Insider Sale: Executive Vice President Nicholas Westfall Sells Shares of Chemed Corp (CHE)

On July 30, 2024, Nicholas Westfall, Executive Vice President of Chemed Corp (NYSE:CHE), sold 2,000 shares of the company. The transaction was documented in a recent SEC Filing. Following this sale, the insider now owns 5,990 shares of Chemed Corp.

Chemed Corp operates through its two wholly-owned subsidiaries, VITAS Healthcare Corporation and Roto-Rooter. VITAS is a provider of end-of-life care services, and Roto-Rooter is a leading provider of plumbing, drain cleaning, and water cleanup services.

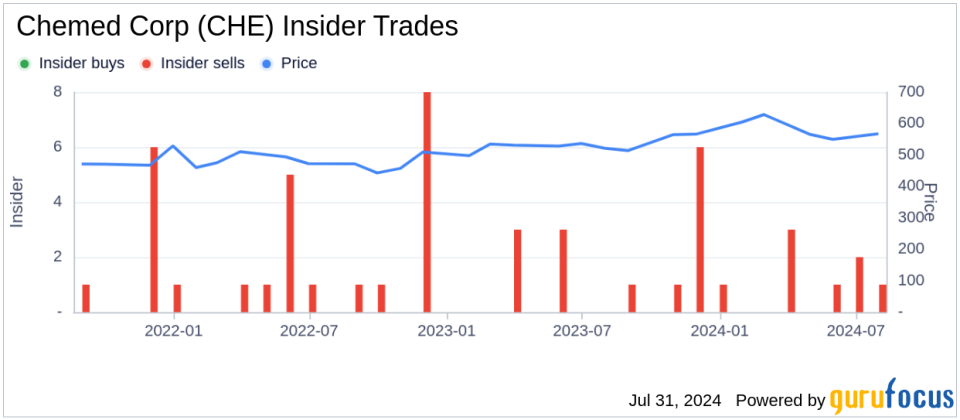

Over the past year, Nicholas Westfall has engaged in the sale of 2,000 shares and has not purchased any shares. This recent transaction reflects a continuation of the insider's selling trend.

The broader insider transaction history for Chemed Corp shows a pattern of more sales than purchases. Over the past year, there have been 16 insider sales and no insider buys.

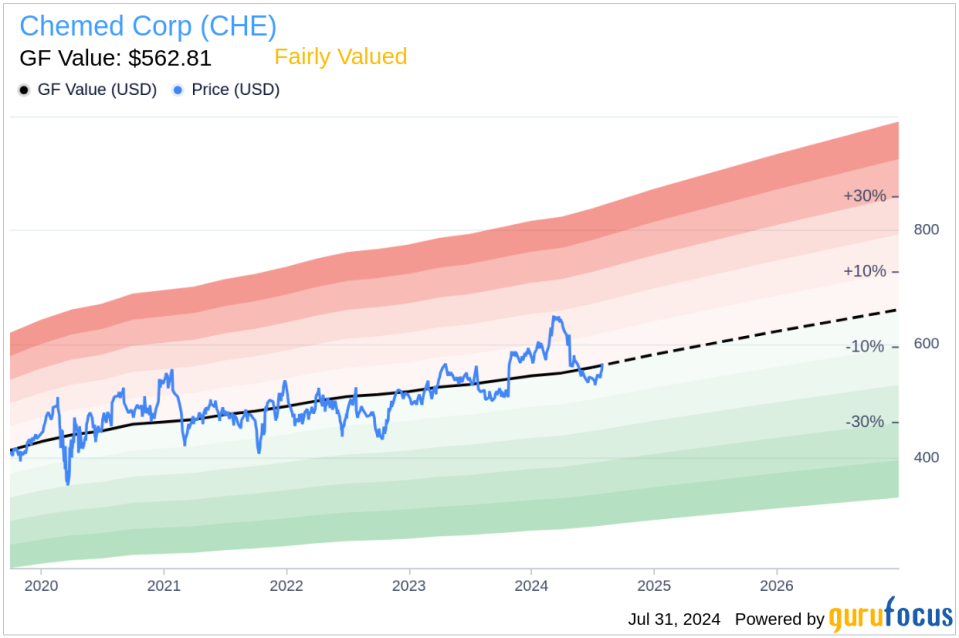

On the date of the sale, shares of Chemed Corp were priced at $561.58, resulting in a market cap of approximately $8.51 billion. The company's price-earnings ratio stands at 28.78, which is above both the industry median of 24.385 and the historical median for the company.

According to the GF Value, which is an intrinsic value estimate from GuruFocus, Chemed Corp is considered Fairly Valued with a price-to-GF-Value ratio of 1. The GF Value of $562.81 is very close to the current trading price, suggesting that the stock is priced appropriately given its earnings outlook and historical trading multiples.

This insider sale comes at a time when the stock is perceived as fairly valued based on comprehensive financial analysis and market performance indicators.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.