Inogen's (INGN) Q4 Earnings Miss, Revenues Top Estimates

Inogen, Inc. INGN reported fourth-quarter 2019 earnings per share (EPS) of 7 cents, which lagged the Zacks Consensus Estimate of 11 cents. This compares to earnings of 44 cents in the year-ago quarter.

EPS in 2019 was 94 cents, which missed the Zacks Consensus Estimate of $1.08. The metric declined from 2018’s figure of $2.30.

Revenues of this Zacks Rank #5 (Strong Sell) company came in at $78.9 million, which surpassed the Zacks Consensus Estimate by 0.02%. On a year-over-year basis, the top line dropped 8.8%.

On a full-year basis, Inogen’s revenues were $361.9 million, missing the consensus estimate of $368.8 million. However, revenues rose 1.1% from 2018 level.

Segmental Details

Revenues at the Sales segment amounted to $73.5 million in the quarter under review, down 9% on a year-over-year basis.

Rental revenues grossed $5.4 million, down 6.1% year over year.

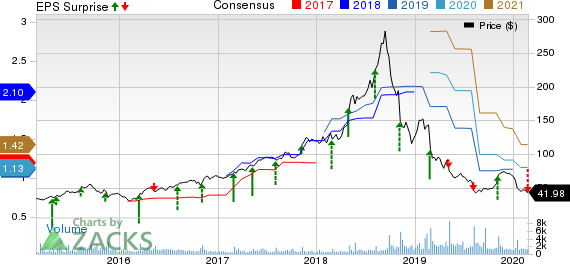

Inogen, Inc Price, Consensus and EPS Surprise

Inogen, Inc price-consensus-eps-surprise-chart | Inogen, Inc Quote

Revenues by Region & Category

Business-to-business revenues in the United States amounted to $20.6 million, down 18.9% on a year-over-year basis. Per management, Inogen saw a decline in orders from one of its private label partners.

Internationally, this segment recorded revenues of $17.1 million, down 7.7% year over year and 5.1% at constant currency. Per management, the decline was primarily led by tender uncertainty in certain European regions and currency headwinds.

Direct-to-consumer revenues fell 2.8% year over year to $35.8 million in the quarter.

Margins

In the fourth quarter, gross profit was $33.9 million, down 22.1% year over year. Gross margin came in at 43%, down a significant 740 basis points (bps).

Loss from operations in the quarter was $5.3 million against operating profit of $4.8 million a year ago.

Guidance

For 2020, Inogen continues to expect revenues within $385-$400 million, calling for 6.4-10.5% growth over 2019. The Zacks Consensus Estimate for the same is pinned at $402.2 million.

Notably, Inogen expects modest growth in rental revenues in 2020 compared to 2019.

Also, the company expects to report loss per share for the first quarter of 2020.

That’s not all. Inogen expects 2020 EBITDA within $44-$50 million, down from the earlier projected $56-$58 million.

Wrapping Up

Inogen ended the fourth quarter on a dismal note. The company reported softness in business-to-business international and domestic revenues in the quarter. The drop in the quarterly top and bottom line is disheartening as well. Tender uncertainty in a few European regions and currency headwinds dented the company’s overseas revenues in the quarter. Significant contraction in gross margin and a dull view for 2020 add to the woes.

Nonetheless, Inogen expects the business-to-business arm to be a strong contributor to revenues in 2020, thanks to the Tidal Assist Ventilator. The company also expects rental revenues to grow modestly in 2020 on a slight increase in patient count. Inogen has thus kept its 2020 revenue guidance intact.

Earnings of Other MedTech Majors at a Glance

Some better-ranked companies, which reported solid results this earnings season, include Stryker Corporation SYK, Accuray Incorporated ARAY and IDEXX Laboratories, Inc. IDXX. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stryker reported fourth-quarter 2019 adjusted EPS of $2.49, outpacing the Zacks Consensus Estimate by 1.2%. Revenues of $4.13 billion surpassed the consensus estimate by 0.7%. The company carries a Zacks Rank #2 (Buy).

Accuray reported second-quarter fiscal 2020 adjusted EPS of a penny against the Zacks Consensus Estimate of a loss of 7 cents. Net revenues of $98.8 million outpaced the consensus mark by 0.3%. The company sports a Zacks Rank #1.

IDEXX Laboratories reported fourth-quarter 2019 adjusted EPS of $1.04, which beat the Zacks Consensus Estimate of 91 cents by 14.3%. Revenues were $605.4 million, surpassing the Zacks Consensus Estimate by 0.9%. The company carries a Zacks Rank of 2.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Stryker Corporation (SYK) : Free Stock Analysis Report

Accuray Incorporated (ARAY) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

Inogen, Inc (INGN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance