Infant Formula Global Market Forecast Report 2024-2029: Demand for Organic Infant Formula in the U.S. Set to Rise

Global Infant Formula Market

Dublin, Sept. 25, 2024 (GLOBE NEWSWIRE) -- The "Global Infant Formula Market - Forecasts from 2024 to 2029" report has been added to ResearchAndMarkets.com's offering.

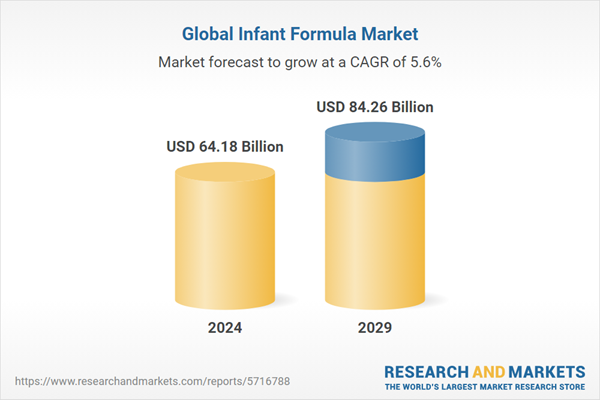

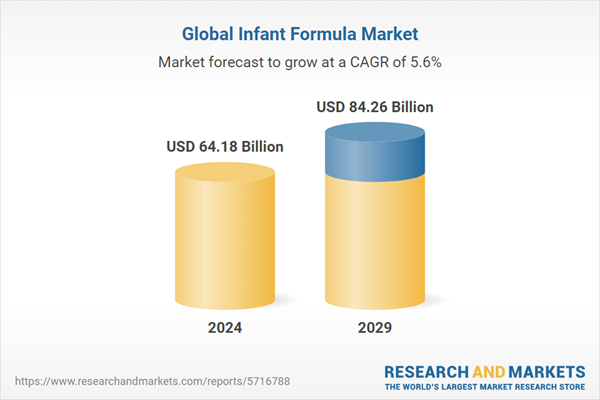

The global infant formula market is projected to grow at a CAGR of 5.6% over the forecast period, from US$64.183 billion in 2024, and is expected to reach US$84.268 billion by 2029.

The growing female participation within the worldwide workforce is set to push the market for infant formula forward as it is forecasted to boost disposable income and decrease breastfeeding of infants within the worldwide market. Within the past two years, the worldwide female labor force expanded from 39.7% in 2022 to almost 40.1% in 2023, according to the World Bank information. The data further expressed that in countries like Japan and the USA, female workforce participation expanded from 44.9% and 46.3% in 2022 to 45.1% and 46.5%, respectively, in 2023.

The constantly growing global population is expected to boost the demand for infant formula

One of the major driving variables anticipated to push the worldwide demand for infant formula is the continually growing global population. With this increment, the number of children born worldwide will increase. This increment in the worldwide population and increasing childbirth are anticipated to boost the worldwide demand for infant formula in the forecasted period.

The World Bank observed in its report that the global population reached 8.02 billion in 2023, up from 7.95 billion in 2022. This represents a steady rise in the worldwide population, particularly in developing countries such as India, Malaysia, and Vietnam. India is home to the biggest population globally, with around 1.43 billion individuals living within the country in 2023. The expanding population surges the market's requirement for infant food and formula.

The cow's milk protein-based infant formula is anticipated to boost the market expansion

The infant formula market for cow's milk protein-based is driven by expanding consumer mindfulness of the healthy and nutritious benefits of cow milk protein for general infant development. Pediatricians broadly endorse cow milk protein-based infant formulas as an elective to breast milk. One of the primary variables driving this segment's development is the various well-being benefits of cow milk infant formula over other types of infant formula.

Moreover, the expanding infant mortality rate is one of the reasons for the need for nutritious infant formula within the nation. For instance, according to the Centers for Disease Control and Prevention, the infant mortality rate within the United States in 2022 was 5.60 per 1,000 live births, which was 3% higher compared to 2021, where the infant mortality rate was 5.44 per 1,000 live births. The increase in cases of newborn mortality is expected to be one of the major reasons for the bolstering of the market for cow milk protein-based infant formula within the anticipated period.

Key market players and new entrants are investing in major market activities such as product launches, developments, and collaborations to meet the growing demand for cow milk protein-based infant formula products.

The United States region is predicted to contribute significantly to market growth

The demand for organic infant formula is anticipated to rise in the United States. The demand for specialty infant formula is expected to increase nationwide. These specialty formulas have specialized ingredients such as hydrolyzed protein, amino acids and prebiotics.

Furthermore, companies are increasing their investments in the United States infant formula market, which is expected to drive market growth in the coming years. For instance, in March 2022, Bobbie, one of the first organic infant formula companies manufacturing in the United States, announced that it had closed funding to US$50 million. This included its Series B funding, which was led by Park West, with existing investors Nextview and VMG. This funding will help the company accelerate the production of its infant formula and support the growing demand for nutritious formula. Hence, such rising investments are expected to fuel the market growth.

According to the U.S. Department of Commerce, the total number of infants (0-5 years) in the United States in 2023 was 1,85,11,160. Of this, 94,59,399 were males, and 90,51,761 were females. Currently, according to the World Bank, 18% of the United States population comprises children aged 0-14 years. Hence, in the coming years, with the rising infant population, the demand for infant formula is anticipated to grow.

Key Attributes:

Report Attribute | Details |

No. of Pages | 149 |

Forecast Period | 2024 - 2029 |

Estimated Market Value (USD) in 2024 | $64.18 Billion |

Forecasted Market Value (USD) by 2029 | $84.26 Billion |

Compound Annual Growth Rate | 5.6% |

Regions Covered | Global |

Key Topics Covered:

1. INTRODUCTION

2. RESEARCH METHODOLOGY

3. EXECUTIVE SUMMARY

3.1. Key Findings

4. MARKET DYNAMICS

4.1. Market Drivers

4.2. Market Restraints

4.3. Porter's Five Forces Analysis

4.4. Industry Value Chain Analysis

4.5. Analyst view

5. GLOBAL INFANT FORMULA MARKET BY FORMULA TYPE

5.1. Introduction

5.2. Cow's Milk Protein-Based

5.3. Soy-Based

5.4. Protein Hydrolysate

6. GLOBAL INFANT FORMULA MARKET BY FORM

6.1. Introduction

6.2. Powdered

6.3. Concentrated Liquid

6.4. Ready-to-Use

7. GLOBAL INFANT FORMULA MARKET BY DISTRIBUTION CHANNEL

7.1. Introduction

7.2. Offline

7.3. Online

8. GLOBAL INFANT FORMULA MARKET BY GEOGRAPHY

9. COMPETITIVE ENVIRONMENT AND ANALYSIS

9.1. Major Players and Strategy Analysis

9.2. Emerging Players and Markey Lucrativeness

9.3. Mergers, Acquisitions, Agreements, and Collaborations

9.4. Competitive Dashboard

10. COMPANY PROFILES

Abbott

Nestle

Dana Dairy Group

Danone

Ausnutria Dairy Corporation Ltd.

Perrigo Company

Else Nutrition

Biostime

HHPL Healthcare

Mead Johnson & Company

Estrellas Life Sciences

Nutricore Biosciences

Morinaga Milk Industry Co.

Meiji Holdings Co.

Bean Stalk Snow Co.

For more information about this report visit https://www.researchandmarkets.com/r/wb1en4

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world's leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900