IDEXX (IDXX) Beats Q2 Earnings Estimates, Lifts EPS Guidance

IDEXX Laboratories, Inc. IDXX posted second-quarter 2019 earnings per share (EPS) of $1.43, reflecting a 16.3% year-over-year rise on a reported basis and 19% growth at comparable constant exchange rate (CER). The figure also surpassed the Zacks Consensus Estimate by 4.4%.

Revenues in Detail

Second-quarter revenues increased 6.8% year over year (up 9% on an organic basis) to $620.1 million. The metric however missed the Zacks Consensus Estimate by 1.3%.

The year-over-year upside was primarily driven by strong global gains from Companion Animal Group (CAG) Diagnostics’ recurring revenues.

Segmental Analysis

IDEXX derives revenues from four operating segments: CAG, Water, Livestock, Poultry and Dairy (LPD) and Other. In the second quarter, CAG revenues climbed 8% (up 10% organically) year over year to $547.3 million. Water segment’s revenues were up 6% from the prior-year quarter (up 10% organically) to $30.3 million. LPD revenues dropped 5% (flat organically) to $31.5 million. Revenues at the Other segment also slipped 12.5% on a reported basis to $4.9 million.

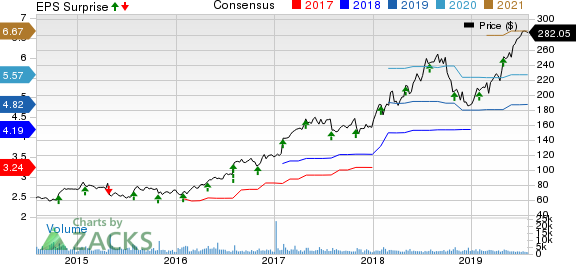

IDEXX Laboratories, Inc. Price, Consensus and EPS Surprise

IDEXX Laboratories, Inc. price-consensus-eps-surprise-chart | IDEXX Laboratories, Inc. Quote

Margins

Gross profit in the second quarter rose 7.6% to $357.9 million in spite of a 5.6% rise in cost of revenues to $262.3 million. Accordingly, gross margin expanded 47 basis points (bps) to 57.7%.

Sales and marketing expenses rose 5.3% to $101.3 million while general and administrative expenses slid 1.8% to $59.9 million. Additionally, research and development expenses increased 9.3% to $32.3 million. Operating margin in the quarter expanded 142 bps to 26.5%.

Financial Position

IDEXX exited the second quarter of 2019 with cash and cash equivalents of $ 110.8 million compared with $116.6 million at the end of the first quarter of 2019. Year-to-date net cash provided by operating activities was $171.5 million compared with $153.7 million in the year-ago period.

2019 Outlook Updated

IDEXX slightly narrowed its revenue guidance for 2019. Full-year revenues are now estimated in the range of $2.38-$2.41 billion, (from the past projection of $2.38-2.42 billion), indicating organic revenue growth of 9.5-10.5% (reported revenue growth of 7.5-9%).

Meanwhile, EPS projection has been raised to the $4.82-4.92 (from the past projection of $4.76-$4.88) band, suggesting annualized growth of 17-20% at CER. The current Zacks Consensus Estimate for EPS stands at $4.82 on revenues of $2.41 billion.

Our Take

IDEXX exited the second quarter on a mixed note as EPS beat while revenues missed estimates. Solid organic revenues growth and a lifted EPS view for 2019 are encouraging. We are upbeat to note that the top line in the quarter was driven by strong sales at the CAG business. Specifically, the company witnessed sturdy gains from CAG Diagnostics in the quarter under review.

Management’s innovative multi-modality global strategy, enabled by an enhanced commercial capability, accelerated CAG Diagnostics’ recurrent revenue growth. Expansion of strategic initiatives like IDEXX Preventive Care enabled faster growth of diagnostic testing during the second quarter.

Zacks Rank & Other Key Picks

IDEXX has a Zacks Rank #2 (Buy).

Some other top-ranked companies, which posted solid results this earnings season, are Stryker Corporation SYK, Baxter International Inc. BAX and Intuitive Surgical, Inc. ISRG.

Stryker delivered second-quarter 2019 adjusted EPS of $1.98, beating the Zacks Consensus Estimate by 2.6%. Revenues of $3.65 billion surpassed the Zacks Consensus Estimate by 1.4%. The company carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Baxter delivered second-quarter 2019 adjusted EPS of 89 cents, which surpassed the Zacks Consensus Estimate of 81 cents by 9.9%. Revenues of $2.84 billion beat the Zacks Consensus Estimate of $2.79 billion by 1.9%. The company holds a Zacks Rank #2.

Intuitive Surgical reported second-quarter 2019 adjusted EPS of $3.25, which beat the Zacks Consensus Estimate of $2.85. Revenues were $1.1 billion, surpassing the Zacks Consensus Estimate of $1.03 billion. The company sports a Zacks Rank #1.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

Baxter International Inc. (BAX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance