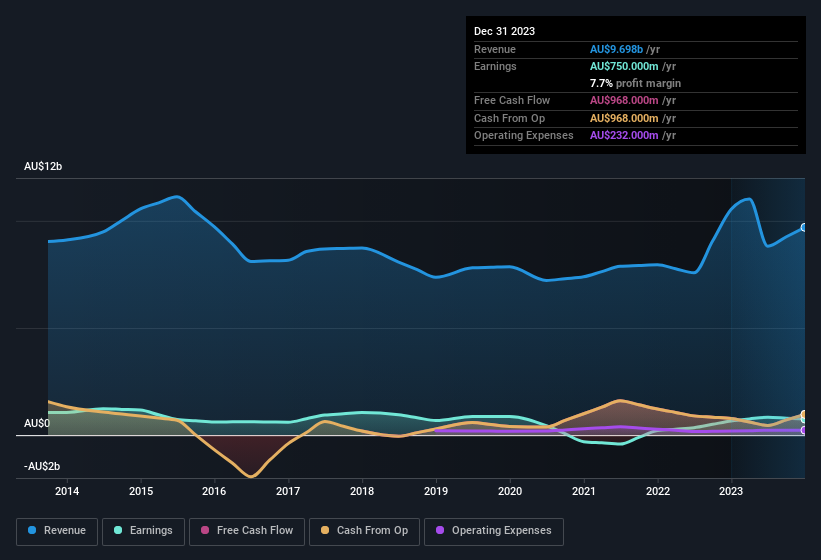

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Insurance Australia Group's EBIT margins have actually improved by 4.5 percentage points in the last year, to reach 15%, but, on the flip side, revenue was down 8.0%. That falls short of ideal.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Insurance Australia Group's future profits.

Are Insurance Australia Group Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Insurance Australia Group shareholders is that no insiders reported selling shares in the last year. Add in the fact that Wendy Thorpe, the Independent Non-Executive Director of the company, paid AU$15k for shares at around AU$5.83 each. It seems that at least one insider is prepared to show the market there is potential within Insurance Australia Group.

Recent insider purchases of Insurance Australia Group stock is not the only way management has kept the interests of the general public shareholders in mind. Namely, Insurance Australia Group has a very reasonable level of CEO pay. The median total compensation for CEOs of companies similar in size to Insurance Australia Group, with market caps over AU$12b, is around AU$6.2m.

The CEO of Insurance Australia Group only received AU$2.9m in total compensation for the year ending June 2023. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Insurance Australia Group Deserve A Spot On Your Watchlist?

As previously touched on, Insurance Australia Group is a growing business, which is encouraging. And there's more to Insurance Australia Group, with the insider buying and modest CEO pay being a great look for those with an eye on the company. If these factors aren't enough to secure Insurance Australia Group a spot on the watchlist, then it certainly warrants a closer look at the very least. Now, you could try to make up your mind on Insurance Australia Group by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Keen growth investors love to see insider activity. Thankfully, Insurance Australia Group isn't the only one. You can see a a curated list of Australian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com