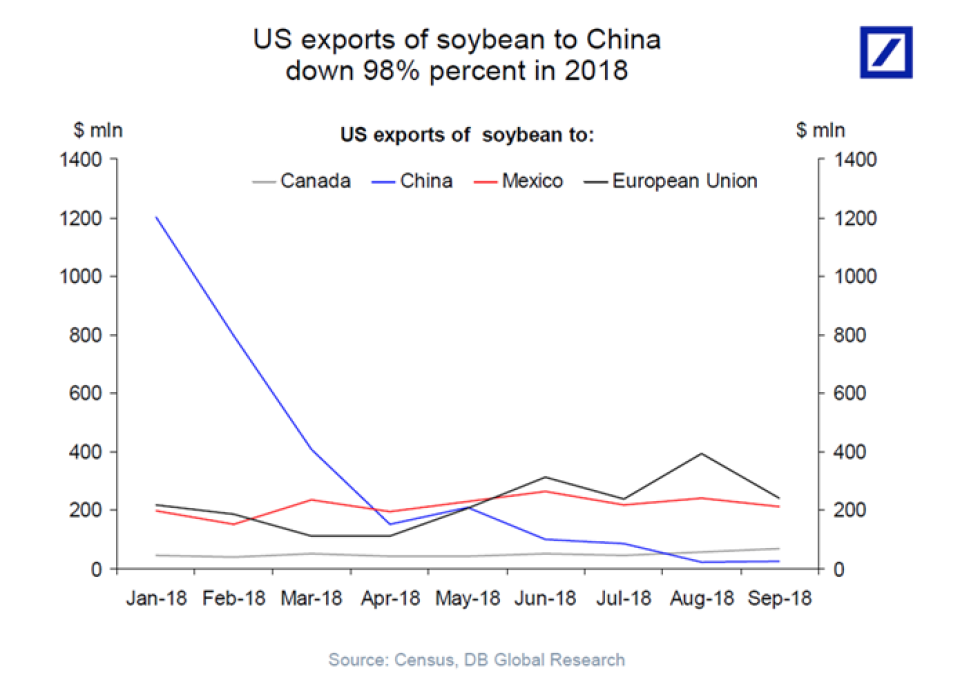

The incredible U.S.-to-China soybean nosedive, in one chart

President Trump’s trade war with China is having a major impact on agricultural industries, most notably on U.S. soybean exports.

According to Torsten Slok, chief international economist at Deutsche Bank, U.S. soybean exports to China are down 98 percent in 2018.

There was about $1.2 billion in soybean exports to China in January 2018 before the nosedive. Soybeans were the top U.S. agricultural export to China last year.

This is because trade tensions led China to stop buying U.S. soybeans. Instead, China has turned to Brazil. In September, Yahoo Finance reported that Brazilian soybean exports to China had already begun increasing and were expected to go higher.

The other big buyers of U.S. soybeans include Mexico, Spain, Argentina, the Netherlands and Egypt. But according to the American Farm Bureau Federation, “The pace of exports this year remains well below the level needed to meet USDA’s projection of 1.9 billion bushels.”

‘A dramatic decline in Chinese purchasers’

The U.S. has become increasingly reliant on China for trade, especially with soybeans. The crop is grown in numerous states across the country, including Illinois, Iowa and Nebraska. Soybean inventory is up in all of those states.

The USDA is forecasting that soybean-planted acreage will drop by 6.6 million acres to 82.5 million in 2019. The American Farm Bureau Federation notes that “if realized, this would be the third-largest acreage decline of all time and the largest year-over-year decline in soybean plantings since … 2007.

“The decline in soybean acreage is anticipated given the slow pace of soybean exports, the dramatic decline in Chinese purchases, expectations for a nearly billion-bushel-carryout and projections for decade-low soybean marketing year average prices.”

Negotiations are still underway between the Trump administration and the Chinese government over trade issues. However, the U.S. government has emphasized that it is committed to getting things back to normal for soybean farmers. According to Bloomberg, “Any trade pact would also address the resumption of soybean sales specifically, since that was targeted in the trade war.”

Adriana Belmonte is an associate editor for Yahoo Finance. Follow her on Twitter @adrianambells.

Read more:

Wealth manager on trade tensions: ‘If you’re a soybean farmer in Iowa, it’s a war’

Brutal map shows why U.S. farmers want Trump to ‘end the trade war’

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, and reddit.

Yahoo Finance

Yahoo Finance