Illumina's (ILMN) Innovations Drive Growth, Cost Woes Linger

Illumina’s ILMN market opportunities continue to expand owing to accelerated demand from clinical and translational customers. Yet, government budget cuts, including NIH funding issues, are a major headwind. The stock currently carries a Zacks Rank #3 (Hold).

llumina exited first-quarter 2022 with better-than-expected earnings and revenues. The robust year-over-year improvement in Core Illumina businesses was encouraging. Revenue contributions from the newly-formed GRAIL business, primarily from Galleri test fees, were significant. NovaSeq consumable and instrument shipments reached new highs during the quarter as the company witnessed robust demand for NextSeq 1000, 2000 from new customers. The company also saw significant growth in the installed base and a record backlog, instilling optimism. Orders for sequencing consumables surpassed $1 billion for the first time in the quarter, setting a new high for the company.

Illumina is currently working on its goals to strengthen its foothold in the multi-billion gene sequencing worldwide market with some highly competitive products in its existing portfolio and pipeline. This market is developing rapidly on a global scale, leading to consistent growth in the number of non-invasive prenatal test (NIPT) samples.

Within reproductive health, Illumina saw continued expansion of coverage, reimbursement and evidence generation in the first quarter of 2022, particularly in Europe. Countries such as Spain and Italy have expanded coverage for NIPT, with Germany set to follow suit later this year. In the fourth quarter of 2021, the company noted that the American College of Obstetricians and Gynecologists, or ACOG, revised its guidelines, enabling genetic testing coverage for all U.S. pregnancies, as well as increasing the adoption of its VeriSeq NIPT V2 product globally.

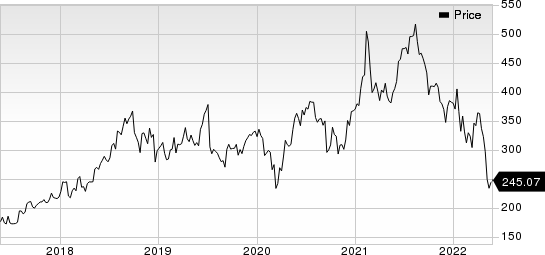

Illumina, Inc. Price

Illumina, Inc. price | Illumina, Inc. Quote

Within genetic disease testing, Illumina registered robust first-quarter performance on expanded coverage and utilization of whole genome sequencing (WGS) globally. In April 2022, the company announced an agreement with Germany's Hannover Medical School to implement the use of WGS for critically ill children suspected of having a genetic or rare disease. In infectious disease and microbiology, the company saw a record quarter with incremental global investments in pathogen identification monitoring and resistance. This upside was driven by COVID-19 surveillance and increasing traction for other pathogens, including tuberculosis.

In its oncology business, yet another area of focus in Illumina’s market expansion, this strategy led the company to develop pharma partnerships and bring to market custom panel tests.

Illumina’s sequencers saw robust demand as sequencing is gradually becoming the standard of care and therapy selection. Genetic testing for therapy selection is also becoming more widely reimbursed, with more than 70% of insured lives in the United States currently covered for these tests. Further, more than 60 targeted and immunotherapy treatments are presently available on the market.

On the flip side, during the first quarter, Illumina’s revenue growth across the EMEA was modestly impacted by lower shipments to Russia due to the ongoing war in Ukraine. Revenues from Greater China (which includes China, Taiwan and Hong Kong) were flat year over year as the region's robust clinical demand in hospitals was offset by COVID-19 restrictions since March.

Illumina registered a significant year-over-year decline in adjusted EPS in the quarter under review, raising apprehension. The company’s research and development expenses increased 63.9% year over year, which pushed up operating costs by 10.5%. These escalating costs are building significant pressure on the bottom line.

Further, in August 2021, Illumina closed the $7.1-billion impending acquisition of non-invasive, early detection liquid biopsy test provider, GRAIL. However, during the European Commission's ongoing regulatory review, the company will hold GRAIL as a separate and independent unit. Illumina is positioned to abide by the final results reached in these legal processes by keeping GRAIL separate while proceedings continue. Further, the company is dedicated to working through the continuing FTC administrative process and will follow any decision the U.S. courts reach.

These regulatory complications raise the legal expenses for Illumina, thereby building pressure on the bottom line.

In the past year, Illumina has underperformed its industry. The stock has lost 25.2% compared with the industry's 8.1% fall.

Key Picks

A few better-ranked stocks in the broader medical space are AMN Healthcare Services, Inc. AMN, Medpace Holdings, Inc. MEDP and UnitedHealth Group Incorporated UNH.

AMN Healthcare has a long-term earnings growth rate of 1.1%. The company surpassed earnings estimates in the trailing four quarters, delivering a surprise of 15.6%, on average. It currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

AMN Healthcare has outperformed its industry in the past year. AMN has declined 2.7% compared with the industry’s 62.4% fall.

Medpace has a historical growth rate of 27.3%. Medpace’s earnings surpassed estimates in the trailing four quarters, the average surprise being 17.1%. It currently has a Zacks Rank #2 (Buy).

Medpace has outperformed its industry in the past year. MEDP has declined 18.8% against the industry’s 62.4% fall.

UnitedHealth has an estimated long-term growth rate of 14.8%. UnitedHealth’s earnings surpassed estimates in the trailing four quarters, the average surprise being 3.7%. It currently carries a Zacks Rank #2.

UnitedHealth has outperformed the industry over the past year. UNH has gained 16.3% compared with 14% industry growth in the said period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Illumina, Inc. (ILMN) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance