IMF launches World Trade Uncertainty index; Asia-Pacific among regions feeling the heat most

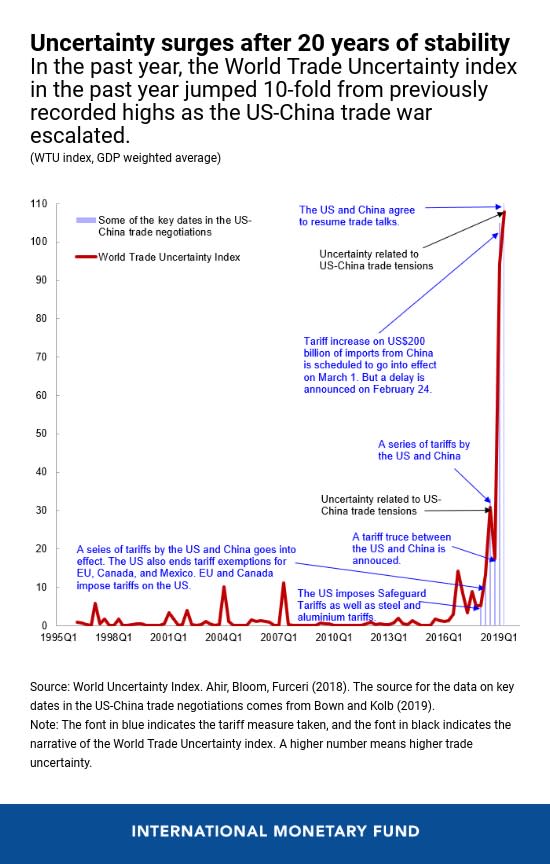

(Sept 10): The newly minted World Trade Uncertainty (WTU) index has detected a significant rise in global trade uncertainty after remaining at stable low levels for about 20 years.

The WTU index, which was launched on Monday by the International Monetary Fund (IMF), measures uncertainty related to trade for 143 individual countries on a quarterly basis.

Concerns about global trade hit nearly 10 times the peaks seen in previous decades and could shave about 0.75 percentage point off world economic growth this year, the IMF said, in reference to the data it had compiled.

Following two decades of relative stability, the WTU index started to climb around 3Q18, in tandem with a heavily publicised series of tariff increases by both the US and China before declining in 4Q18 on the back of the G-20 summit, according to the IMF. After a brief respite, the index rocketed up in 1Q19, reflecting a substantial expansion of US tariffs on Chinese imports from March 1, the IMF said.

The WTU index counts the number of times uncertainty mentioned within a proximity to a word related to trade in Economist Intelligence Unit (EIU) country reports. To calculate the new gauge, IMF researchers counted how often the word ““uncertainty” appears in the EIU reports near terms such as “tariffs,” “protectionism” or “trade“.

In order to make the WTU index comparable across countries, the IMF scales the raw counts by the total number of words in each report; with an increase in the index indicating that trade uncertainty is rising.

According to the index, the recent WTU spike was felt most in the Western Hemisphere, followed by Asia-Pacific and Europe. In contrast, trade uncertainty remained moderately low in the Middle East, Central Asia, and Africa.

Advanced economies displayed the highest trade uncertainty, followed by emerging markets, while low levels were noted in low-income economies.

The IMF noted that previous WTU spikes were seen near the 9/11 attacks, the Sars outbreak, Gulf War II, the Euro debt crisis, El Niño, Europe border-control crisis, the UK's referendum vote in favour of Brexit and the 2016 US presidential election.