Import Collapse Turns Into a Boon for Philippines’ Currency

By Chester Yung and Masaki Kondo

One consequence of the Philippines’ struggling economy is turning into a boon for its currency.

A collapse in imports has had a positive effect on the nation’s trade deficit, leading to lower demand for overseas currencies and helping to strengthen the peso. The Philippine currency is the best performer in Asia this year, up more than 2% against the dollar.

“With Philippine growth likely to be hamstrung by enforced and voluntary social distancing, imports will remain weak,” said Eugenia Fabon Victorino, head of Asia strategy at SEB AB in Singapore. “This will cap the trade deficit, allowing the peso to strengthen.”

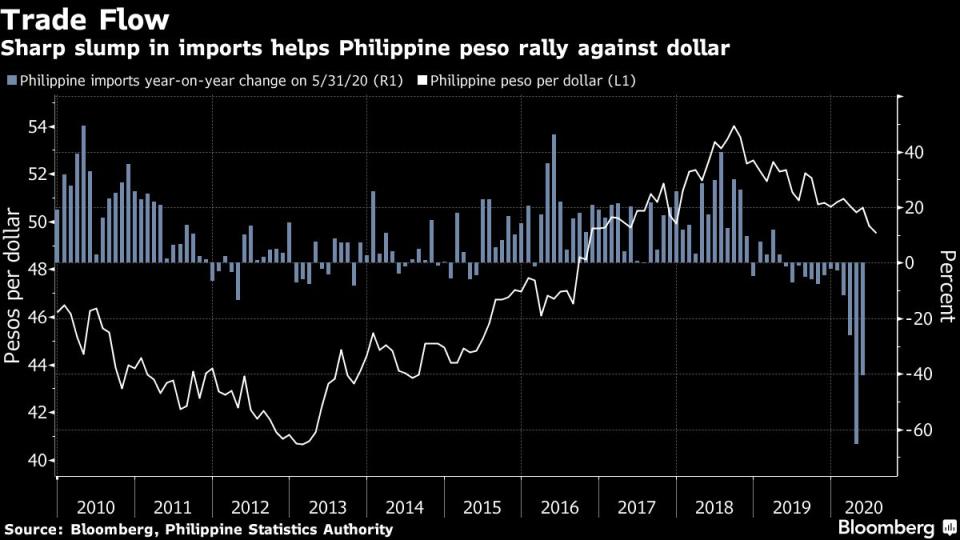

Sharp slump in imports helps Philippine peso rally against dollar

Imports slumped 41% year-on-year in May following a record 65% tumble in April. That’s a continuation of a trend seen in the first quarter, when a decline in goods imports outpaced a drop in exports, narrowing the country’s goods trade deficit to $10.2 billion from $12.2 billion a year previously.

The smaller gap is helping offset the impact of a decline in remittances from the Philippines’ overseas workers, which is expected to weigh on the currency. Bangko Sentral ng Pilipinas estimates a 5% slide in remittances this year to $28.6 billion.

The Philippines is bracing for its deepest economic slump in more than three decades, with a contraction of 2% to 3.4% on the cards for this year as virus cases continue to rise. President Rodrigo Duterte said he will “have to be very circumspect in reopening the economy” given the recent spike.

This year will be the year that investment drops off, and with it demand for imports and dollars, “which translates to the stronger peso story,” said Nicholas Mapa, senior economist at ING Groep NV in Manila.

© 2020 Bloomberg L.P.

Yahoo Finance

Yahoo Finance