Industrial Stocks' May 7 Earnings Roster: BLL, AAXN & More

So far 44.8% of the S&P participants in the Industrial Products sector have reported first-quarter 2020 results. These companies have logged a decline of 22.1% in earnings, highlighting the severe impact of the coronavirus pandemic that crippled supply chain, weakened manufacturing activity and demand worldwide. Taking into account all of the companies that are yet to report, the sector is anticipated to log a 20.9% decline in earnings, per the latest Earnings Trends. However, the slump is not restricted to this sector alone, as 11 of the 16 Zacks sectors are expected to log declines this earnings season, mostly casualties of COVID-19 outbreak.

Key Factors to Note

Per the Federal Reserve, industrial production contracted 7.5% in first-quarter 2020 — the steepest since second-quarter 2009. Manufacturing output also slumped at an annual rate of 7.1% in the first quarter, the sharpest since first-quarter 2009. Meanwhile, per the Institute for Supply Management, the Manufacturing Purchasing Managers’ Index (PMI), after recording 50.9 in January and 50.1 in February (indicating expansion), contracted again to 49.1% in March. These figures clearly indicate that the manufacturing sector has been impacted by the pandemic and energy market volatility in the January-March period.

Consequently, the sector’s performance in the first quarter is likely to reflect the challenges associated with COVID-19 outbreak, which include factory closures worldwide owing to restrictions imposed by several governments, supply chain disruptions, low demand for goods, and logistic costs. Moreover, low oil prices on account of weak demand and excess supply might get reflected in the sector’s performance.

Further, capital expenditures in oil & gas, mining and construction are likely to have been restrained and thus, may have a bearing on companies that are exposed to these sectors. However, the sector players, which are engaged in packaging for food, medicines, home and personal-care products, are likely to have benefited from higher demand during the pandemic. Meanwhile, several sector participants have been focusing on extensive cost cutting and lean manufacturing actions in a bid to mitigate the impact of the coronavirus outbreak somewhat.

It will be interesting to see how some of the industrial companies fare when they release quarterly financial numbers on May 7.

Ball Corporation BLL is scheduled to report first-quarter 2020 results before the market opens. The company has surpassed the Zacks Consensus Estimate in one of the four trailing quarters while missing the same in the other three. The company has a trailing four-quarter negative earnings surprise of 0.81%, on average.

Ball Corporation Price and EPS Surprise

Ball Corporation price-eps-surprise | Ball Corporation Quote

The ongoing momentum in the global beverage-can demand driven by consumers’ preference for cans over glass and plastic might have benefited Ball Corporation’s first-quarter performance. Further, a robust aerospace backlog is likely to have contributed to the company’s results in the quarter to be reported.

Per the Zacks quantitative model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can see the complete list of today’s Zacks #1 Rank stocks here.

Ball Corporation has a Zacks Rank #3 and an Earnings ESP of +1.56%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

The Zacks Consensus Estimate for its first-quarter 2020 earnings is currently pegged at 60 cents, indicating an improvement of 22.5% from the year-ago quarter. The estimates have been stable in the past 30 days. (Read more: Ball Corp to Report Q1 Earnings: What's in Store?)

Axon Enterprise, Inc. AAXN is scheduled to report first quarter 2020 results after the closing bell. The company has surpassed the Zacks Consensus Estimate in three of the trailing four quarters, while missing on one occasion. It has a trailing four-quarter positive earnings surprise of 7.89%, on average.

Axon Enterprise, Inc Price and EPS Surprise

Axon Enterprise, Inc price-eps-surprise | Axon Enterprise, Inc Quote

The company’s results are likely to reflect strong momentum in TASER 7, continued growth of higher margin Axon Cloud revenues and Axon Body 3 shipments.

The company currently has a Zacks Rank of 3 and an Earnings ESP of +18.31%.

The Zacks Consensus Estimate for the company’s first quarter 2020 earnings has gone up 6% to 18 cents per share over the past 30 days. The figure suggests a decline of 14.3% from the prior-year reported figure.

Flowserve Corporation FLS is scheduled to report first-quarter 2020 results after the market close. The company surpassed the Zacks Consensus Estimate in each of the trailing four quarters. It has a trailing four-quarter positive earnings surprise of 8.34%, on average.

Flowserve Corporation Price and EPS Surprise

Flowserve Corporation price-eps-surprise | Flowserve Corporation Quote

Challenging conditions in the oil and gas end markets are expected to have adversely impacted bookings in the first quarter. Further, the company’s results in the to-be-reported quarter might reflect the impact of the coronavirus pandemic on its supply chain and demand for its products and services. Shutdowns owing to the outbreak are likely to get reflected in the performance of the quarter to be reported.

The company currently has a Zacks Rank of 4 (Sell) and an Earnings ESP of +1.52%.

Over the past 30 days, the Zacks Consensus Estimate for the to-be-reported earnings has been revised downward by 2% to 41 cents, which indicates that earnings will be flat with the prior-year reported figure. (Read more: Flowserve to Report Q1 Earnings: What's in the Offing?)

Colfax Corporation CFX is scheduled to report first-quarter 2020 results before the market opens. The company beat estimates in each of the trailing four quarters. It has trailing four-quarter positive earnings surprise of 8.1%, on average.

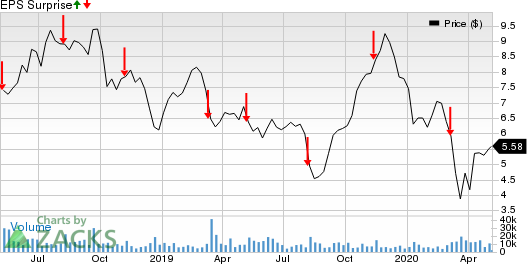

Colfax Corporation Price and EPS Surprise

Colfax Corporation price-eps-surprise | Colfax Corporation Quote

The company’s first-quarter results are likely to reflect weak industrial sector. Weak rising costs of sales have been a major concern for Colfax over the past several quarters and will likely have impacted the first quarter earnings as well. Nevertheless, benefits from the company’s productivity actions might have negated some of the impact.

The company currently has a Zacks Rank of 4 and Earnings ESP of -5.80%.

The Zacks Consensus Estimate for the first quarter is currently pegged at 37 per share, suggesting decline of 30% from the prior-year quarter. The estimates have been revised downward by 5% over the past 30 days.

ADT Inc. ADT is scheduled to report first-quarter 2020 results after the closing bell. The company has missed the Zacks Consensus Estimate in each of the trailing four-quarters. It has trailing four-quarter negative earnings surprise of 110.5%, on average.

ADT Inc. Price and EPS Surprise

ADT Inc. price-eps-surprise | ADT Inc. Quote

The company currently has a Zacks Rank #4 and an Earnings ESP of 0.00%. Over the past 30 days, the Zacks Consensus Estimate for its first quarter 2020 earnings has been stable at 15 cents. The estimate indicates an improvement from a loss of 2 cents reported in the prior-year quarter.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ball Corporation (BLL) : Free Stock Analysis Report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Colfax Corporation (CFX) : Free Stock Analysis Report

ADT Inc. (ADT) : Free Stock Analysis Report

Axon Enterprise, Inc (AAXN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance