IBM's Maximo Solution to Aid ASPI Manage Civil Infrastructure

International Business Machines Corporation IBM recently collaborated with Europe-based Autostrade per l'Italia (or ASPI) to enable real-time maintenance of civil infrastructure.

Per the deal, IBM’s Maximo Asset Monitor and Maximo Enterprise Asset Management, and AI and IoT capabilities will be integrated into ASPI’s new Autostrade "IOT" solution. IBM Research will develop the new system along with ASPI’s subsidiary, Autostrade Tech.

After trials of the new system, ASPI aims to deploy the new technology by the end of 2020, across all 1,943 prominent network structures.

Advanced Tech to Facilitate Asset Management

The new system will be connected to mobile devices and sensors to aid technicians and operators to continuously monitor the state of civil infrastructure, and assess lifecycle of roads, bridges, and tunnels.

This will ensure timely maintenance. The workflow processes can then be resumed to track the status of maintenance activities to full-proof the infrastructure management processes.

Further, the system integrates 3D modeling technology to facilitate AI-driven classification of maintenance checks and other physical inspections. This will aid the operator to keep track of structures under review and continuously assess the maintenance processes.

Strength in Maximo Holds Promise

Robust demand of IBM Maximo on strength in asset optimization and management capabilities is expected to favor the top line in the days ahead.

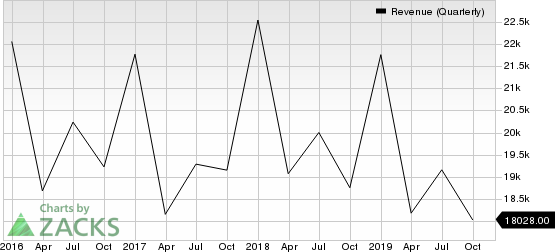

International Business Machines Corporation Revenue (Quarterly)

International Business Machines Corporation revenue-quarterly | International Business Machines Corporation Quote

Asset management solutions not only assist technicians to understand the operating conditions of their assets but also to take appropriate action to increase productivity in an efficient way. These solutions help in expanding operating margins of process manufacturers.

Moreover, IBM is integrating AI and IoT capabilities across its portfolio, which is expected to bolster adoption rate, in the days ahead.

Further, per MarketsandMarkets data, enterprise asset management (EAM) market is projected to hit $8.2 billion by 2024, from estimated valuation of $5.1 billion in 2019, at a CAGR of 10%, between 2019 and 2024. Based on IBM Maximo’s advanced capabilities, we believe that the company is well poised to gain from this robust growth prospect going forward.

Additionally, IBM's strength in automation, cognitive and optimization capabilities enable enterprises to run business processes efficiently in a secure infrastructure. The company’s capabilities and synergies from RedHat acquisition is anticipated to aid the company in winning similar deals.

Notably, IBM has been positioned in the “Leaders” quadrant by IDC in its assessment report on SaaS and Cloud-Enabled Asset-Intensive EAM Applications vendors.

The company’s investments in Maximo are expected to strengthen its position in the EAM market against competing solutions including Oracle Enterprise Asset Management solution, SAP EAM suite, and other comparable offerings from Aspen technology.

Zacks Rank & Key Picks

IBM currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Marchex, Inc. MCHX, Fortinet, Inc. FTNT and Commvault Systems, Inc. CVLT. All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Marchex, Fortinet and Commvault Systems is currently pegged at 15%, 14% and 10%, respectively.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Marchex, Inc. (MCHX) : Free Stock Analysis Report

CommVault Systems, Inc. (CVLT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance