This Indicator Called the British Pound Reversal - What Now?

DailyFX.com -

Why and how do we use the SSI in trading? View our video and download the free indicator here

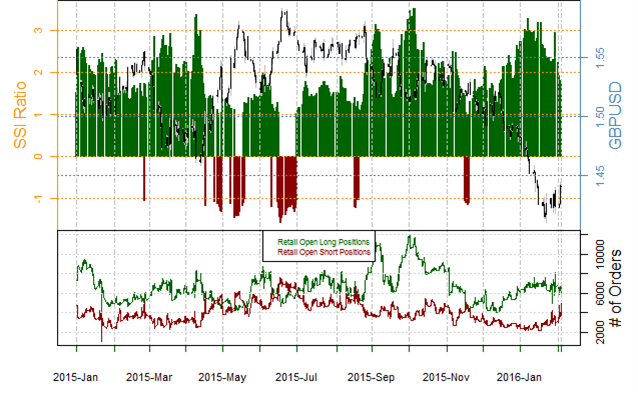

GBPUSD– A remarkable shift in retail FX trader sentiment helped confirm that the British Pound set a lasting low through last week, and a continued move in both price and sentiment points to further GBP/USD gains.

Current data shows there are 1.2 open long positions in the GBP/USD for every 1 short, and this represents a substantial change from the 3:1 seen just over a week ago. Indeed, total open short positions have surged 56 percent while longs have fallen 14 percent.

The severity of the GBP/USD rally along with the marked shift in trader positioning points to continued British Pound strength.

See next currency section:USDCAD - Canadian Dollar Rally is Set to Last

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance