Illumina (ILMN) Beats on Q2 Earnings, Lifts '18 Guidance

Illumina, Inc. ILMN reported adjusted earnings per share (EPS) of $1.43 in the second quarter of 2018, beating the Zacks Consensus Estimate of $1.11 by 28.8%. Also, the bottom line exceeded the year-ago number by 74.4%.

Including one-time items, the company reported EPS of $1.41 compared with 87 cents a year ago.

Revenues

In the quarter under review, Illumina's revenues rose 25.4% year over year to $830 million. The top line surpassed the Zacks Consensus Estimate of $787.7 million by 5.4%. The upside can be attributed to strong consumables growth across Illumina’s sequencing portfolio with strength in all throughput categories.

Moreover, the NovaSeq platform continued to show strong momentum. NovaSeq consumables grew approximately $40 million sequentially with strong performance by both the S2 and S4 flow cells. The company also witnessed impressive ramp up in the recently launched S1 flow cell.

Product revenues (81.1% of total revenues) increased 23.9% year over year to $673 million, and Service and Other (18.9%) revenues were up 31.9% year over year to $157 million.

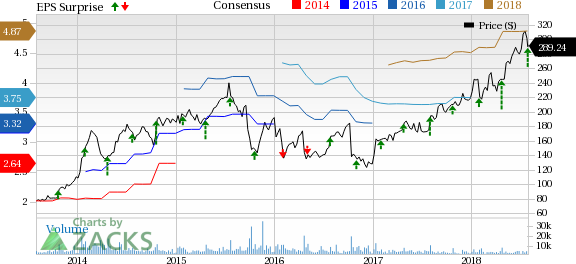

Illumina, Inc. Price, Consensus and EPS Surprise

Illumina, Inc. Price, Consensus and EPS Surprise | Illumina, Inc. Quote

Operational Update

Adjusted gross margin (excluding amortization of acquired intangible assets) came in at 68.2%, reflecting an expansion of 420 basis points (bps) year over year owing to a favorable product mix within sequencing consumables.

Research and development expenses rose 16.2% year over year to $151 million, and selling, general & administrative expenses increased 22.4% to $197 million. The adjusted operating margin of 26.3% expanded 620 bps from a year ago.

Financial Update

Illumina exited the second quarter with cash and cash equivalents plus short-term investments of $2.51 billion, up from $2.37 billion at the end of first-quarter 2018. For the first six months, net cash provided by operating activities as of Jul 1, 2018, was $550 million compared with $346 million as of Jul 2, 2017.

2018 Guidance

Illumina has raised its full-year revenue growth expectation to around 20% as compared to the earlier projection of 15-16% rise. Meanwhile, the Zacks Consensus Estimate for the metric is pegged at $3.20 billion.

Adjusting for certain net specified items for the full year, EPS is expected in the band of $5.35-$5.45, highlighting a rise from the earlier forecast of $4.75-$4.85. The consensus mark for the earnings is at $4.87, below the projected range.

Our Take

Illumina exited the second quarter of 2018 on a solid note. We are encouraged by the year-over-year increase in both the counts. Moreover, management is hopeful about the recently-launched NovaSeq S1 flow cell reagent kit. The company also launched the S4 200 cycle kit on NovaSeq and the NovaSeq S Prime (SP) flow cell. However, both the products will be made commercially available in fourth-quarter 2018.

Illumina’s acquisition of Edico Genome is also expected to drive results in the days ahead. Additionally, improving margins buoy optimism. Meanwhile, the company is operating in a tough competitive landscape which is a concern.

Zacks Rank & Other Key Picks

Illumina carries a Zacks Rank #1 (Strong Buy).

Other top-ranked stocks in the broader medical sector which reported solid results this earnings season are Intuitive Surgical ISRG, Chemed Corporation CHE and Align Technology, Inc. ALGN. While Intuitive Surgical sports a Zacks Rank #1, Chemed and Align Technology carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Intuitive Surgical reported second-quarter 2018 adjusted EPS of $2.76, which beat the Zacks Consensus Estimate of $2.48. Revenues totaled $909.3 million, also surpassing the consensus estimate of $870 million.

Align Technology posted second-quarter 2018 adjusted EPS of $1.30, steering past the Zacks Consensus Estimate of $1.09. Revenues came in at $490.3 million, beating the consensus estimate of $462.9 million.

Chemed reported second-quarter 2018 adjusted EPS of $2.81, which trumped the Zacks Consensus Estimate of $2.68. Revenues of $441.8 million edged past the Zacks Consensus Estimate of $432.3 million.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Illumina, Inc. (ILMN) : Free Stock Analysis Report

Chemed Corporation (CHE) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance