Income Investing: 3 Technology Stocks Worth Consideration

When thinking of dividends, common sectors of the market that are popular among investors include utilities, finance, or consumer staples.

However, a fair number of technology companies also reward their investors handsomely.

Technology stocks are generally not targeted by income investors, as it’s common for these companies to utilize cash to fuel growth and future opportunities.

However, three large-cap companies – Apple AAPL, Microsoft MSFT, and Texas Instruments TXN – are all examples of technology stocks that provide shareholders with a passive income stream.

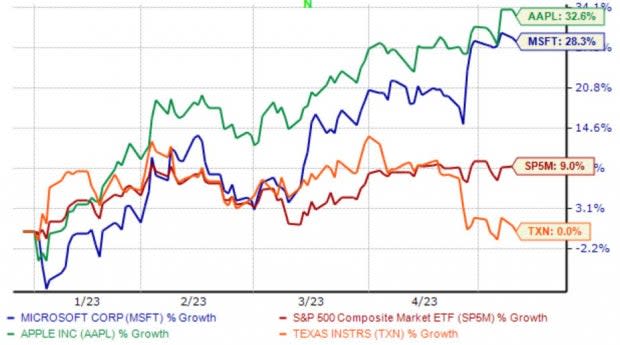

Below is a chart illustrating the performance of all three year-to-date, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

For those interested in tapping into technology exposure paired with dividends, let’s take a closer look at each.

Apple

In its latest quarterly release, Apple delivered a positive 5.6% EPS surprise and reported revenue 2% above expectations. In a shareholder-friendly move, the company also announced a 4% increase to its quarterly cash dividend, payable on May 18th.

The dividend increases from Apple have definitely added up over time, and this is paired with the stellar price return that shares have provided.

Image Source: Zacks Investment Research

Apple is a cash-generating machine, allowing it the flexibility to reward its shareholders consistently. In FY22, the technology titan generated a mighty $111.4 billion in free cash flow, improving nearly 20% year-over-year.

Image Source: Zacks Investment Research

Microsoft

Microsoft posted quarterly results that impressed the market in its latest release, delivering a 10% EPS beat and reporting revenue nearly 4% above expectations. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

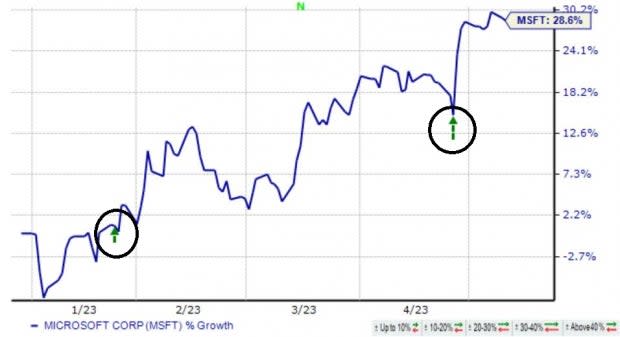

The market has been impressed with MSFT’s quarterly releases in 2023 so far, as we can see by the green arrows circled in the chart below.

Image Source: Zacks Investment Research

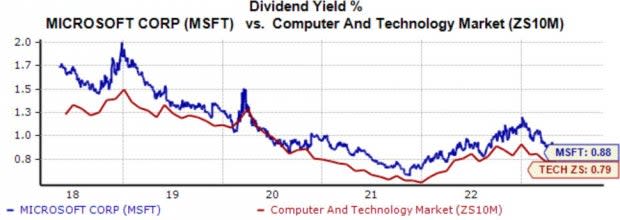

The company’s annual dividend presently yields 0.9%, above the Zacks Computer and Technology sector average by a few ticks. Notably, Microsoft has grown its payout by more than 10% over the last five years, fully reflecting its shareholder-friendly nature.

Image Source: Zacks Investment Research

Texas Instruments

Texas Instruments is an original equipment manufacturer of analog, mixed-signal, and digital signal processing (DSP) integrated circuits.

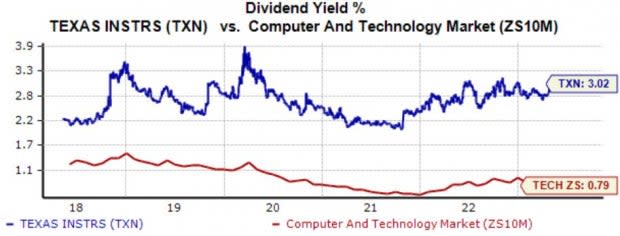

TXN’s dividend metrics could be the most attractive of all three; TXN’s annual dividend presently yields 3%, more than triple the Zacks sector average. In addition, the company boasts a 15% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

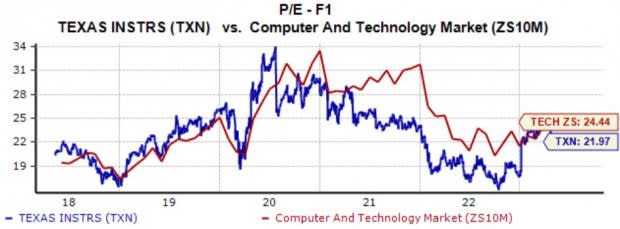

Texas Instrument shares are somewhat cheap on a relative basis, with the current 21.9X forward earnings multiple sitting nicely below the 23.2X five-year median and highs of 24.1X last year.

Image Source: Zacks Investment Research

Bottom Line

Investors shouldn’t forget technology stocks when considering an income-generating portfolio. On top of a passive income stream, market participants receive exposure to the high-flying sector.

And all three companies above – Apple AAPL, Microsoft MSFT, and Texas Instruments TXN – are all examples of dividend-paying technology stocks.

All three have grown their dividend payouts nicely over the years, reflecting a commitment to increasingly rewarding shareholders.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Texas Instruments Incorporated (TXN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance